If you understand trends, trading becomes much easier.

If you fight them, the market will punish you.

This concept comes straight from Richard Wyckoff — and it’s simpler than most people think.

🧠 What Is a Trend?

A trend is nothing complicated.

👉 A trend is the path of least resistance for price.

Price moves through waves:

• Waves moving with the trend → impulses

• Waves moving against the trend → pullbacks

Your job as a trader is not to predict,

but to identify this direction and trade with it.

🔄 How Trends Are Formed

Price keeps moving until it meets resistance.

• In an uptrend → resistance comes from sellers

• In a downtrend → resistance comes from buyers

At these points:

✔️ Price either breaks through

✔️ Or reverses direction

These turning points are called pivots —

and they are some of the best areas to trade.

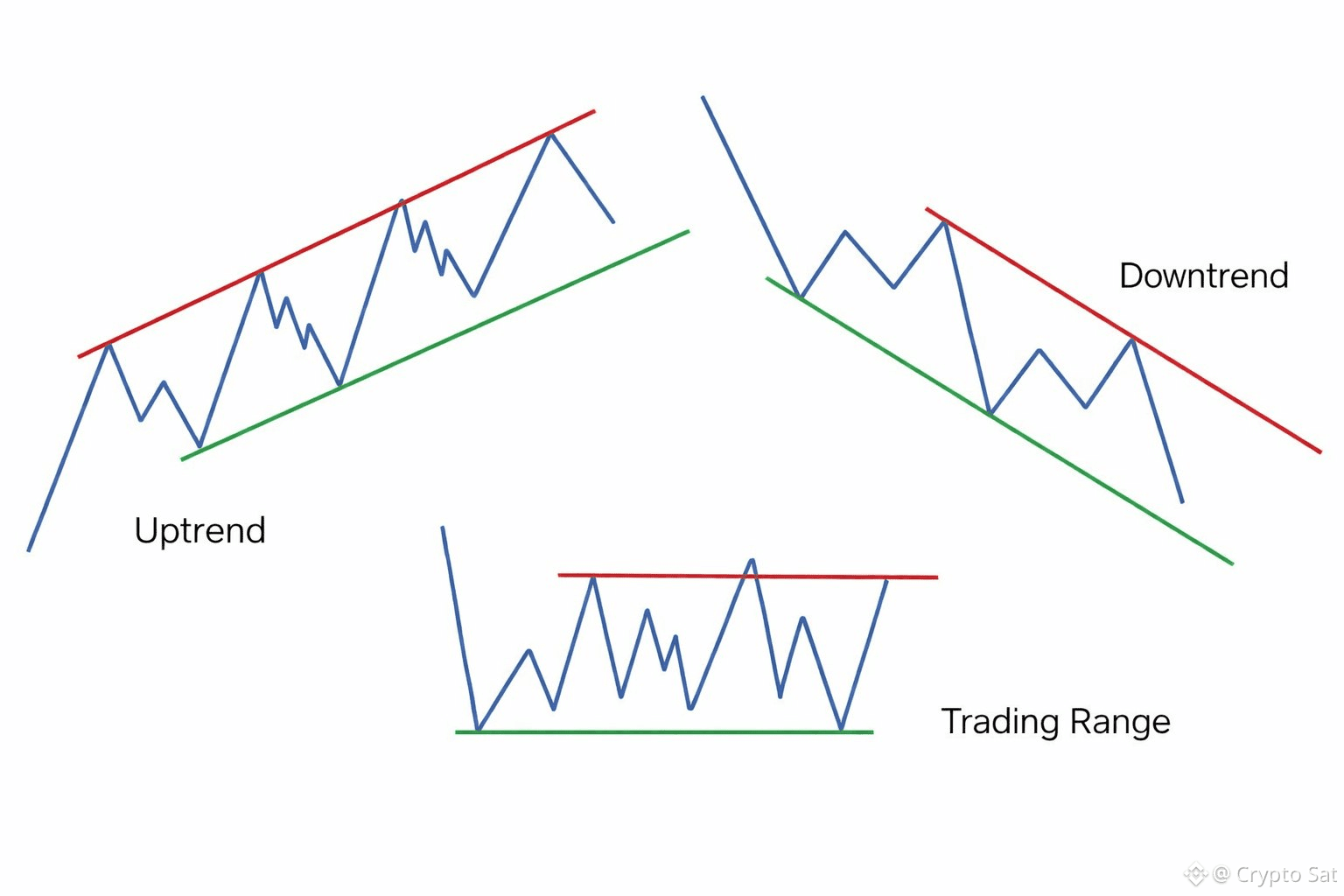

3 Types of Trends

🟢 1. Uptrend (Bullish)

• Higher highs

• Higher lows

• Strong upward impulses

• Pullbacks fail to break structure

📌 Buyers are in control.

🔴 2. Downtrend (Bearish)

• Lower highs

• Lower lows

• Strong downward impulses

• Bounces fail to continue

📌 Sellers are in control.

🟡 3. Sideways (Range)

• Highs and lows stay within a zone

• No clear direction

• Buyers and sellers balanced

📌 Best avoided by beginners.

⏱ Trends Exist on ALL Timeframes

There are three trend levels:

• Long-term trend

• Medium-term trend

• Short-term trend

Important rule 👇

👉 A short-term trend exists inside a medium-term trend

👉 A medium-term trend exists inside a long-term trend

This is why timeframes can show different stories at the same time.

🎯 Why This Matters

If the trend is up:

✔️ Look for buys

❌ Avoid shorts

If the trend is down:

✔️ Look for sells

❌ Avoid longs

Trading against the trend means fighting market structure.

🧩 Final Takeaway

Trends are not opinions.

They are visible in price waves.

Once you learn to spot:

• Impulses

• Pullbacks

• Pivots

You stop guessing — and start trading with the flow.

📌 The trend is your ally. Respect it.