Three possible Long & Short scenarios for the $HBAR (Hedera Hashgraph) cryptocurrency by the end of January 2026 at the current price of approximately 0.11888💲 with a deposit of 1000💲

Stock market information for Hedera (HBAR)

Hedera crypto is on the CRYPTO market.

Current price 0.118681💲 with a change of -0.00💲 (-0.01%) from the previous close.

Intraday high is 0.123108💲, and intraday low is 0.118314💲

Scenario A: Conservative (Neutral-Bullish)

Long Target:

rise to ~0.15-0.18💲

Short Risk:retracement to ~0.100.095💲

Description:

The current technical situation suggests HBAR may already be oversold or in a neutral zone: a potential rise to ~0.15-0.18💲 is possible with moderate bullish pressure.

Consensus forecasts for the coming months/year suggest average levels could be higher than current ones, but without sharp spikes.

Entry/Exit Points:

Long Entry: 0.118-0.122💲 (support zone)

Take profit (Long): 1) 0.15💲 - 2) 0.18💲

Stop loss (protective): 0.095💲

Risk/Potential:

Growth from 0.118💲 to 0.18💲 ≈ +52%

Potential loss if falling to 0.095💲 ≈ -20%

Capital Management:

Long position: 1000💲

Profit-taking plan in parts: 50% ~ 0.15💲, 50% ~ 0.18💲

Scenario B: Bullish (Optimistic)

Long Target:

rise to ~0.23-0.30💲

Short Risk:

retracement to ~0.095-0.105💲

Description:

According to some forecasting models, HBAR could develop growth potential above current levels to significant marks in the next cycle—around 0.23-0.30💲

Bullish potential here is based on improved market sentiment, possible institutional interest (ETFs/partnerships), and technical breakthroughs.

Entry/Exit Points:

Long Entry: 0.115-0.12💲

Take profit (Long): 1) 0.23💲 - 2) 0.30💲

Stop loss: 0.105💲

Risk/Potential:

Growth from 0.118💲 to 0.30💲 ≈ +153%

Potential loss if falling to 0.105💲 ≈ -11%

Capital Management:

Diversification:

Long 70% of capital closer to entry

Additional Long 30% upon break above 0.15💲

Scenario C: Bearish (Correction/Downward)

Short Target:

drop to ~0.095-0.085💲

Long bounce chance:

from zone ~0.08-0.095💲

Description:

If the critical support level ~0.11💲 is not held, technical selling could lead to deeper declines.

Within a correction, consider Short positions if the market confirms weakness.

Entry/Exit Points (Short):

Short Entry: Break and close below 0.115💲

Take profit (Short): 1) 0.095💲 - 2) 0.085💲

Stop loss: above 0.122💲

Risk/Potential (Short):

Decline from 0.118💲 to 0.085💲 ≈ +28% for Short

Stop-loss if rising above 0.122💲 ≈ -3%

Alternative Long on bounce:

Long Entry: 0.085-0.095💲

Take profit: 1) 0.12💲 - 2) 0.135💲

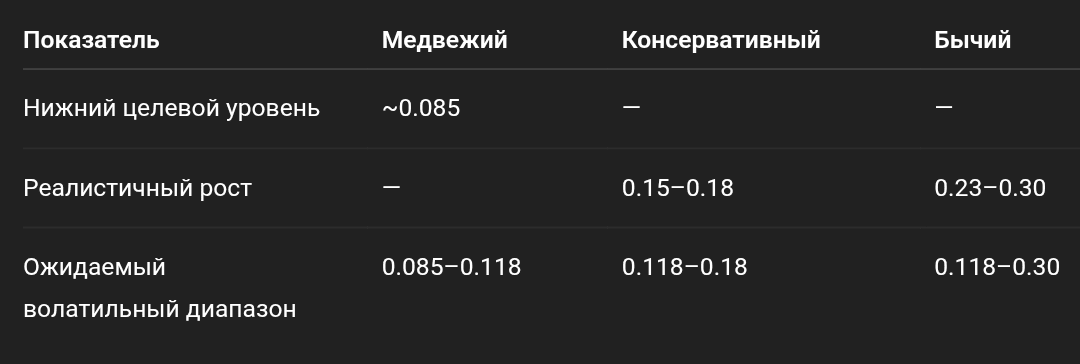

Summary of Comparative Potential

Risks and Recommendations

Risks:

The cryptocurrency market is extremely volatile, especially altcoins.

Forecasts can be conservative or significantly higher/lower than actual movement—especially in the absence of major fundamental drivers.

Risk Management:

Use stop-losses and take profits in parts.

Follow the dominance of $BTC and the overall market trend (altcoins are highly correlated).

Assess news about institutional interest (ETFs, partnerships).

P.S. All scenarios are based on common technical and fundamental levels, including analyst forecasts, key support/resistance levels, and market sentiment.🤔