If you’ve been watching @undefined from a distance, it’s easy to file it away under a familiar label and move on. A private chain. A niche. A side story. But DUSK doesn’t really behave like something that exists to “hide transactions.” DUSK behaves like a system that’s been designed around a more uncomfortable question: when money moves through real institutions, who is allowed to know what, and what happens when the right answer changes mid-stream?

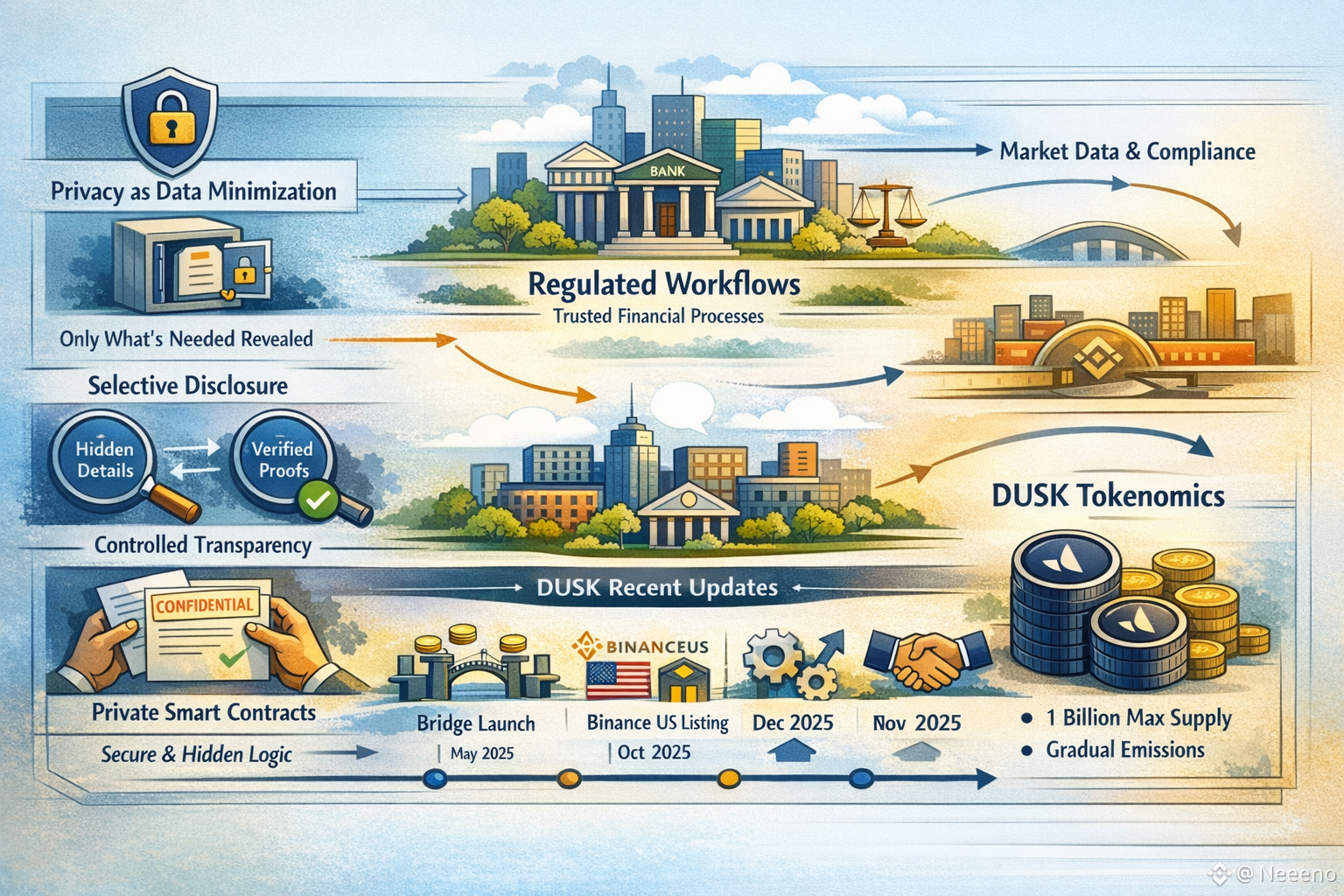

That difference sounds subtle until you’ve lived through an audit request, a counterpart dispute, or a compliance review that arrives on the worst possible day. In those moments, privacy isn’t a vibe. It’s a boundary you either control or you don’t. DUSK’s most interesting idea is that boundaries can be enforced without breaking verification, and that verification can stay intact without forcing public exposure as the default. That’s the “adult” version of confidentiality: not secrecy for its own sake, but selective visibility that still leaves a clean trail when a legitimate party needs to check the story.

The easiest way to understand DUSK is to stop thinking about what it hides and start thinking about what it refuses to leak. Most blockchain systems leak by design. They leak balances, patterns, relationships, intent. Even when the math is correct, the surrounding context can quietly turn into surveillance. DUSK tries to minimize that leakage while still allowing the network to agree on what’s valid. That’s not ideological. It’s operational. It’s the difference between a system that works on a calm day and a system that can survive a tense day without turning everyone’s financial life into collateral damage.

This is also why DUSK keeps pointing toward regulated finance instead of trying to win the culture war. In that world, confidentiality isn’t optional, and neither is accountability. You don’t get to pick one and call it “values.” You need both, and you need them in a form that can withstand lawyers, regulators, counterparties, and human error. DUSK’s own documentation frames the network as built for regulated finance, with confidential balances and transfers while still supporting institutional requirements.

Where this becomes more than philosophy is when you follow how DUSK has been updating itself to meet the reality of adoption. In June 2025, DUSK described a shift toward a layered design that reduces integration friction by leaning into standard Ethereum tooling while keeping the network’s privacy and regulatory posture intact. It’s a pragmatic move: the system stays itself, but it stops asking every external builder to learn a whole new world just to participate.

That matters because integration is where trust usually dies. Not in the whitepaper, but in the connectors: wallets, bridges, exchanges, custody flows, reporting tools, internal controls. DUSK is making the bet that “mature infrastructure” looks like being easy to plug into without becoming easy to exploit. The layered direction is a kind of confession: that the best privacy boundary in the world doesn’t help you if your on-ramps are brittle or your tooling isolates you from the liquidity and habits that already exist.

You can see the same philosophy in the token story, which is rarely told in a way that feels human. DUSK isn’t treated as an optional add-on; it’s treated as the network’s working currency and the incentive glue that keeps participation honest over long time horizons. The official tokenomics describe a maximum supply of 1,000,000,000 DUSK, composed of an initial 500,000,000 and an additional 500,000,000 emitted over decades to reward network security participation. That long emission window isn’t just economics. It’s an admission that reliability is a long game, and that systems meant for real finance can’t be built around short bursts of attention

There’s also a quiet but important operational detail in that same documentation: DUSK exists in common token formats while users can migrate to the network’s native form now that mainnet is live. That’s the kind of unglamorous bridge between “the market we have” and “the system we want,” and it’s exactly where users feel the difference between a project that talks about infrastructure and a project that actually carries the burden of transition

When you want “recent updates” that show what DUSK is really built for, look at the moments where DUSK chooses connectivity without surrendering control. In May 2025, DUSK launched a two-way bridge that allows movement between the network and a widely used environment for token activity, explicitly framing it as a step toward broader ecosystem connectivity while keeping the network’s own issuance as the source of truth. That move is less about convenience than it is about reducing the distance between DUSK and the places liquidity already lives, because in finance, distance becomes risk.

Then in October 2025, DUSK announced a Binance US listing with a clear timeline and trading pair details, calling out the significance of US market access at a time when the project was also pushing forward on its regulated-finance roadmap. Listings are not “tech,” but they change the psychology of participation: they reduce friction, broaden the holder base, and increase the number of people who can stake, use, or simply watch the token without needing insider navigation.

The most telling update, though, is the one that sounds the least exciting: the kind of upgrade you do because you don’t want surprises later. In early December 2025, DUSK community communications described a final major upgrade to the base network intended to prepare for the next stage of execution on top, emphasizing that it aligns the system so the next launch doesn’t require more last-minute disruption. That’s what “built for when things go wrong” looks like in practice: you spend your effort removing the need for emergency heroics.

Now step back and think about the messy reality DUSK is trying to hold. Regulated assets are not like meme tokens. They come with issuers, disclosures, legal boundaries, and the constant possibility of conflict between what a participant wants and what the rules demand. So DUSK has been building partnerships that don’t just add “users,” but add institutional constraints to the design. In November 2025, DUSK announced that it and NPEX would adopt Chainlink standards to bring regulated European securities on-chain, explicitly positioning this as a framework for compliant issuance, settlement, and high-integrity market data.

The NPEX detail matters because it anchors the story in a world where accountability is not optional. The announcement describes NPEX as a regulated Dutch exchange supervised by the Netherlands Authority for the Financial Markets (AFM), and it cites over €200 million in financing for 100+ SMEs and a network of 17,500+ active investors. In other words, DUSK isn’t courting “attention.” It’s courting environments where the cost of a mistake is reputational, legal, and human.

This is where the “disagreements between sources” problem becomes real. Markets don’t fail only when code breaks. They fail when data is contested, when the timing of disclosure is disputed, when the right party can’t prove what happened without revealing more than they should. DUSK’s approach—proofs for validity, sealed details by default, and controlled visibility when required—is essentially a strategy for surviving disagreement. It acknowledges that truth in finance is often procedural: who is allowed to verify, what counts as evidence, and how you reveal enough to resolve conflict without exposing everything.

And that loops back to the token again, because incentives decide whether those boundaries stay credible. DUSK’s tokenomics spell out that DUSK is used to participate in network security and to pay network fees, with rewards and penalties shaping behavior over time. The reason that matters emotionally is simple: users can tolerate complexity; they can’t tolerate betrayal. When a network’s incentives are sloppy, the betrayal eventually arrives as downtime, censorship pressure, or quiet centralization disguised as “efficiency.”

Even the market snapshot tells a story about scale and expectations. As of January 10, 2026, CoinMarketCap reports DUSK around $0.0535, with roughly 487 million circulating and a maximum supply of 1 billion. Price is not the point here, and it’s not a promise. The point is that DUSK is already living in the public market while trying to grow into a regulated-grade system, which means it has to survive volatility, narratives, and impatient timelines without bending its core boundaries just to appease the moment.

So when someone says “DUSK is a privacy chain,” I don’t argue. I just think they’re naming the surface instead of the purpose. DUSK reads more like an attempt to make confidentiality behave like a professional standard: reveal only what’s necessary, keep verification intact, and make the hard moments predictable instead of dramatic. The recent cadence—connectivity work, exchange access, institutional partnerships, and pre-launch stability upgrades—feels aligned with that.

In the end, the most serious infrastructure is the kind you stop noticing when it works. DUSK is trying to earn that kind of invisibility: the quiet assurance that your balances won’t become a public spectacle, that disputes can be resolved without overexposure, and that “verification” doesn’t have to mean “everyone sees everything.” Quiet responsibility looks like shipping the unglamorous upgrades, building the boring connectors, and designing incentives that still hold when nobody is cheering. Reliability matters more than attention because attention moves on. Your financial history doesn’t.