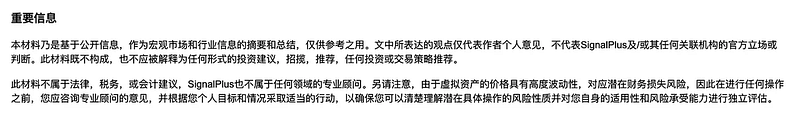

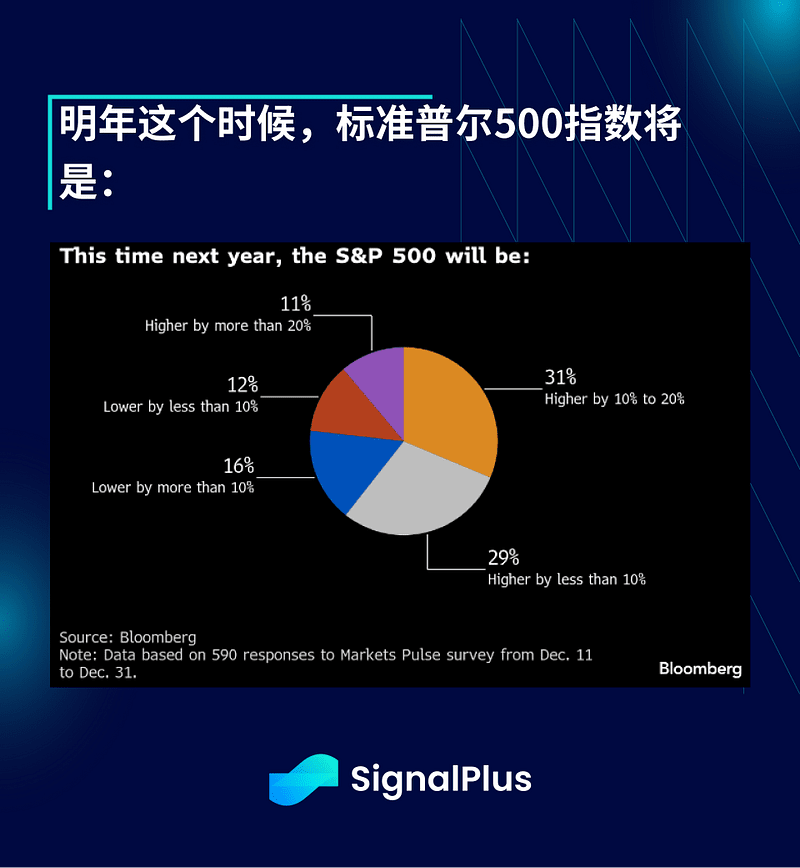

Regardless of geopolitical tensions, markets have swiftly returned to a full-risk-taking mode. The S&P 500 index is nearing the 7,000 mark. Despite extensive discussions about Venezuela's situation and the next potential target under the new 'Tang Luoism' (Iceland?); it is evident that a global effort to hoard precious metals and imported raw materials is underway. In a world where free trade and strategic alliances are gradually unraveling, this creates a long-term bullish outlook for commodities.

While 2025 has already been a stellar year for nearly all macro asset classes except crypto, it is concerning that the ingredients driving further escalation in market animal spirits may already be in place.

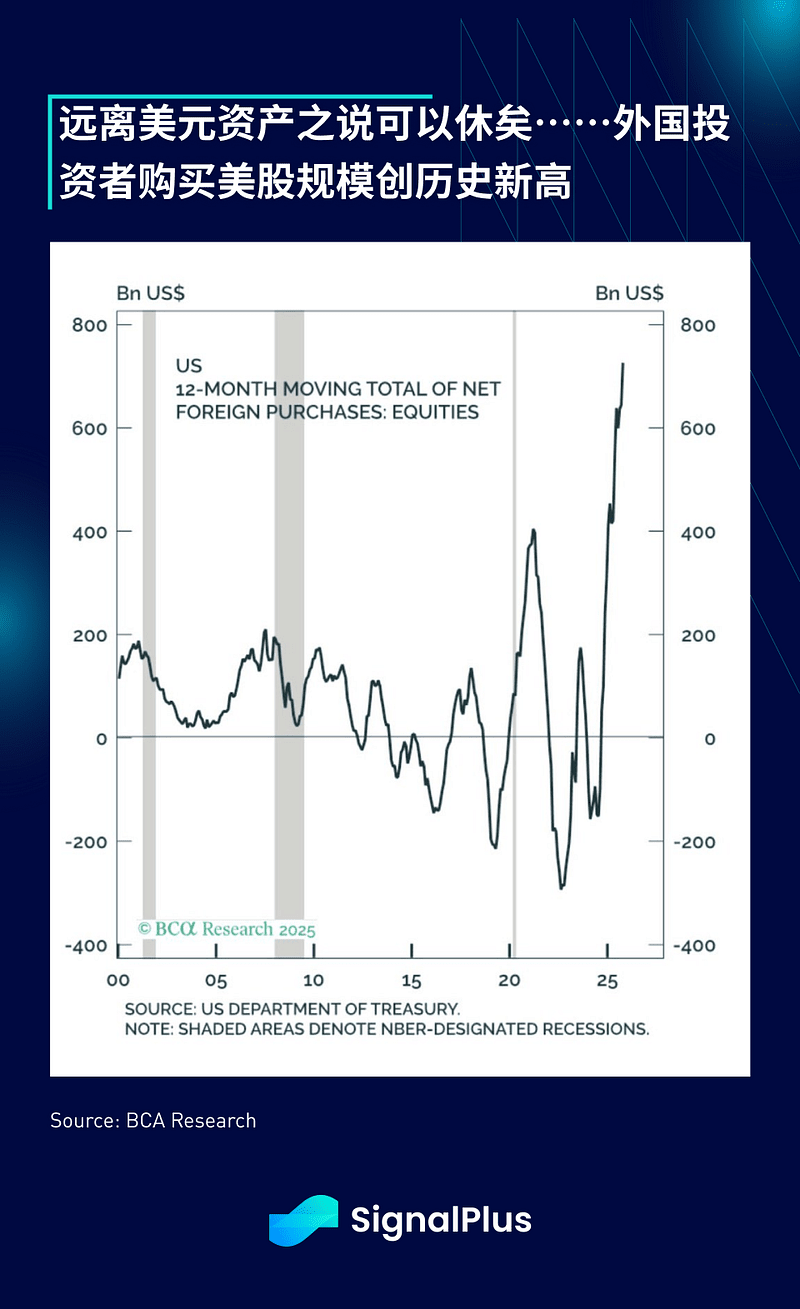

First, despite ongoing concerns about dollar depreciation and capital fleeing U.S. markets (ha!), by the end of 2025, the 12-month rolling total of foreign investors' purchases of U.S. stocks has set a... record high in history.

The idea of distancing from dollar assets can finally be put to rest... Foreign investors' purchases of U.S. stocks have reached an all-time high.

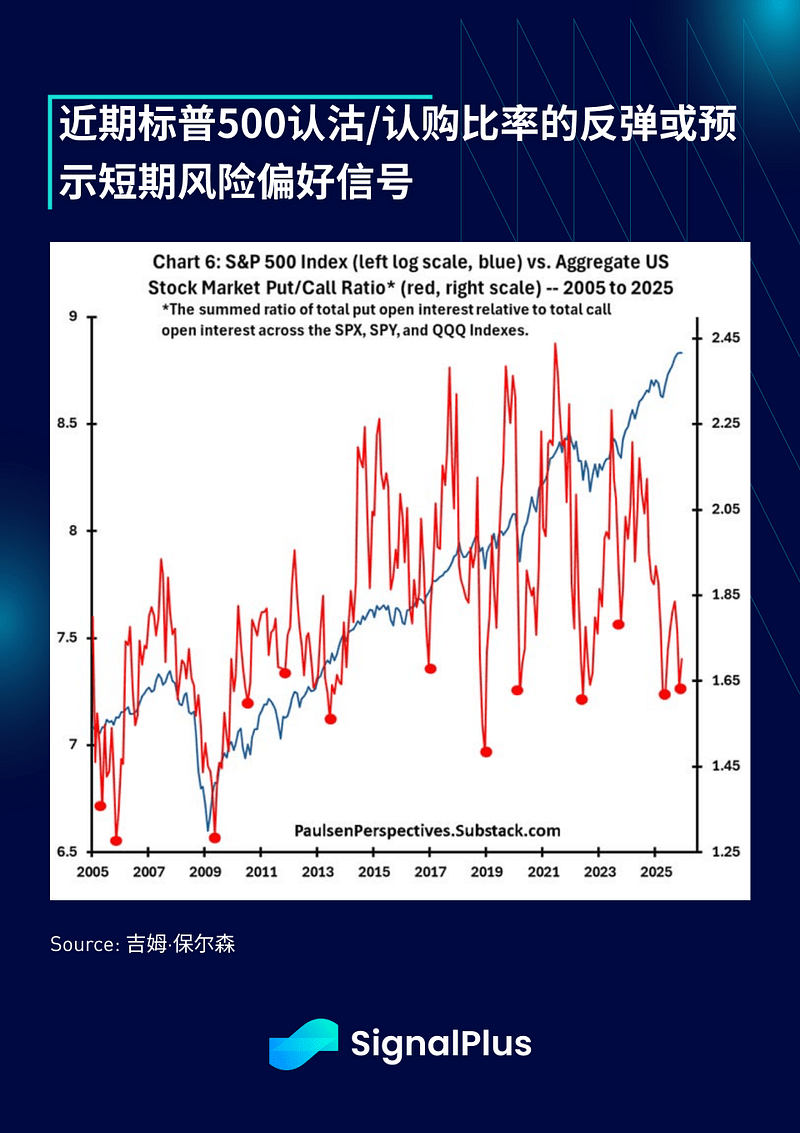

Secondly, despite strong capital inflows, the put-call ratio of the S&P 500 has remained low during the index's continuous record highs (indicating caution). Historically, rebounds in this ratio (red dots in the chart) have often signaled strong upcoming shifts toward risk appetite, which we observed once at the end of last year. (Entirely thanks to Jim Paulson's research).

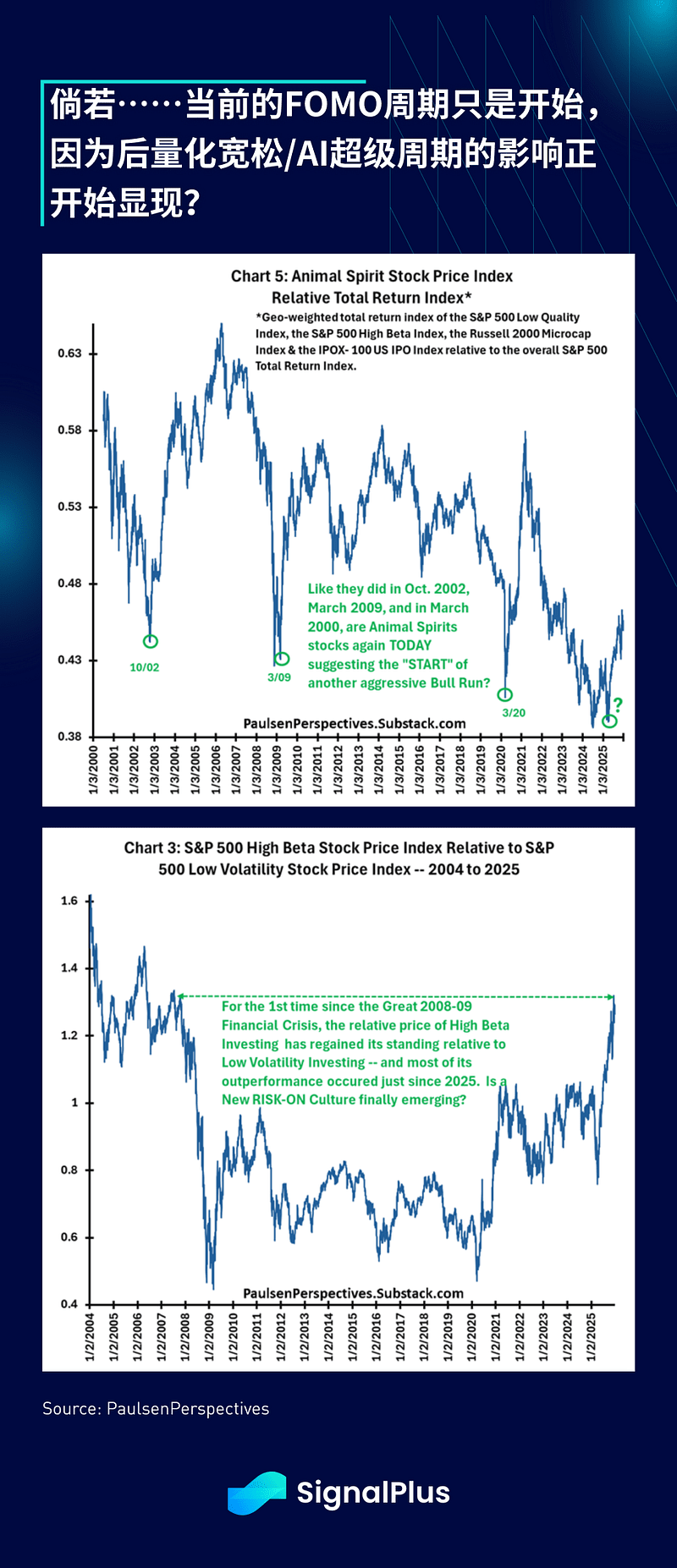

Third, we may be witnessing a significant shift in animal spirits. Recently, high-beta, low-quality, small-cap, and IPO stocks have performed strongly, genuinely regaining leadership and outperformance. Ultra-long-term charts suggest we might be seeing a structural breakout rally driven by FOMO (fear of missing out) and animal spirits—could this be one tangible outcome of the long-term AI supercycle and the rise of mercantilist superpowers?

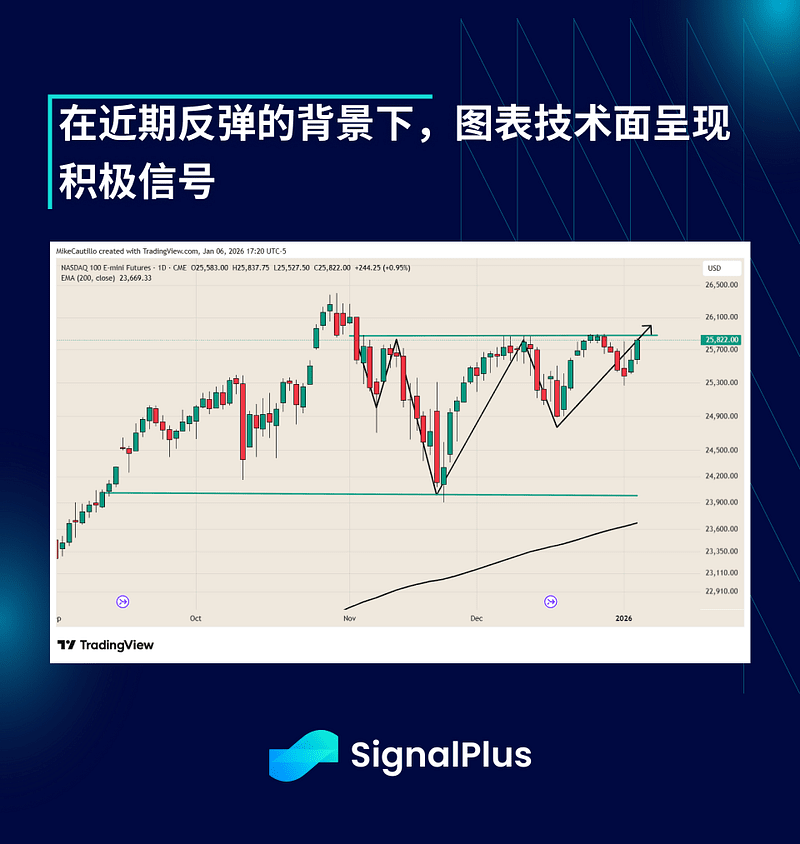

Fourth, the technical picture looks favorable, with the Nasdaq index appearing poised for further upside breakout.

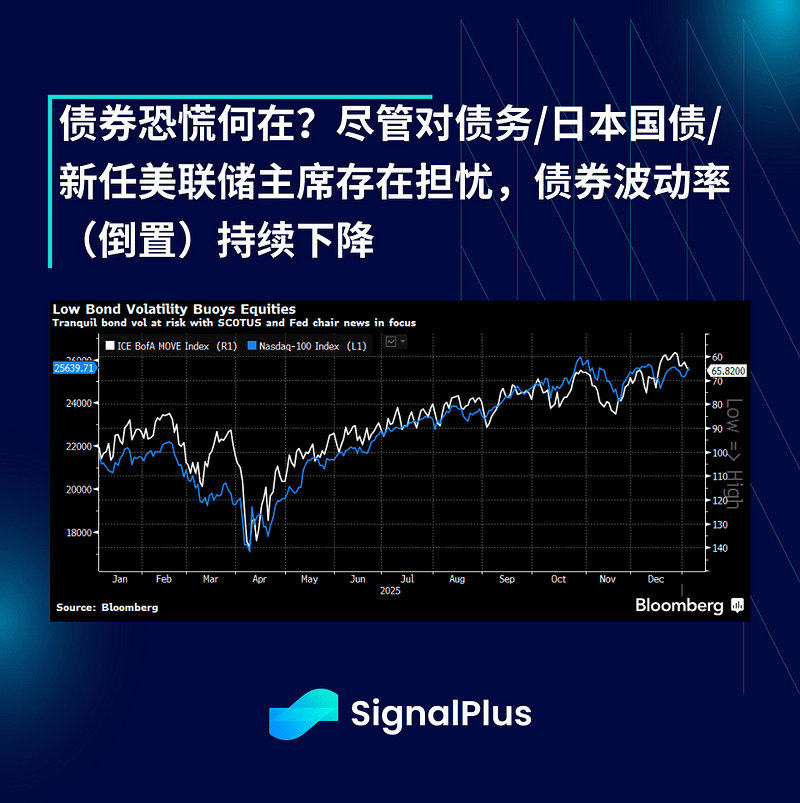

Lastly, declining volatility and correlation are another signal. As stock breadth improves, implied correlation continues to fall, and lower macro volatility is helping push equity prices higher. Despite doomsday talk about rising outstanding debt and rising Japanese government bond yields, fixed-income implied volatility ended 2025 at a multi-year low.

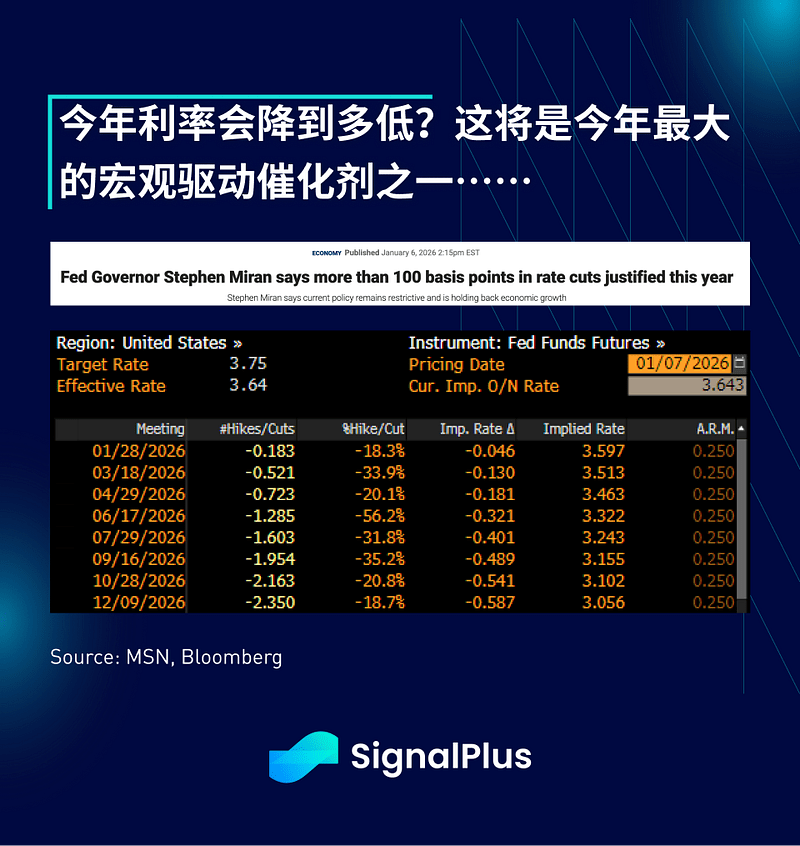

On interest rates, the market has begun focusing on Federal Open Market Committee meetings, with several Fed officials set to speak. Richmond Fed President Barkin is attempting to maintain balance, highlighting the delicate trade-off between inflation and employment; meanwhile, ultra-doveish official Milan is calling for rate cuts of 'far more than' 100 basis points, reminding everyone that, until further notice, an era of accommodative monetary policy should remain the baseline assumption.

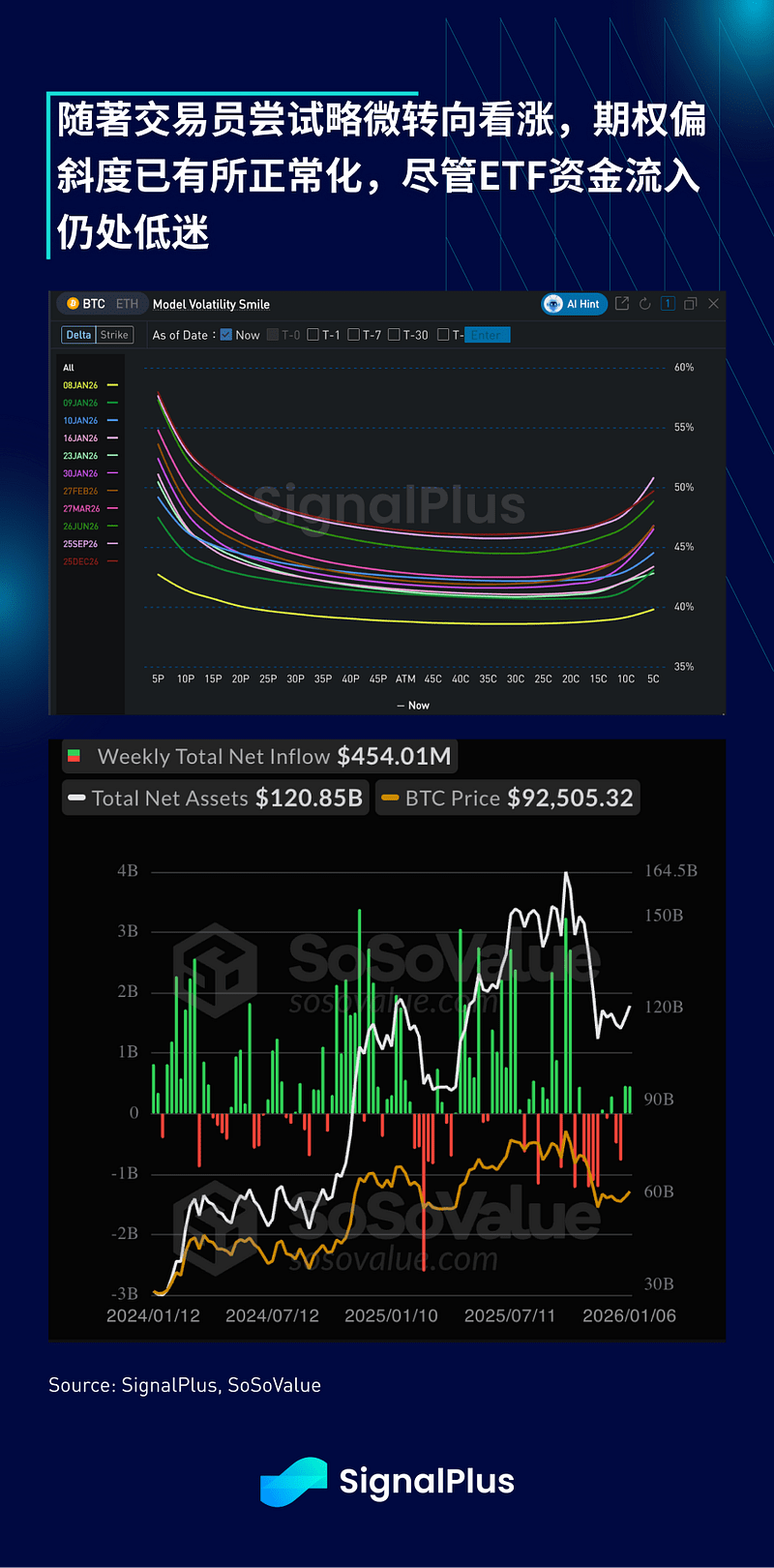

In the crypto space, since we've held the 2024 trendline, prices have rebounded strongly to around $93,000. MSCI's decision to maintain the index eligibility of digital asset trusts (such as MSTR) has provided urgently needed short-term support. However, the index provider announced it will initiate a 'broader consultation' on how to handle non-operating companies.

Recently, call skew has improved, particularly around the $100,000 level, as traders have slightly turned more positive on BTC, though overall caution remains due to lackluster ETF inflows since November. Market activity remains subdued, awaiting a stronger catalyst to break out from the persistent $87,000–$95,000 range since November. Best of luck, happy trading.