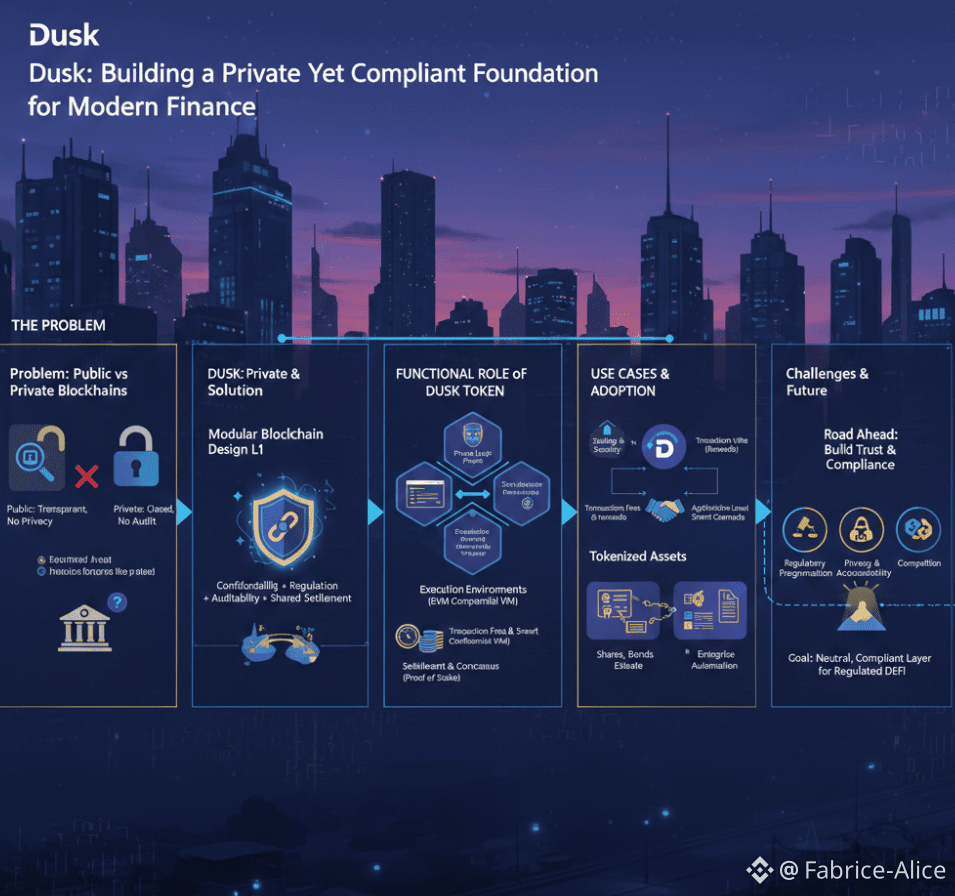

@Dusk is a Layer 1 blockchain developed to address a fundamental limitation in existing blockchain systems. Most networks fall into one of two extremes: they are either fully public and transparent, or entirely private and restricted. Regulated financial environments, however, require a middle ground. Financial institutions, asset issuers, and banks cannot operate on blockchains where all transactions and balances are publicly visible, yet closed systems fail to provide the shared verification, auditability, and trust that open networks offer. Dusk was designed specifically to bridge this divide by delivering a public blockchain that supports privacy while remaining compatible with regulatory oversight and compliance requirements.

The challenge Dusk tackles is foundational rather than superficial. Traditional financial systems rely on confidentiality, controlled information sharing, and enforceable legal frameworks. In contrast, most public blockchains expose transaction data by default and were never built with regulatory constraints in mind, such as investor confidentiality, reporting standards, or jurisdictional limitations. Instead of adding privacy as an afterthought, Dusk reengineers transactions, smart contracts, and asset behavior directly at the protocol level to better align with institutional needs.

From a technical perspective, Dusk follows a modular blockchain design. Rather than bundling consensus, execution, and privacy into a single monolithic layer, these components are separated. The base layer handles consensus and final settlement, guaranteeing transaction irreversibility once confirmed. On top of this foundation, the network supports multiple execution environments. One of these is compatible with Ethereum, enabling developers to reuse existing tools and workflows, while another is purpose-built for applications that demand enhanced confidentiality. This structure balances flexibility for developers with stability at the core protocol level.

Privacy on Dusk does not come from obscuring the blockchain itself, but from cryptographic mechanisms that verify correctness without exposing sensitive information. Transaction values, account balances, and smart contract data can remain private while still allowing the network to confirm that protocol rules are followed. This capability is particularly relevant for regulated financial products like securities, where participants must be identifiable and transactions auditable without being openly published. Dusk enables selective disclosure, allowing regulators or authorized entities to examine activity when necessary without making all data publicly accessible.

The network operates using a proof-of-stake consensus model. Participants secure the blockchain by staking the native token, which allows for fast and deterministic finality—an essential feature for financial settlement systems. Validators are economically motivated to behave honestly, as malicious actions put their staked assets at risk, aligning network security with participant incentives.

The DUSK token serves multiple practical purposes within the ecosystem. It is required for transaction fees, smart contract deployment, and interaction with decentralized applications. Its most critical role, however, is in securing the network through staking. Token holders can participate directly in consensus or delegate their stake to validators in exchange for rewards. Dusk also supports more advanced staking mechanisms, including smart contract-managed staking, which allows applications themselves to participate in network security. This ties network usage, security, and token utility together, rather than relying solely on speculative demand.

Dusk does not aim to compete with every blockchain platform, but rather to complement the broader ecosystem. By supporting Ethereum-compatible development environments, it reduces friction for developers entering the network. At the same time, its emphasis on confidentiality and regulatory alignment makes it suitable for applications that are impractical on fully transparent chains. Over time, Dusk can serve as a specialized settlement layer for regulated assets while remaining interoperable with other networks.

The most compelling applications for Dusk lie in real-world finance rather than purely crypto-native use cases. One key area is the tokenization of real-world assets such as equities, bonds, and other regulated financial instruments. Dusk enables these assets to be issued, traded, and managed on-chain while adhering to legal ownership structures and privacy obligations. This has the potential to modernize capital markets, where issuance, trading, and settlement processes remain slow, costly, and fragmented. The platform also supports confidential smart contracts for enterprise use, allowing organizations to automate agreements without revealing sensitive business information.

While adoption is still in its early stages, the project has emphasized infrastructure development over hype. Efforts have focused on test networks, developer tools, and engagement with institutional stakeholders rather than short-term exposure. This deliberate pace reflects the realities of regulated finance, where trust, legal certainty, and technical resilience are prerequisites for meaningful adoption.

Nonetheless, significant challenges remain. Regulatory frameworks vary widely across jurisdictions, making it difficult to design a system that satisfies all legal environments simultaneously. Privacy is also a delicate issue, as regulators must be assured that confidentiality does not facilitate misuse or reduce accountability. While Dusk’s selective disclosure approach offers a theoretical solution, its effectiveness will depend on real-world implementation. Competition is another factor, as multiple blockchain projects are exploring privacy-focused and institutional-grade solutions, each with its own compromises.

Ultimately, Dusk’s long-term impact will depend on execution rather than ambition. Its vision is to become a neutral, compliant settlement layer for regulated decentralized finance and tokenized real-world assets. If it succeeds in proving that privacy, programmability, and regulation can coexist on a public blockchain, Dusk could play a significant role in the next stage of blockchain adoption. Rather than following short-term trends, it targets a structural limitation that has so far constrained blockchain’s integration into traditional financial systems.