📰 Daily Market Update:

Today’s market data from Binance on-chain indicators is sending mixed signals.

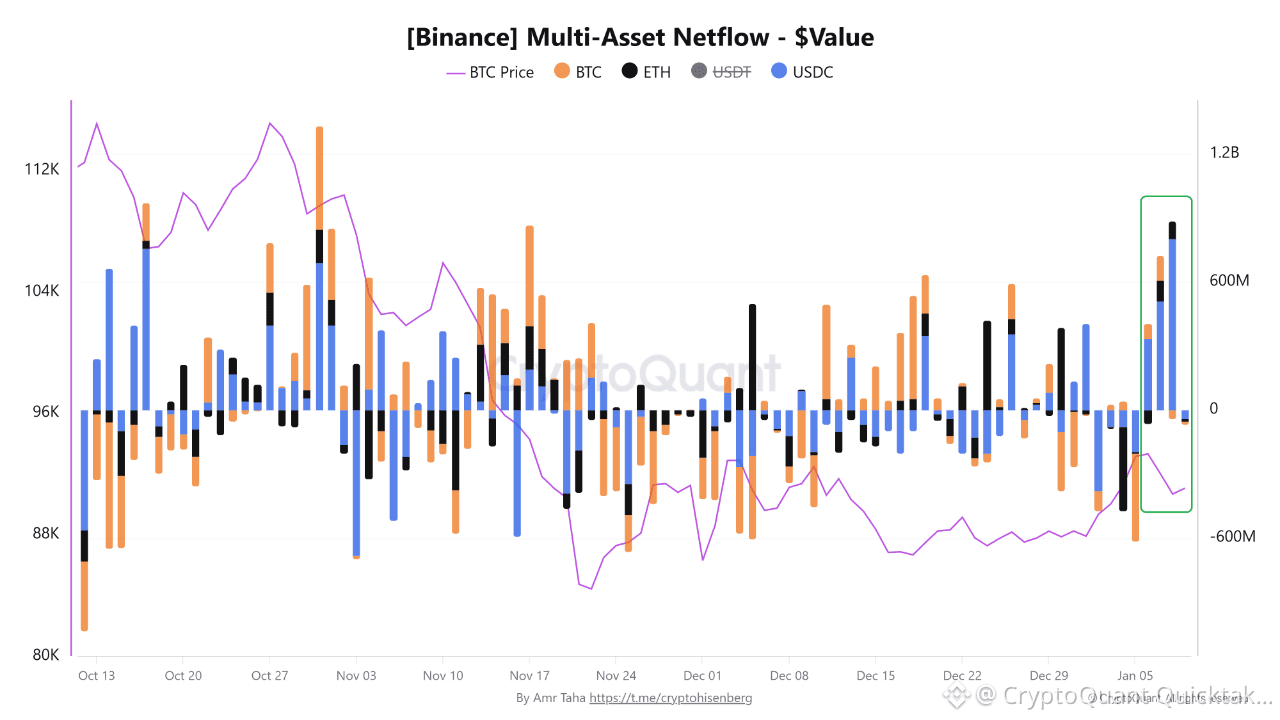

📊 [Binance] Multi-Asset Netflow — $Value

This chart tracks daily netflows (USD value) of multiple assets moving into and out of Binance.

📈 Positive netflow → More deposits than withdrawals (capital moving to exchanges)

📉 Negative netflow → More withdrawals than deposits (capital leaving exchanges)

🔬Key Observations:

USDC recorded 3 consecutive days of strong positive netflows

💵 Jan 6: +$300M

💵 Jan 7: +$500M

💵 Jan 8: +$800M+

📌 What makes this more important is that we saw a very similar setup in mid-October, shortly before Bitcoin dropped from $109,000 to below $85,000.

This doesn’t mean price must dump again, but it clearly shows capital is being parked on exchanges, not deployed yet.

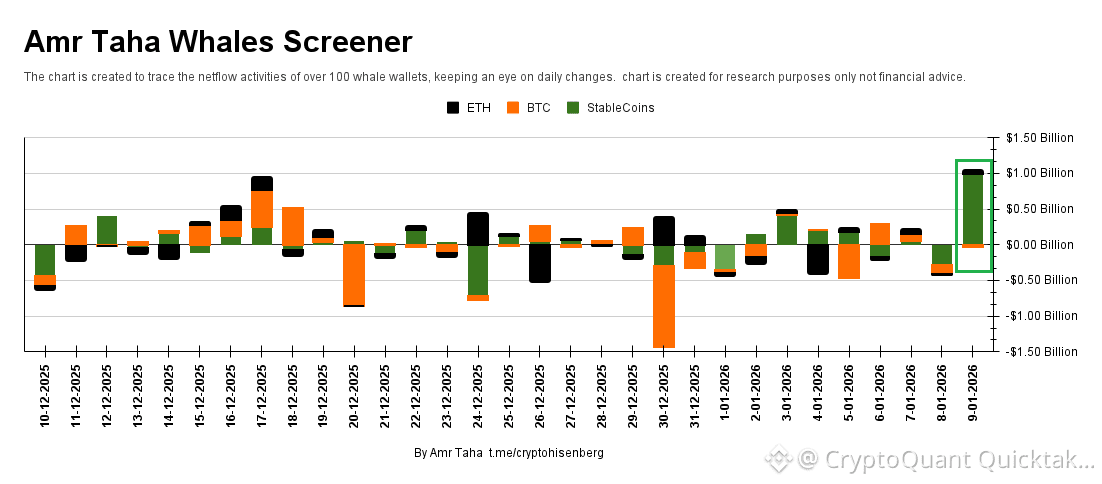

📊 Whales Screener – BTC, ETH, Stablecoin Netflows

The Whales Screener tracks real-time deposits and withdrawals of Bitcoin, Ethereum, and Stablecoins from over 100 actively monitored whale wallets — spot market only.

* The majority of inflows to spot exchanges are dominated by stablecoins.

* Deposit activity for Stablecoins increased noticeably today.

* Stablecoins recorded the largest deposit activity, reaching nearly $1 billion.

* This behavior usually indicates preparation for making a purchase.

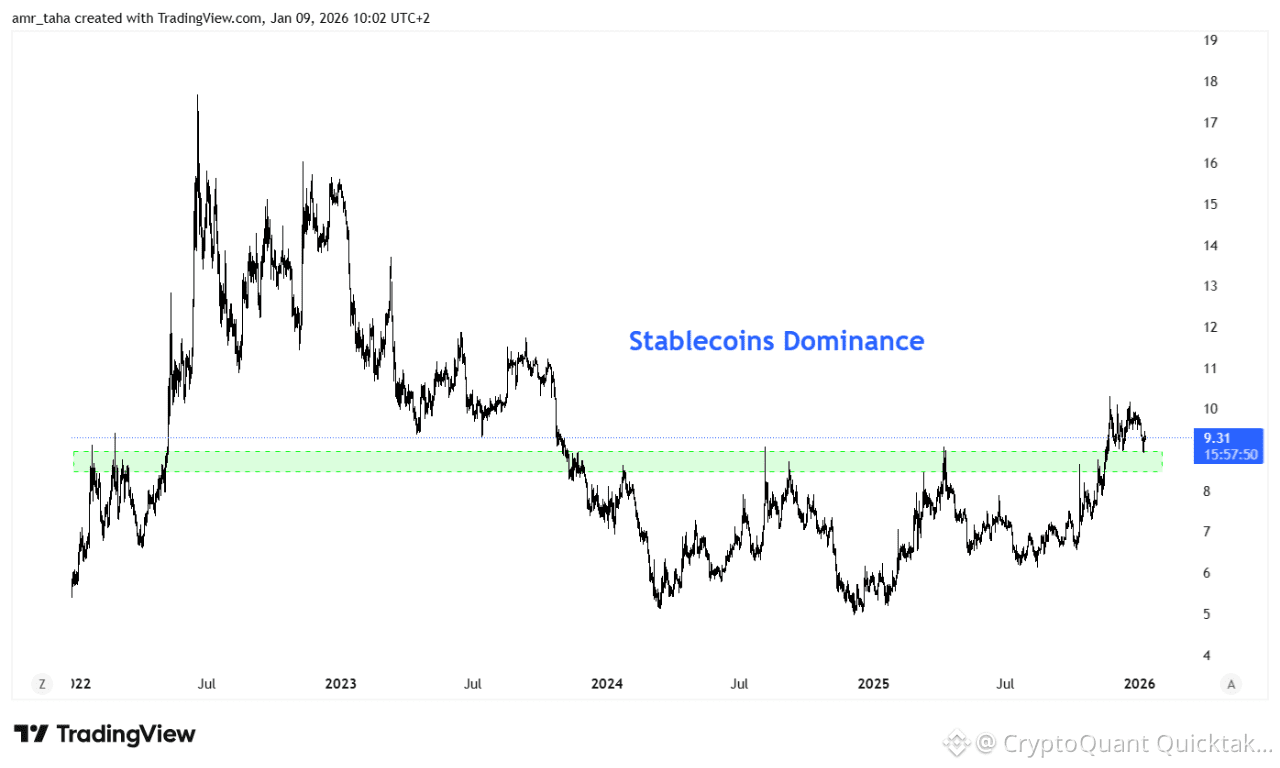

📊 Stablecoins Dominance

The Stablecoins Dominance chart measures the percentage of stablecoins compared to the total crypto market.

* Rising dominance → more selling than buying

* Falling dominance → capital rotating into crypto assets

📌 Right now:

* Stablecoins dominance is holding above 9%

* The daily chart has not closed below 9%

As long as dominance stays elevated, upside momentum for BTC remains limited.

🧠 Final Thoughts

increasing stablecoin balances on spot exchanges can sometimes be bullish (dry powder for future buys),

rising stablecoin dominance usually tells a different story.

Written by Amr Taha