@Walrus 🦭/acc The current crypto cycle is being shaped less by headline-grabbing applications and more by a quiet re-evaluation of infrastructure assumptions that were taken for granted during earlier phases of growth. One of the most important of these assumptions concerns data itself. As blockchains have moved toward modular architectures, rollups, and application-specific execution layers, data availability has emerged as a primary bottleneck rather than an afterthought. Execution can scale, consensus can be optimized, but without reliable, verifiable, and economically sustainable data storage, the entire stack becomes fragile. Walrus enters the market at a moment when this reality is no longer theoretical. It reflects a structural shift away from treating storage as a passive utility and toward recognizing it as an active component of security, market design, and user trust. This timing matters. The industry is no longer experimenting with scale in isolation. It is confronting the cost, latency, and incentive failures that appear when usage becomes real and adversarial.

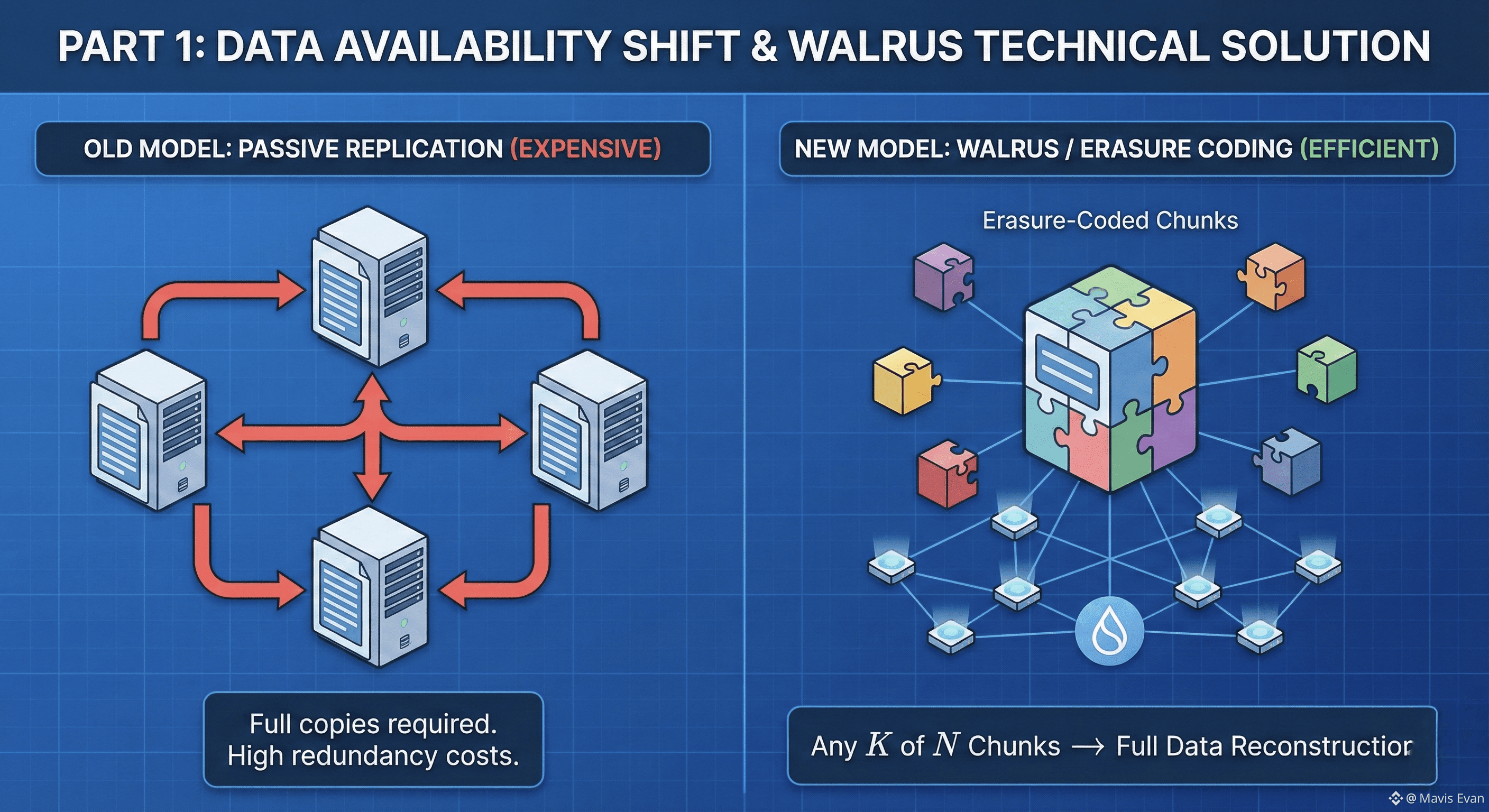

@Walrus 🦭/acc is often introduced as a decentralized storage protocol, but that framing undersells its intent. At a deeper level, it is an attempt to re-architect how large-scale data is handled in blockchain systems that demand both availability and verifiability under economic stress. Built on the Sui blockchain, Walrus leverages a combination of erasure coding and blob-based storage to distribute data across a decentralized network in a way that minimizes redundancy costs while preserving fault tolerance. This design choice is not cosmetic. Traditional decentralized storage systems rely heavily on replication, which is simple to reason about but expensive at scale. Walrus instead treats data as something that can be mathematically reconstructed even when large portions of the network are unavailable or adversarial, shifting the security model from brute-force duplication to probabilistic guarantees grounded in coding theory.

Internally, the protocol operates by splitting large data objects into smaller chunks, encoding them using erasure coding schemes, and distributing these encoded fragments across a network of storage nodes. Only a subset of these fragments is required to reconstruct the original data, which means the system can tolerate node failures without requiring full replication. Blob storage further optimizes this process by grouping data into units that are efficient to publish, reference, and verify on-chain. On Sui, this approach integrates naturally with the chain’s object-centric model, allowing data references to behave more like composable assets than static files. The result is a storage layer that is deeply aware of blockchain execution rather than bolted on as an external service.

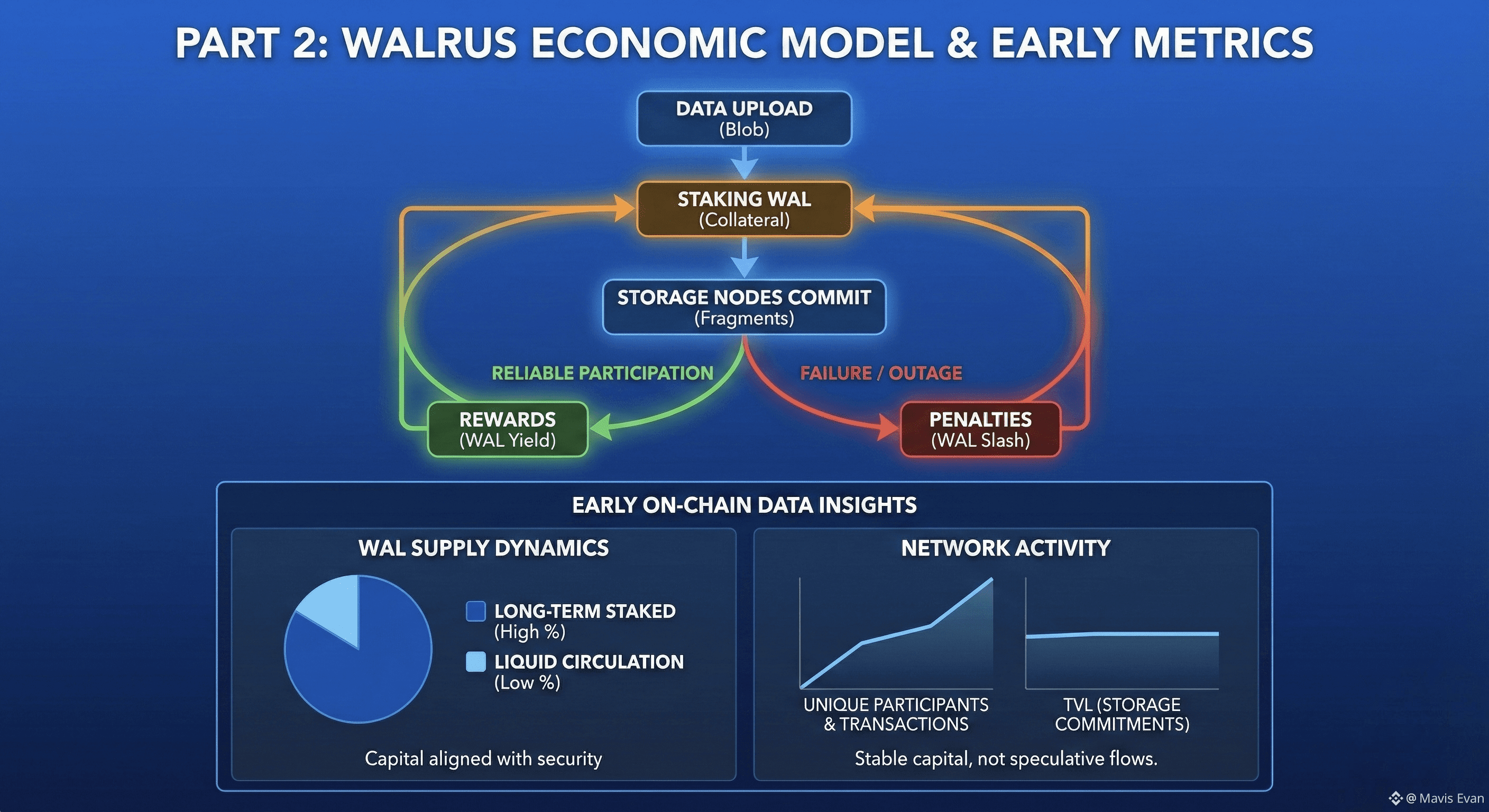

This architectural choice has direct economic consequences. By reducing the amount of raw storage required per unit of usable data, Walrus lowers the marginal cost of availability. That reduction changes the incentive landscape for both storage providers and users. Providers are not paid for holding redundant copies indefinitely but for participating in a network that maintains recoverability under defined conditions. Users, in turn, pay for guarantees rather than excess capacity. The WAL token sits at the center of this system, functioning as the medium through which storage commitments, staking, and governance are coordinated. Token utility is not limited to fee payment. It is embedded in the security model, as storage nodes are required to stake WAL to participate, aligning their economic exposure with the integrity of the data they help secure.

Transaction flow within Walrus reflects this alignment. When data is uploaded, the protocol specifies the encoding parameters, the required availability threshold, and the duration for which the data must remain recoverable. Storage nodes commit to holding specific fragments and stake tokens as collateral. Failure to meet availability requirements can result in penalties, while reliable participation yields rewards. This creates a feedback loop in which honest behavior is continuously reinforced, not through trust assumptions but through measurable performance. Governance mechanisms allow parameters such as encoding ratios, reward curves, and penalty thresholds to evolve as network conditions change, but these mechanisms themselves are constrained by on-chain voting and stake-weighted participation, introducing a second layer of incentive alignment.

On-chain data from Walrus’s early lifecycle provides insight into how these mechanisms are being received by the market. WAL supply dynamics show a clear separation between liquid circulation and staked tokens, with a significant portion of supply committed to network security rather than speculative trading. This pattern suggests that participants perceive staking yields and protocol participation as competitive with alternative uses of capital, which is notable in an environment where liquidity is often prioritized over long-term alignment. Wallet activity indicates a steady increase in unique participants interacting with storage contracts rather than a concentration of activity among a small set of actors. Transaction density related to data uploads has grown alongside broader Sui network usage, implying that Walrus is not operating in isolation but benefiting from ecosystem-level adoption.

TVL movement within Walrus reflects a different profile than typical DeFi protocols. Instead of sharp inflows and outflows driven by yield incentives, capital appears more stable, tied to long-duration storage commitments and node operations. This stability has implications for market psychology. It suggests that participants view Walrus less as a short-term opportunity and more as infrastructure worth anchoring capital to. Network throughput metrics further support this view. As data volumes increase, latency and retrieval performance have remained within predictable bounds, indicating that the erasure-coded architecture is scaling as intended rather than degrading under load.

For builders, these trends are particularly significant. Reliable and cost-efficient data availability lowers the barrier to deploying applications that generate or depend on large data sets, such as gaming, social platforms, AI-integrated systems, and enterprise analytics. The ability to reference data blobs on-chain without bearing the full cost of replication enables new design patterns where execution and data are decoupled but still cryptographically linked. Investors, meanwhile, are responding to a different signal than they would with application-layer tokens. Capital allocation toward WAL reflects a bet on structural demand rather than user growth alone. It is an investment in the persistence of modular architectures and the belief that data availability will remain a scarce and valuable resource.

Market psychology around Walrus also reveals a broader shift. During previous cycles, infrastructure tokens often struggled to capture value because their benefits were abstract and indirect. In the current environment, the pain points they address are tangible. High data costs, congestion, and unreliable availability have already constrained rollup ecosystems and application scalability. Walrus benefits from entering the conversation after these constraints have been experienced, not merely anticipated. This changes how its value proposition is evaluated. Rather than asking whether decentralized storage is necessary, the market is asking which model can deliver it sustainably.

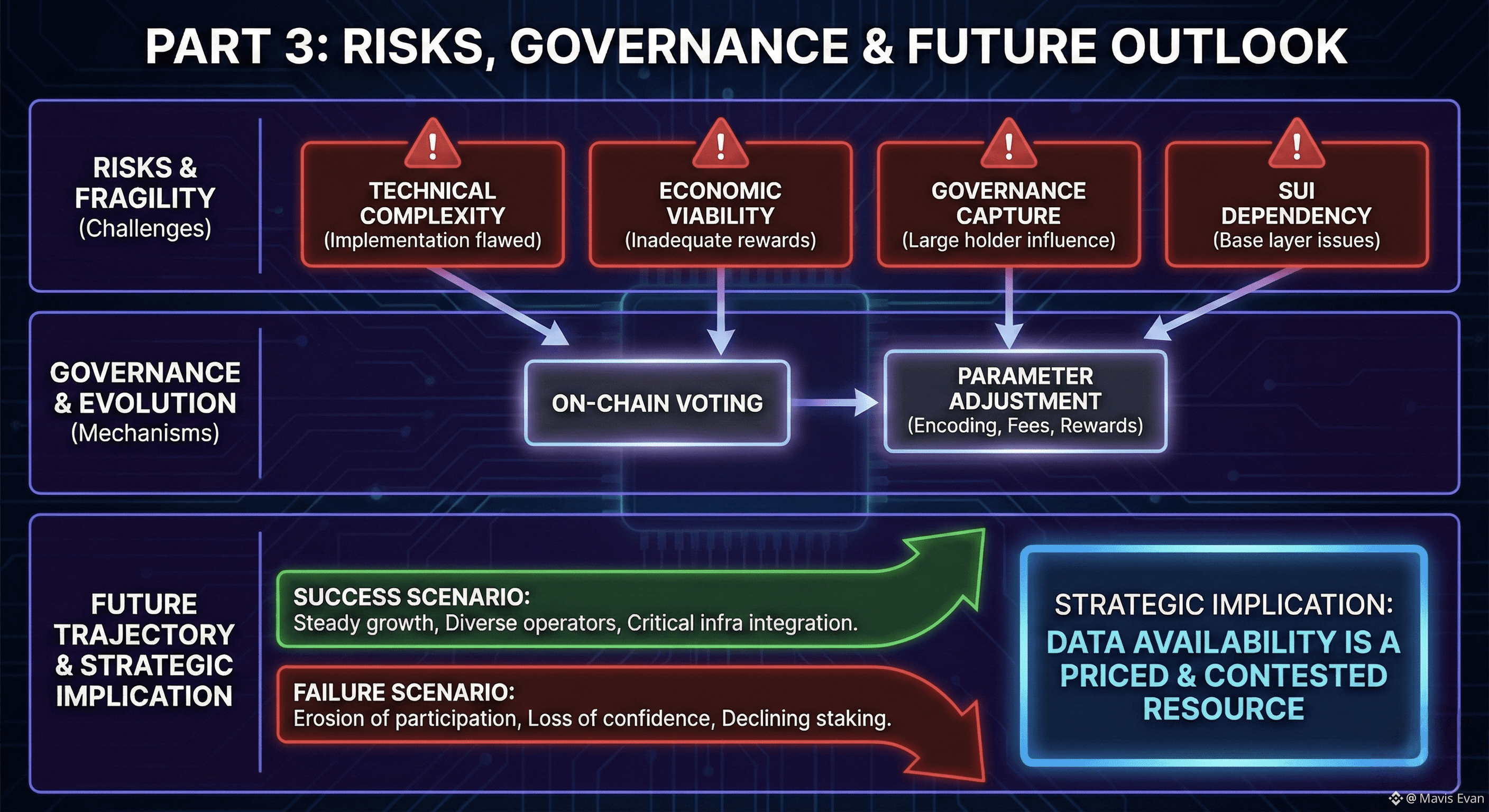

Despite these strengths, Walrus is not without risks, and these are easy to underestimate when focusing on architectural elegance. Technically, erasure coding introduces complexity that can become a liability if implementation or parameter choices are flawed. Reconstruction guarantees depend on assumptions about node availability and network connectivity that may not hold under extreme conditions. While the system is designed to tolerate failures, correlated outages or targeted attacks on specific node subsets could stress these guarantees in unexpected ways. Economic risks are equally important. If staking rewards fail to adequately compensate for hardware, bandwidth, and operational costs, node participation could decline, weakening availability over time.

Governance presents another layer of fragility. Parameter changes that appear rational in isolation can have unintended second-order effects when applied at scale. Increasing encoding ratios to improve fault tolerance, for example, raises storage costs and may discourage usage. Conversely, optimizing for cost efficiency could reduce resilience. Governance capture is a further concern, particularly if large stakeholders accumulate disproportionate influence over protocol evolution. While on-chain voting provides transparency, it does not eliminate the risk of decisions that favor capital over long-term network health.

There is also an ecosystem-level dependency risk tied to Sui itself. Walrus’s deep integration with Sui’s architecture is a strength, but it also means that broader issues affecting the Sui network could cascade into Walrus. Network congestion, validator performance, or governance controversies at the base layer would directly impact storage reliability and perception. This coupling makes Walrus less modular than some cross-chain storage solutions, which could limit its appeal to developers operating outside the Sui ecosystem.

Looking forward, the trajectory of Walrus over the next cycle will depend less on speculative narratives and more on measurable adoption by systems that have no tolerance for unreliable data. Success would look like steady growth in long-duration storage commitments, increasing diversity of node operators, and integration into critical infrastructure for rollups and data-intensive applications. It would also involve governance decisions that demonstrate restraint and a willingness to prioritize resilience over short-term optimization. Failure, by contrast, would not necessarily be dramatic. It would manifest as gradual erosion of participation, declining staking ratios, and a loss of confidence among builders who begin to seek alternatives.

The broader implication of Walrus’s experiment is that data availability is becoming a priced and contested resource within crypto markets. Protocols that treat it as an afterthought are likely to face structural limits as usage grows. Walrus’s approach suggests that the future belongs to systems that internalize the true cost of availability and design incentives accordingly. Whether Walrus itself becomes a dominant player or a stepping stone toward more refined models, its contribution lies in reframing the problem. It forces the market to confront the reality that decentralized systems are only as strong as their weakest data guarantees.

The strategic takeaway is not that Walrus represents a definitive solution, but that it exemplifies a necessary evolution in how infrastructure is evaluated. Storage, availability, and verifiability are no longer background concerns. They are core to economic security and user trust. By aligning engineering design with incentive mechanics and grounding its model in measurable performance, Walrus offers a case study in how infrastructure protocols can capture value without relying on hype. For those willing to look past surface narratives, it provides a clearer lens through which to assess where durable value is likely to accrue in the next phase of the crypto market.