📰 Daily Market Update

Based on Binance Retail Flow, STH MVRV , and Stablecoins Dominance

Today’s charts give us a very interesting but mixed picture of what is really happening behind price movements.

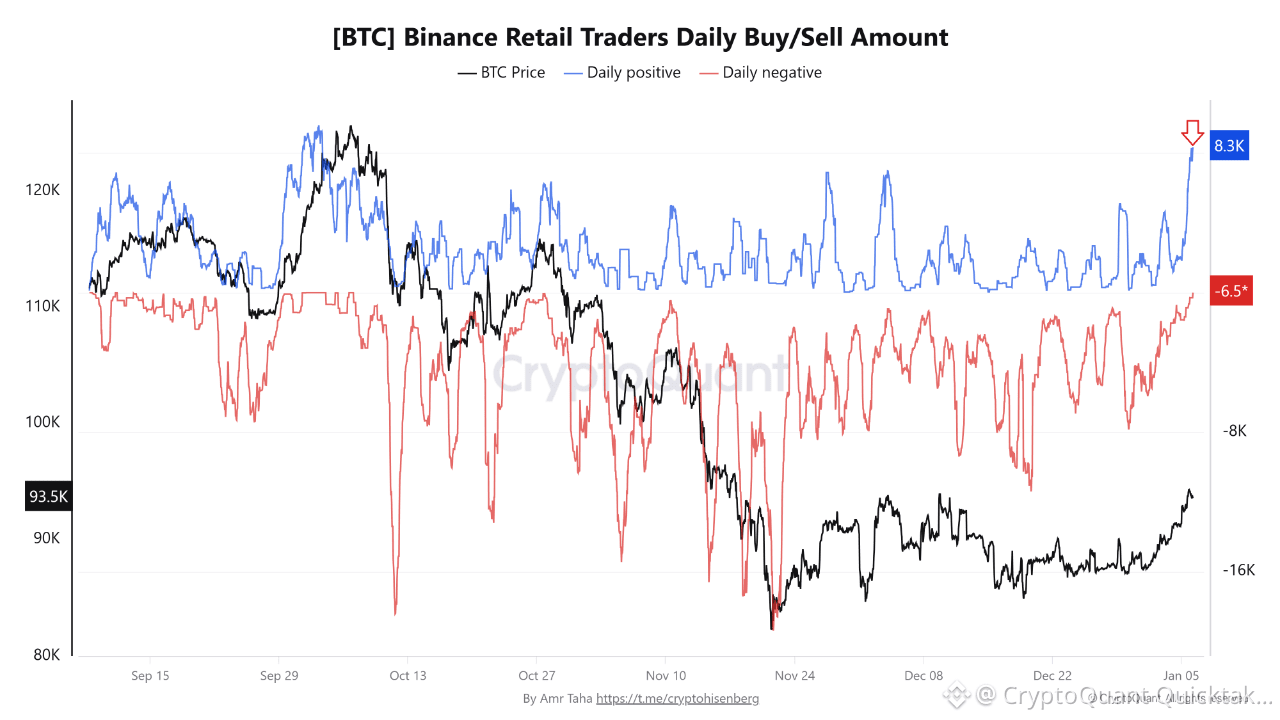

📊[BTC] Binance Retail Traders Daily Buy/Sell Amount

Crypto investors can generally be split into two groups:

Long-term holders and short-term traders.

This indicator focuses specifically on short-term retail behavior and tracks immediate profit/loss activity on Binance.

📈 On Jan 6, retail traders bought 8.3K BTC as price crossed $94K

📆 This level of buying hasn’t been seen since Oct 2, when BTC was above $120K.

📌 This suggests that retail traders are once again becoming aggressive, typically a sign of rising confidence — but historically also a point where risk starts to increase.

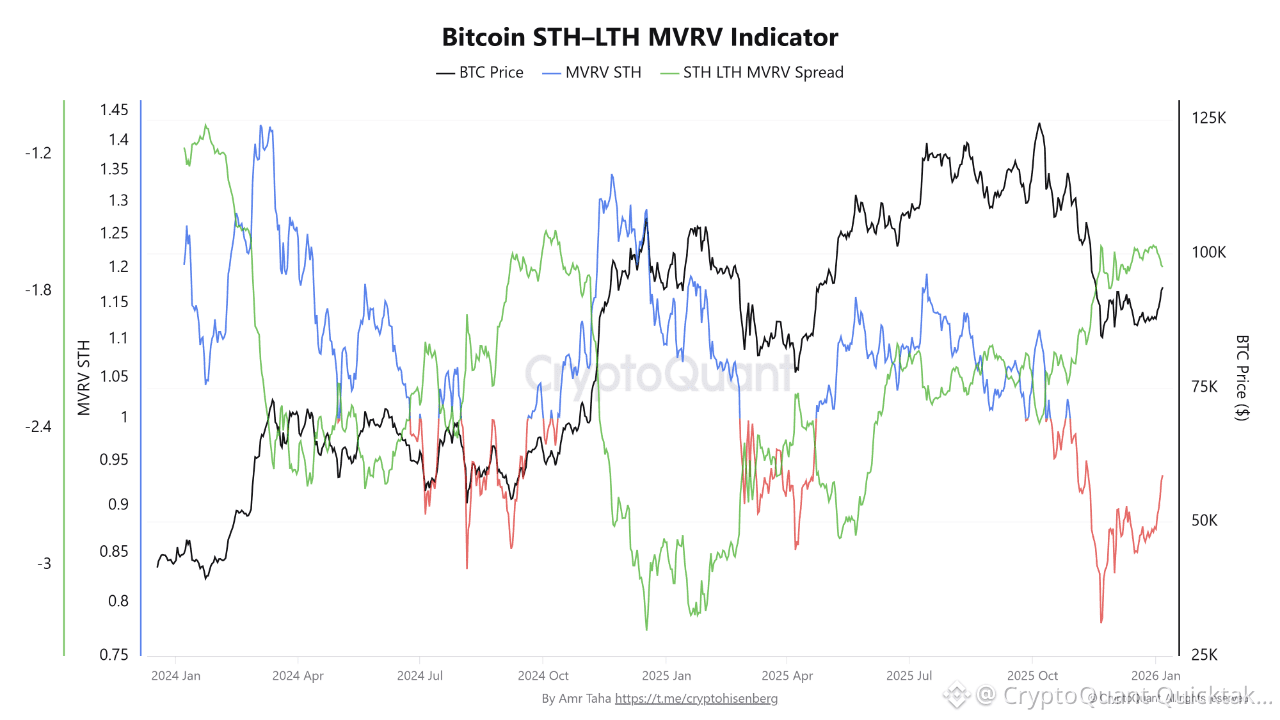

📊 Bitcoin STH–LTH MVRV Indicator

The STH-MVRV is an on-chain metric that assesses the average profit or loss of Bitcoin investors who have held their coins for less than 155 days.

It helps determine if these recent buyers are, on average, in profit or loss, offering insights into potential market tops or bottoms.

📉 The indicator bottomed at 0.78 on Nov 22, breaking below prior lows in Aug 2024 and Apr 2025

* This suggests that short-term holders still at deep loss .

* During drawdowns, weak hands sell back to stronger, long-term holders.

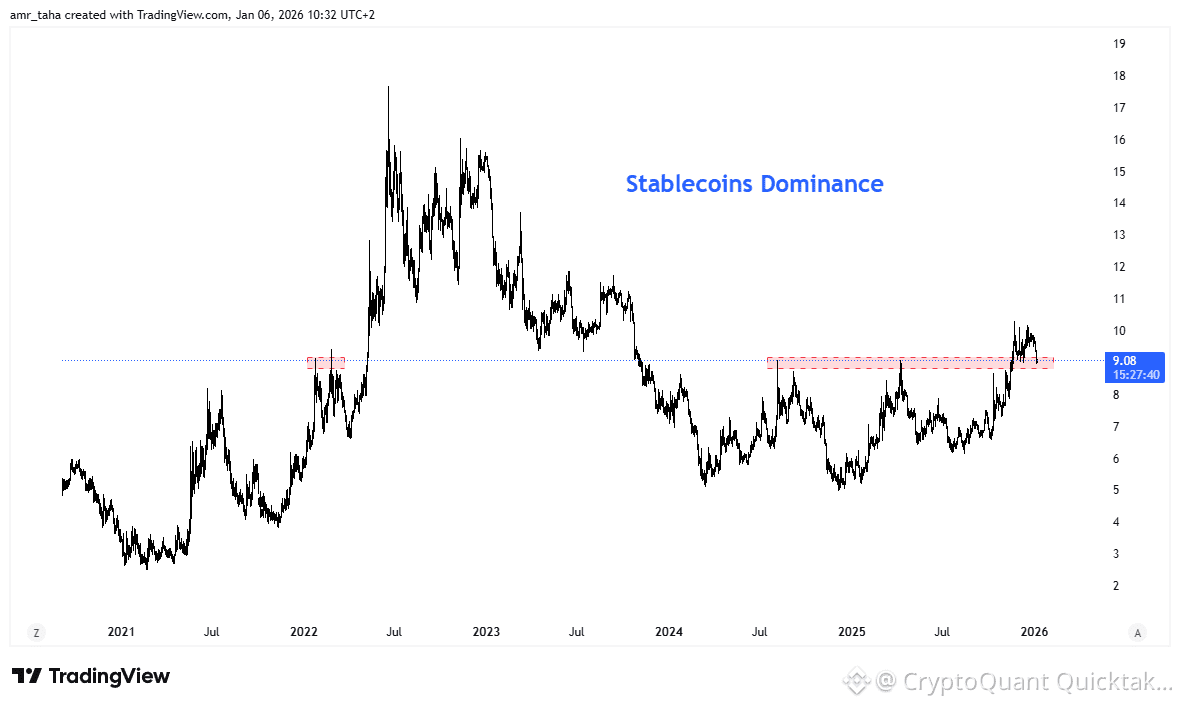

📊 Stablecoins Dominance

This chart tracks the market share of stablecoins vs total crypto market cap.

Current Situation:

* Stablecoins dominance is currently holding above 9%, clearly marked by the red zones.

* Importantly, it has not yet closed below 9% on the daily timeframe.

📌 This tells us that a meaningful amount of capital is still sitting on the sidelines, waiting for confirmation, not fully committed to risk assets yet.

📝 Final Thought

Monitoring retail behavior, STH MVRV , and stablecoin dominance together gives a much deeper understanding of what’s really driving price — Markets right now are optimistic, but not fully convinced.

Written by Amr Taha