On-chain analysis is a method of examining transaction data recorded directly on the blockchain to understand market supply and demand as well as participant behavior. Because transaction history, balances, and asset movements are publicly verifiable, this approach is built on a level of transparency that does not exist in traditional financial markets.

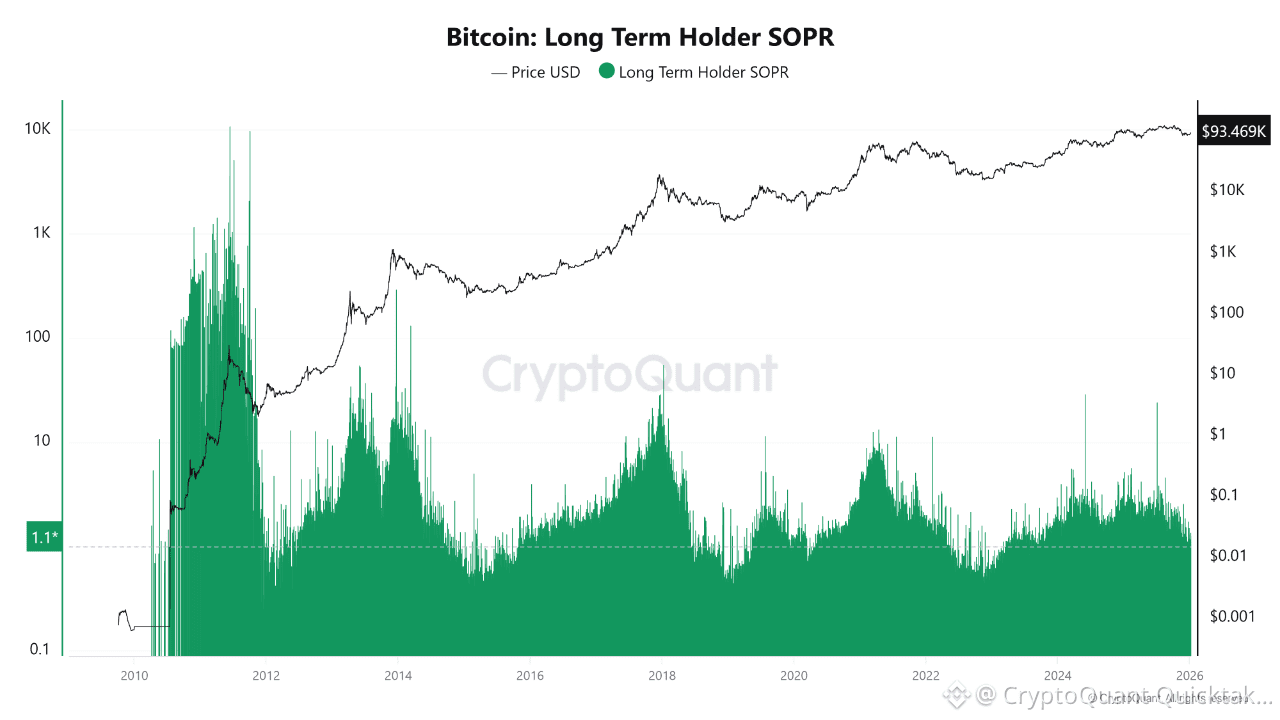

One of the key indicators used in on-chain analysis is Long Term Holder SOPR. This metric shows whether long-term holders are selling their assets at a profit or at a loss. Values above 1 indicate profit-taking, while values below 1 suggest capitulation or loss-driven selling. When Long Term Holder SOPR remains stable, it implies that long-term holders are sitting on unrealized gains but are not actively selling, keeping structural selling pressure low.

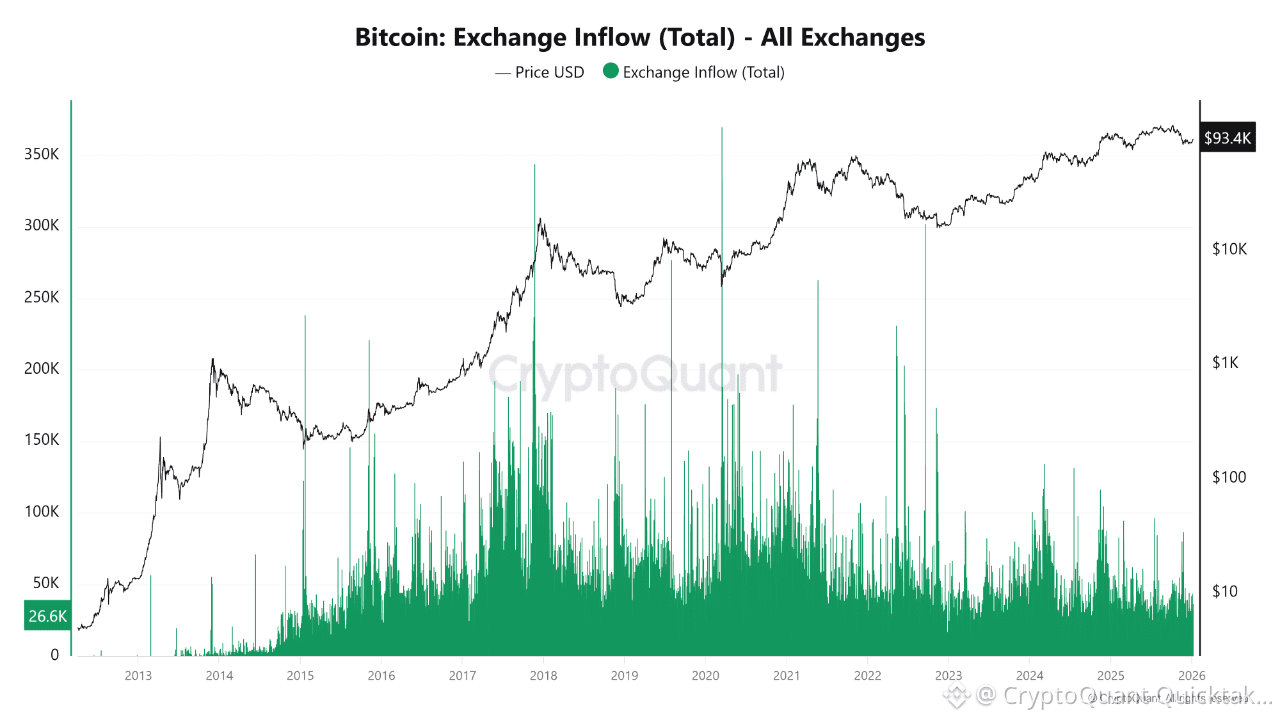

Another important indicator is Exchange Inflow (Total) – All Exchanges, which tracks the total amount of crypto assets flowing into exchanges. Rising inflows typically signal increasing sell-side pressure, as assets are moved to exchanges in preparation for liquidation. Conversely, subdued inflows suggest that actual selling pressure is limited, even if prices are volatile.

By analyzing these two indicators together, investors can better assess whether price movements are driven by genuine supply-side pressure or merely short-term noise, helping to distinguish structural weakness from temporary fluctuations.

Written by XWIN Research Japan