I’ve been in Bitcoin since 2016 — long enough to watch the same cycle repeat again and again. That experience is exactly why I decided to cash out most of my Bitcoin earlier this year when the price fell from around $120,000 to $110,000.

This wasn’t an emotional decision. It was a cycle-based decision.

Bitcoin doesn’t move in straight lines. It moves in predictable, repeating cycles driven by one key event: the halving.

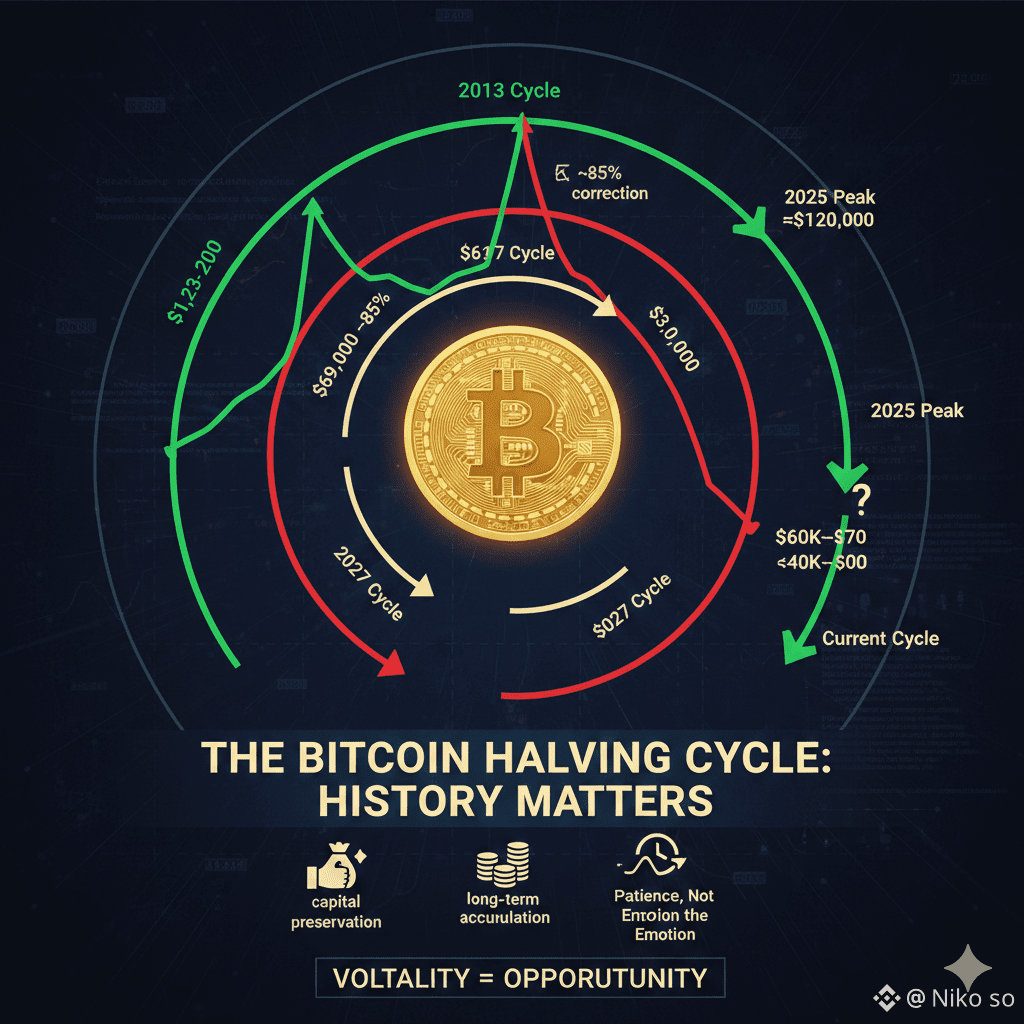

The Bitcoin Halving Cycle: Why History Matters

Every four years, Bitcoin goes through a halving, cutting the block reward in half. This reduces new supply, pushes prices higher, creates hype — and eventually leads to a major correction.

The next halving is expected around April 2028, but historically, Bitcoin peaks 12–18 months after a halving, followed by a deep reset.

This pattern has never failed so far.

Historical Data: The Pattern Is Clear

Let’s look at previous cycles:

2013 cycle:

Bitcoin surged to ~$1,200, then crashed into the $200 range by 2014

📉 ~80% correction

2017 cycle:

Bitcoin hit ~$20,000, then fell to ~$3,000 by the end of 2018

📉 ~85% correction

2021 cycle:

Bitcoin peaked at ~$69,000, then dropped to ~$15,000 in 2022

📉 ~78% correction

Every cycle follows the same story: parabolic rise, euphoria, and a brutal correction.

The Current Cycle: What Could Happen Next?

After the April 2024 halving, Bitcoin entered another strong uptrend. If we assume a cycle top near $120,000 in 2025, the math is simple:

A 50% correction brings Bitcoin back to $60K–$70K

A 60–70% correction, consistent with history, could push prices into the $40K–$50K range

This wouldn’t be shocking — it would be normal.

Why This Isn’t Bad News

Big pullbacks aren’t a flaw in Bitcoin. They’re part of how the system works.

Corrections:

Flush out leverage and hype

Shake out weak hands

Reset the market for sustainable growth

For long-term investors, these periods often create the best buying opportunities.

Why I’ve Done This Before — And Why I’ll Do It Again

I followed this same strategy in:

2017

2021

Each time:$BTC

I took profits near cycle highs

Waited patiently during the downturn

Re-entered during deep corrections

The result wasn’t panic selling — it was capital preservation and long-term accumulation.

Looking Ahead to 2026

If Bitcoin is trading around $60,000 or lower by the end of 2026, don’t be surprised.

That wouldn’t mean Bitcoin failed.

It would simply mean the cycle is doing what it has always done.

Final Thoughts

Bitcoin rewards patience, not emotion.

Zoom out.

Respect the cycles.

Stack smart — not impulsively.

🚀 For long-term holders, volatility isn’t a threat. It’s the opportunity.#BTCVSGOLD #WriteToEarnUpgrade #BTC走势分析 #Binance