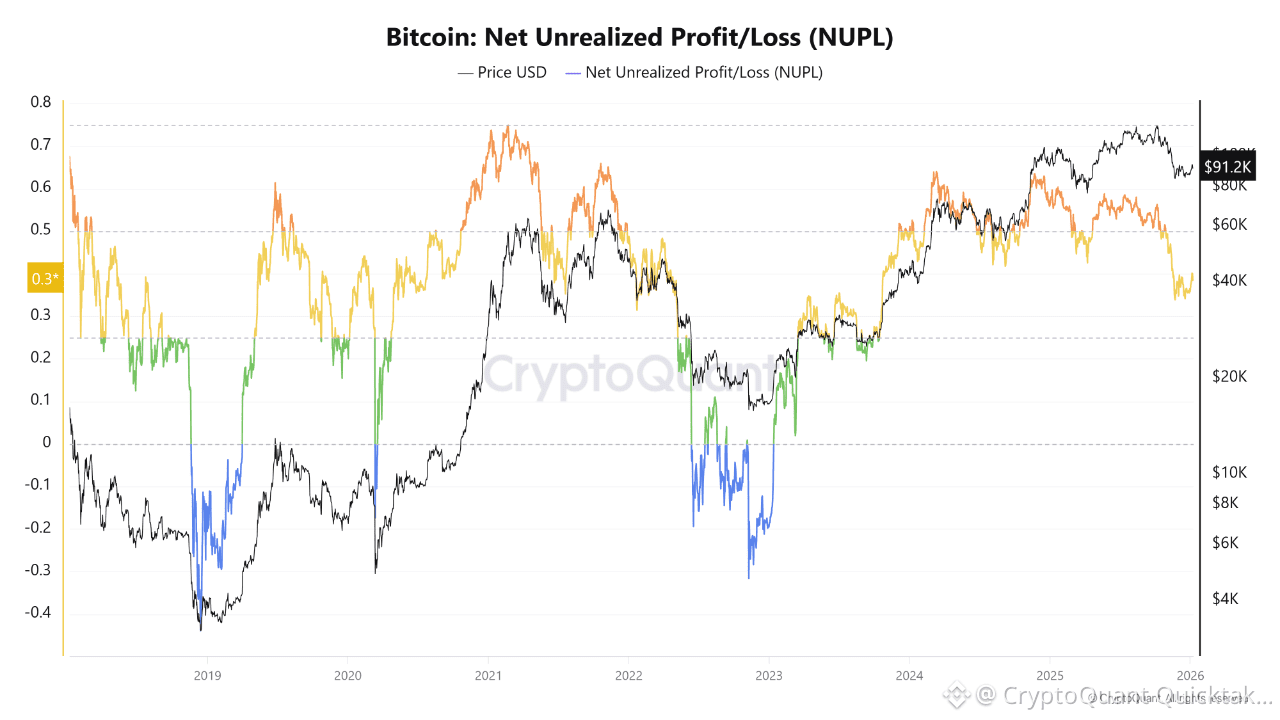

The latest Net Unrealized Profit/Loss (NUPL) reading places Bitcoin around the 0.3 zone, a historically important threshold that often separates early accumulation from broader risk-on behavior. In previous cycles, this level has frequently marked the transition from post-capitulation recovery into a more constructive market structure, while also acting as a consolidation band before the next directional move.

From an on-chain perspective, the current NUPL indicates that the average holder has returned to moderate unrealized profit, yet remains far from the conditions typically associated with late-cycle euphoria. This suggests that the market has largely absorbed prior distribution without entering speculative excess, leaving long-term holders structurally comfortable while shorter-term cohorts remain more sensitive to price fluctuations.

This divergence between holder cohorts tends to amplify volatility around the current range, as marginal shifts in price can trigger faster behavioral responses from short- and mid-term participants. Historically, such environments often precede either a renewed expansion phase or a prolonged period of consolidation, depending on whether confidence continues to build across the broader investor base.

On the macro side, conditions remain mixed. Liquidity has improved relative to last year, but risk assets are still operating under a relatively tight policy backdrop. In past cycles, sustained expansions of NUPL above the 0.5 level have coincided with clearer shifts toward accommodative financial conditions and stronger capital inflows into crypto markets. Until that confirmation emerges, the current NUPL structure is better interpreted as a phase of confidence rebuilding rather than a late-cycle bull signal, pointing to a market that is stabilizing after a major reset while waiting for stronger alignment between on-chain profitability and macro liquidity trends.

Written by CryptoZeno