Walrus is more than just a "cloud drive" for Web3; it acts as a Liquidity Layer for Information. By integrating with the Sui blockchain, it transforms static data into dynamic, financialized objects, bridging the gap between DeFi and the physical world’s data.

Here is an evaluation of how Walrus creates a symbiotic relationship with the DeFi ecosystem.

1. Programmable Collateral: Data as an Asset

In traditional DeFi, collateral is usually a token (like SUI or USDC). With Walrus, Data Blobs are Sui Objects. This allows for a new breed of financial instruments:

Tokenized Data Markets: Research papers, AI training sets, or high-value proprietary algorithms stored on Walrus can be fractionalized and traded. A user could theoretically take out a loan against the "future royalty stream" of a dataset stored on the protocol.

Storage-Backed Securities: Since storage capacity on Walrus is tokenized, developers can hedge against future storage costs by buying "Storage Blobs" today, effectively creating a futures market for digital real estate.

2. Real-World Assets (RWA) and Verifiable Provenance

The biggest hurdle for RWA in DeFi is the "Oracle Problem"—proving that the digital token actually represents a real-world asset.

Immutable Audit Trails: Legal deeds, insurance contracts, and shipping manifests can be stored on Walrus. Because these files are content-addressed (their ID changes if even one pixel is altered), DeFi protocols can verify the underlying documentation of an RWA without a centralized intermediary.

Fraud Prevention: Walrus allows DeFi platforms to verify transactions in real-time by cross-referencing against massive, tamper-proof archives of historical ledger data that would be too expensive to store on a standard Layer 1.

3. DeFi Governance and Transparency

Most DAOs (Decentralized Autonomous Organizations) host their voting discussions and whitepapers on centralized platforms like Discord or Notion.

Censorship-Resistant Governance: By hosting DAO constitutions and historical voting records on Walrus, a protocol ensures that its "memory" cannot be wiped by a central hosting provider.

Transparent Analytics: Walrus enables "Data Availability" for complex DeFi strategies. Yield aggregators can store detailed performance logs and audit reports on-chain (via Walrus) so that users can verify the safety of their funds with 100% transparency.

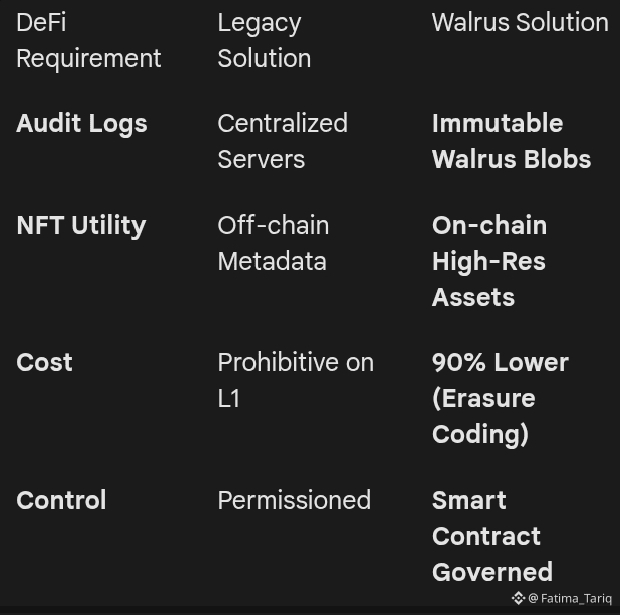

The Synergy: Walrus vs. Traditional DeFi Storage

The WAL Token: The Economic Engine

The WAL token doesn't just pay for "rent." It powers a circular economy:

Usage: Every "Write" to the network burns or locks tokens, creating a deflationary pressure.

Security: Users stake WAL to storage nodes, earning a portion of the protocol's fees—effectively turning storage demand into a DeFi yield opportunity.

Incentives: The RedStuff algorithm ensures that only honest nodes are rewarded, creating a "Proof of Storage" that functions as a high-security foundation for financial apps.

#Walrus || $WAL || @Walrus 🦭/acc