Crypto me aksar do extreme dikhte hain.

Ya to sab kuch fully public hota hai, ya phir regulation aate hi system wapas centralized ho jata hai.

Real finance dono me se koi bhi nahi hota.

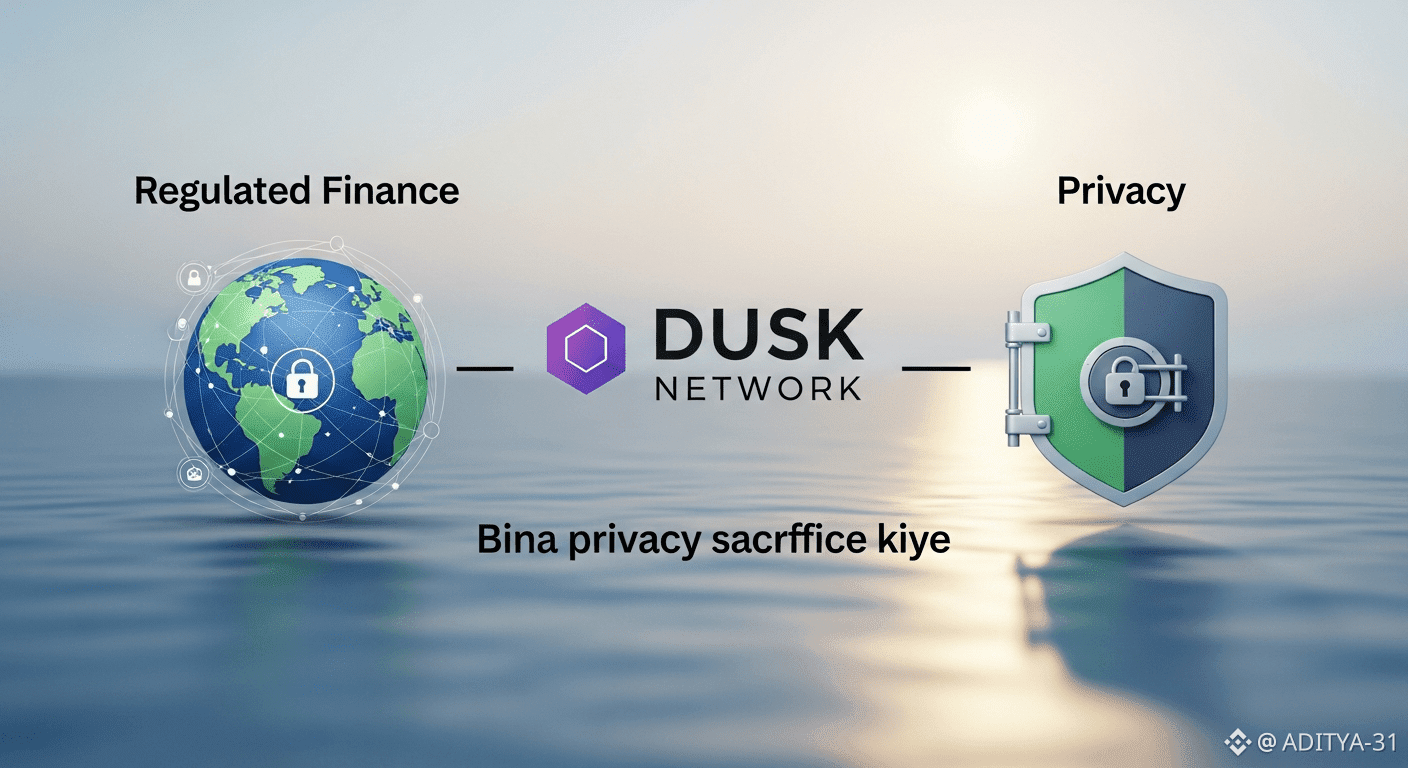

Isi gap ko solve karne ke liye Dusk Network bana hai.

Dusk ka goal DeFi speculation ya meme culture nahi hai. Ye chain specially regulated financial assets ke liye design ki gayi hai — jahan rules bhi follow hote hain aur privacy bhi bani rehti hai.

---

Problem kya hai existing blockchains me?

Most public blockchains transparency pe based hain.

Har transaction, har balance, sab kuch open.

Ye theek hai jab:

simple token transfers ho

open DeFi protocols ho

Lekin jaise hi baat aati hai:

equity

bonds

private shares

regulated securities

wahi transparency problem ban jaati hai.

Real finance me chahiye:

investor privacy

KYC / AML rules

jurisdiction restrictions

controlled transfers

Aaj ke blockchains me ye cheezein ya to off-chain handle hoti hain, ya centralized middlemen ke through. Matlab decentralization weak ho jaata hai.

---

Dusk ka approach different kyu hai

Dusk me compliance koi “extra feature” nahi hai.

Compliance protocol ke andar built-in hoti hai.

Iska matlab:

rules onchain enforce hote hain

lekin sensitive data public nahi hota

Cryptography use karke Dusk ye ensure karta hai ki transaction valid ho, bina ye bataye ki kaun involved hai ya exact details kya hain.

Simple words me:

regulator verify kar sakta hai

company legal reh sakti hai

investor ki privacy safe rehti hai

Aur kisi centralized authority pe trust karna nahi padta.

---

Tokenization, lekin serious version

Dusk pe tokenization ka matlab speculation nahi hai.

Yahan assets natively issue hote hain as regulated digital securities.

Isse kya hota hai:

shares aur debt onchain issue ho sakte hain

transfer rules automatic enforce hote hain

dividends aur voting programmable ho jaati hai

cap table real-time update hota hai

Private companies aur SMEs ke liye ye game changer hai.

Unke liye capital raise karna aaj slow aur costly hota hai. Dusk ye process simplify karta hai, bina rules tode.

---

Institutions ke liye bana hua chain

Bahut chains bolti hain “institutions ke liye”.

Dusk actually waisa bana hua hai.

Iska focus hai:

predictable execution

confidential transactions

clear ownership rules

long-term regulatory compatibility

Isliye ye sirf startups ke liye nahi, balki exchanges, custodians aur regulated platforms ke liye bhi relevant hai.

---

$DUSK token ka role

$DUSK sirf ek trading token nahi hai.

Validators DUSK stake karke network secure karte hain

Honest behavior pe rewards milte hain

Governance ke through protocol future me evolve hota hai

Economic model hype ke liye nahi, long-term stability ke liye design hua hai.

---

Long term me Dusk kyu important hai

Finance slow move karta hai, lekin jab move karta hai to permanently.

Jo infrastructure adopt ho jaata hai, wahi saalon tak chalta hai.

Dusk us jagah pe khada hai jahan:

crypto experimentation khatam hoti hai

aur real financial infrastructure shuru hota hai

Har cheez public hona zaroori nahi.

Har cheez permissionless bhi nahi hoti.

Lekin har cheez verifiable, compliant aur efficient honi chahiye.

Dusk exactly wahi build kar raha hai.

Ye loud project nahi hai.

Ye flashy bhi nahi hai.

Lekin jaise-jaise regulated tokenization grow karega, waise-waise Dusk jaise networks ki importance aur clear hoti jayegi.