The latest U.S. JOLTS (Job Openings) data has just been released and the numbers came "chilled":

📉 Current: 7,146M

🎯 Projection: 7,610M

⬅️ Previous: 7,449M

What does the reading tell us?

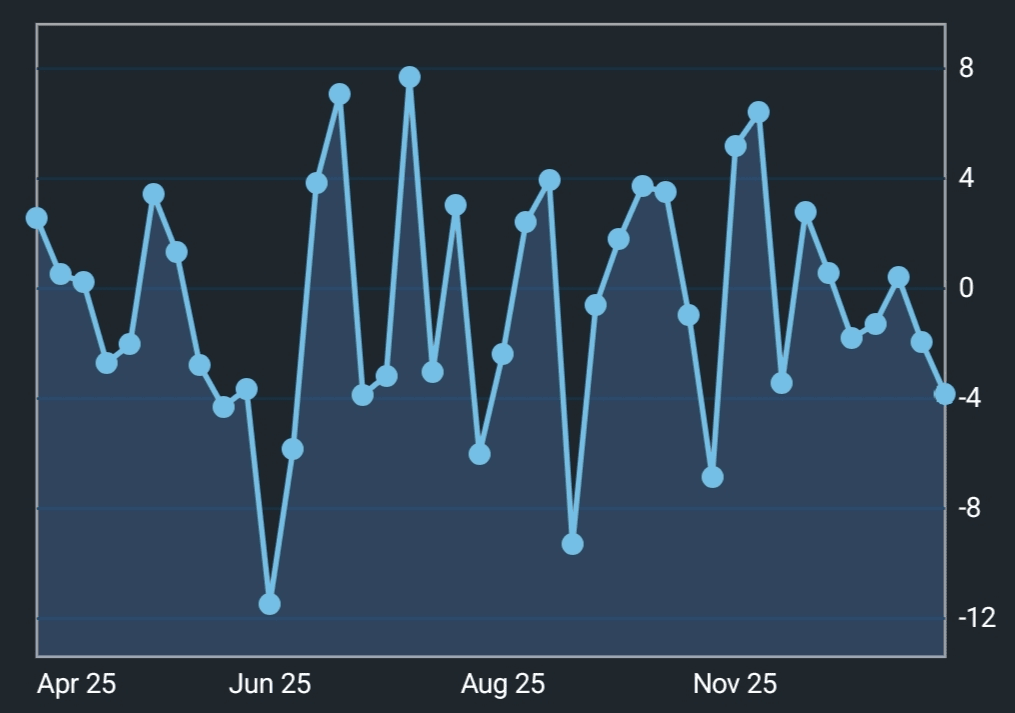

The U.S. labor market is losing momentum faster than analysts anticipated. The chart shows a clear downward trend since 2022, now reaching one of the lowest points in the recent cycle.

Why is this BULLISH for Crypto? 🚀

1️⃣ End of High Interest Rates: With fewer job openings, inflation tends to fall, allowing the Fed to cut rates with greater confidence in 2026.

2️⃣ Dollar Decline: The weakening of the dollar (Bearish for USD) often serves as the perfect fuel for a cryptocurrency rally.

3️⃣ Risk Appetite: Investors anticipate liquidity injection into the market and seek refuge in scarce assets such as the $BTC .

Verdict: The macro environment is aligning to favor risk assets. If upcoming inflation data confirm this trend, the path to new highs may be open.

Do you believe the FED will accelerate rate cuts now? Comment below! 👇

#Crypto #Bitcoin #JOLTS #Economy #FED #Trade #FinancialMarket #Investments