Privacy without accountability is useless. Accountability without privacy is impossible.

That tension sits at the heart of every serious conversation about blockchain adoption in regulated financial markets—and it’s exactly where @Dusk chosen to operate.

For years, crypto has talked about regulation as an external threat. Something imposed. Something to resist.

Institutions, regulators, and real-world financial markets see it differently. For them, regulation is not optional—it is the operating system.

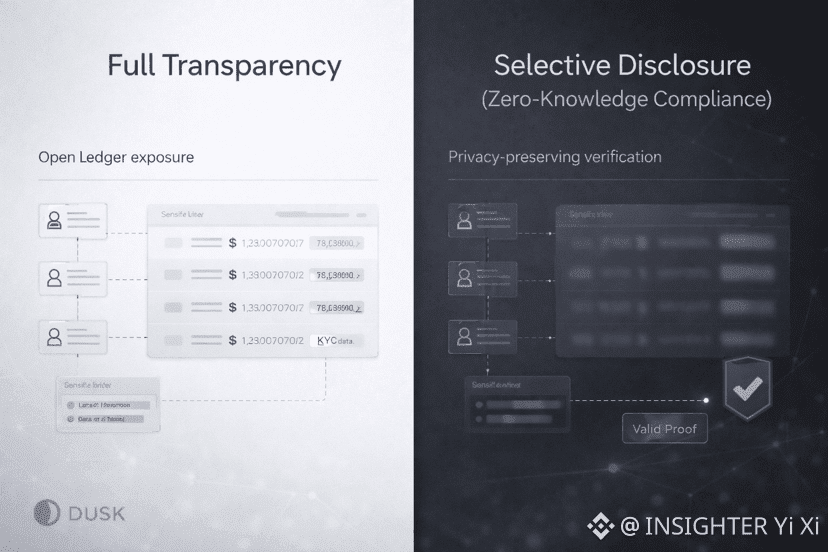

This gap is why so many blockchain pilots stall at the proof-of-concept stage. Public ledgers expose too much. Private systems prove too little. Somewhere between transparency and confidentiality, trust breaks down.

Zero-knowledge compliance is not about hiding activity. It’s about proving correctness without revealing sensitive data. And in regulated markets—securities, RWAs, funds, custody—that distinction is the difference between experimentation and production.

The Problem with “Transparent by Default” Blockchains

Public blockchains were designed for openness, not institutions.

Every transaction, position, and counterparty is visible. That’s a feature for censorship resistance, but a flaw for finance. Asset managers cannot reveal trading strategies. Banks cannot expose client balances. Issuers cannot publish shareholder registries on-chain in plain text.

The common workaround has been permissioned chains or off-chain reporting. Both introduce trust assumptions. Both fragment liquidity. And both defeat the original promise of blockchain-based settlement.

This is where zero-knowledge systems are often misunderstood. Privacy alone is not enough. Regulators do not accept “trust us, it’s private.” They require verifiability.

Dusk’s Core Insight: Privacy and Auditability Are Not Opposites

Dusk’s architecture starts from a simple but often ignored truth:

Regulated finance does not need anonymity. It needs selective disclosure.

In practice, this means transactions can remain confidential while still being provably compliant with rules like:

• Eligibility requirements

• Transfer restrictions

• KYC/AML enforcement

• Ownership limits

• Reporting obligations

Zero-knowledge proofs allow the network to validate that these conditions are met—without exposing the underlying data to the public or even to counterparties.

This is not privacy as secrecy. It is privacy as controlled visibility.

From Theory to Infrastructure: How Dusk Approaches ZK Compliance

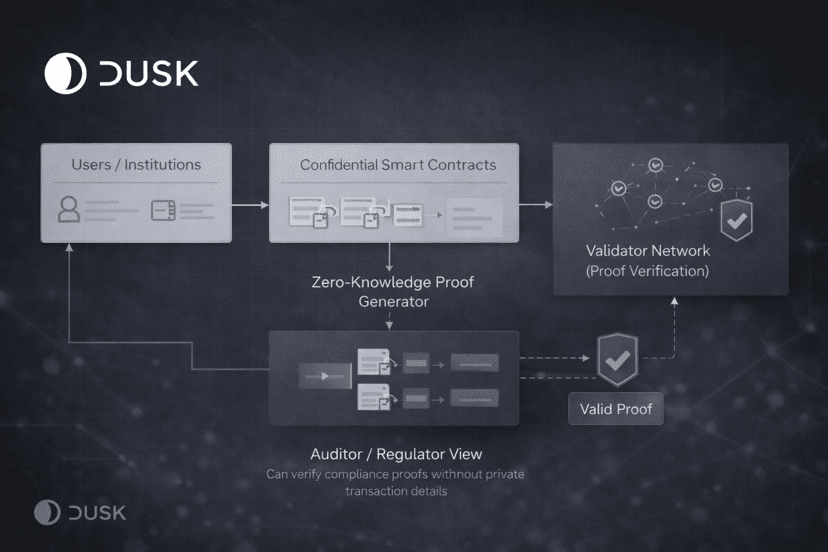

What sets @Dusk apart is not just the use of zero-knowledge proofs, but how deeply they are embedded into the execution layer.

Rather than bolting privacy onto a public chain, Dusk treats confidential logic as a first-class primitive. Smart contracts can enforce regulatory logic internally, generating cryptographic proofs that rules were followed, while keeping sensitive inputs private.

This allows regulators, auditors, or authorized parties to verify compliance cryptographically—without requiring full data access or trusted intermediaries.

In other words, compliance becomes mathematical, not procedural.

Where the DUSK Token Fits into a Compliance-First Design

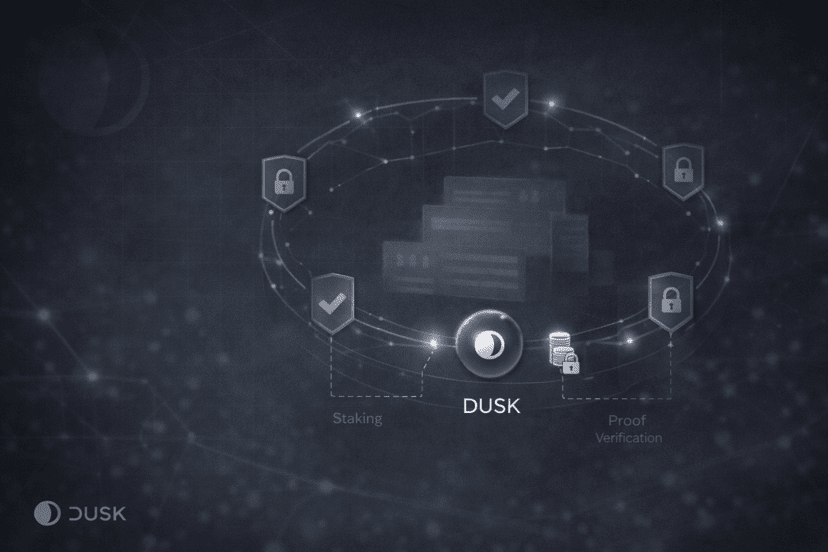

Within Dusk Foundation, the $DUSK token is treated as infrastructure, not narrative. Its primary role is to secure the network and align validators around the correct execution of confidential smart contracts.

More importantly, the token underpins zero-knowledge compliance itself. Validators stake $DUSK to verify privacy-preserving proofs that confirm regulatory rules were followed—without accessing sensitive data. This ties economic accountability directly to cryptographic compliance, removing the need for trusted intermediaries or manual oversight.

As regulated assets and confidential financial workflows expand on-chain, the $DUSK token becomes part of the cost of maintaining privacy, auditability, and settlement integrity. It reflects participation in a compliance-first financial network, not speculative exposure.

Real-World Implications for Regulated Markets

This model changes how on-chain finance can operate at scale.

For issuers, it means tokenized securities that respect jurisdictional rules without manual oversight.

For institutions, it means participating in DeFi-like settlement without leaking proprietary data.

For regulators, it means verifiable oversight without building surveillance infrastructure.

Most importantly, it removes the false tradeoff between decentralization and regulation. Systems no longer have to choose between being open or being compliant—they can be both, by design.

Why This Matters More Than Ever

As RWAs, tokenized funds, and on-chain capital markets move from narrative to necessity, infrastructure choices become irreversible. Compliance retrofits do not scale. Privacy afterthoughts fail audits.

Dusk’s approach suggests a different future: one where regulation is enforced at the protocol level, privacy is cryptographically guaranteed, and trust is replaced by proof.

That future does not require regulators to “understand crypto.” It requires crypto to understand regulation.

And that may be the most important form of innovation happening in blockchain today.