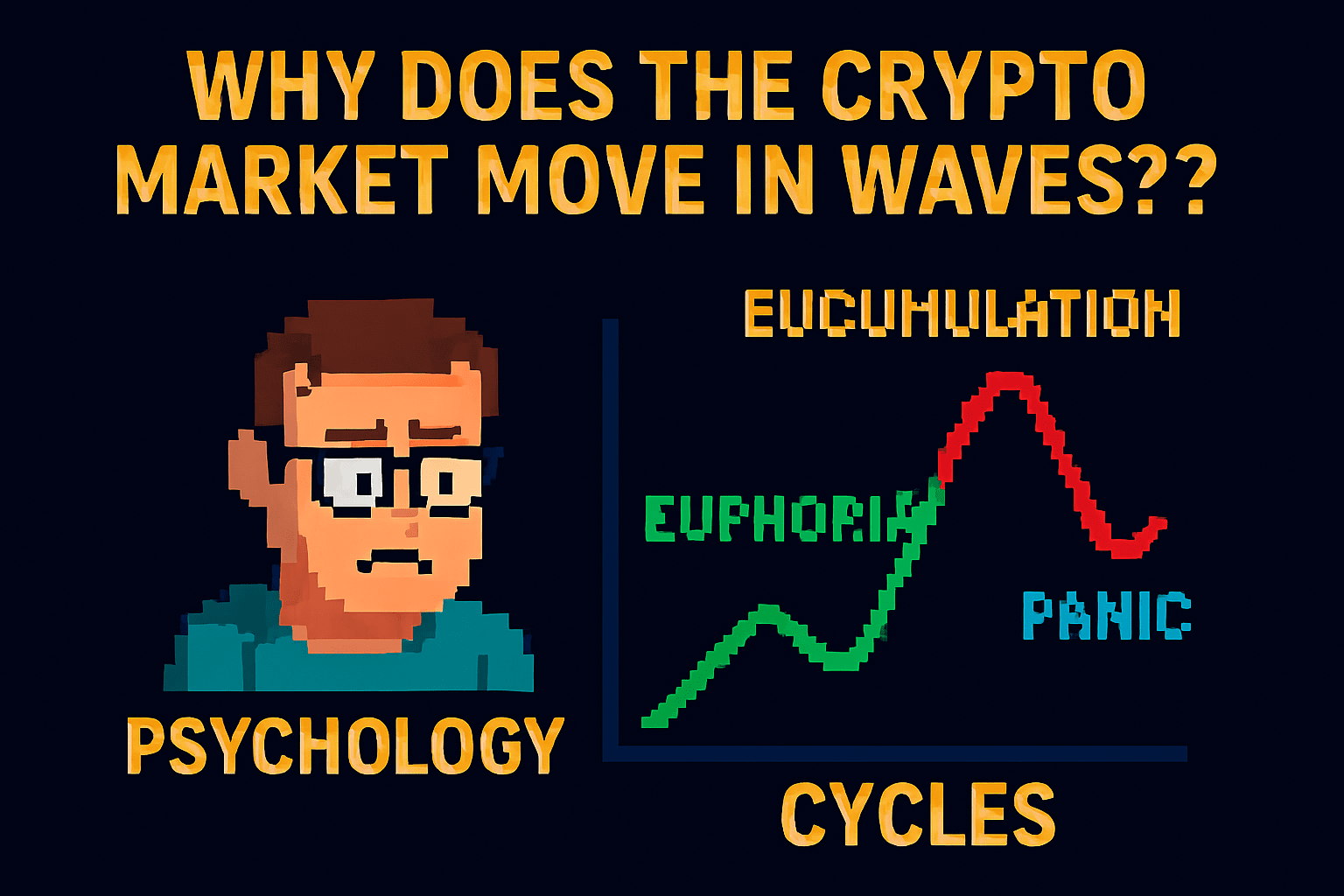

🔍 Why does the crypto market move in waves? Psychology, cycles and investor behavior

1. The crypto market is not just charts — it’s people

Many beginners look at the market as a set of numbers, but the truth is that price is the result of emotions, not the other way around.

Fear, greed, FOMO, panic — these are what create the waves we see on charts.

2. Market cycles — repeat over the years

The crypto market operates in cycles that usually look like this:

1️⃣ Accumulation — little emotion, low interest

2️⃣ Growth — volume increases, hype grows

3️⃣ Euphoria — everyone is buying because 'it will never drop again'

4️⃣ Correction — the market returns to reality

5️⃣ Panic — 'crypto is dead'

6️⃣ Stabilization — and the cycle begins anew

The most interesting part?

Most people buy during euphoria and sell during panic.

3. Why are these cycles so repetitive?

🔸 Because people react emotionally

🔸 Because media amplify narratives

🔸 Because institutional capital acts schematically

🔸 Because FOMO and fear are stronger than logic

The crypto market is pure psychology.

4. How to use cycles to your advantage?

Watch volume, not just price

Don’t buy in euphoria

Don’t sell in panic

Look at the long-term trend

Track your emotions — it really works

Professionals don’t predict the future.

Professionals understand crowd behavior.

5. Summary

The crypto market moves in waves because people move in waves.

Understand emotions — you’ll understand the market.

💬 Question for you:

In which phase of the cycle are we right now, according to you?

🟢 Accumulation

🟠 Growth

🔴 Euphoria

🔵 Correction

⚪ Panic

Write in the comments — let’s see how the community sees it.

ENGLISH

🔍 Why does the crypto market move in waves? Psychology, cycles and investor behavior

1. Crypto is not just charts — it’s people

Price is a reflection of emotions: fear, greed, FOMO, panic.

Charts only show the effect.

2. Market cycles repeat over and over

Typical cycle:

1️⃣ Accumulation

2️⃣ Growth

3️⃣ Euphoria

4️⃣ Correction

5️⃣ Panic

6️⃣ Stabilization

Most people buy in euphoria and sell in panic.

3. Why are cycles so predictable?

🔸 Emotional reactions

🔸 Media amplification

🔸 Institutional patterns

🔸 FOMO stronger than logic

Crypto = psychology.

4. How to use cycles to your advantage?

Watch volume, not just price

Avoid buying in euphoria

Avoid selling in panic

Focus on long‑term trends

Track your emotions

Pros don’t predict the future —

they understand crowd behavior.

💬 Your turn:

Which phase are we in right now?

🟢 Accumulation

🟠 Growth

🔴 Euphoria

🔵 Correction

⚪ Panic

Share your view below.