The first time I saw a serious, professional trader touch on-chain markets, the conversation didn’t start with “Where’s the yield?” It started with, “How do you run size in a market where everyone can watch you build the position?”

That single question explains why modularity matters so much to Dusk, and why it may matter to institutional adoption more than the average crypto investor assumes. Retail can live with clunky workflows, constant upgrades, and fully public strategies. Institutions cannot. They need systems that behave like infrastructure, not like experiments. And in finance, infrastructure means three unglamorous things: predictable operations, controllable risk, and integration that doesn’t break every time the base layer evolves.

Dusk’s “recipe” is essentially an attempt to solve that problem using modular design. Instead of treating the blockchain as one monolithic machine where everything shares the same constraints, Dusk has been moving toward a multilayer architecture where different parts of the system can evolve independently. Their public descriptions outline a stack where the core consensus, data availability, and settlement layer (DuskDS) sits beneath an execution layer (DuskEVM), with a separate privacy-focused environment planned as DuskVM. The point of this design is not marketing. It’s a governance and operational strategy: isolate complexity so upgrades become safer, integrations become easier, and regulated workflows can be supported without forcing the entire network to be rebuilt every cycle.

Why does this matter for institutional adoption specifically? Because institutions buy technology the way airlines buy engines. They care less about how exciting it looks and more about whether it can be maintained, certified, and swapped without grounding the entire fleet. In blockchain terms, modularity lets a network improve execution without rewriting settlement. It lets you bring in new developer tooling without compromising compliance primitives. It creates boundaries, and boundaries are what risk teams understand.

This is not theoretical. Dusk activated a major Layer-1 upgrade to its core chain (DuskDS) in December 2025, described as a step that improves finality and reduces costs while also introducing new APIs for third-party integrations, with nodes required to update ahead of the DuskEVM mainnet launch. That upgrade cadence is exactly where modularity becomes practical: institutions can plan around change when change is structured, segmented, and clearly communicated.

Now bring this back to the trading and investing lens. Traders usually think about modularity as a “tech detail.” But for market structure, it’s closer to a reliability premium. When execution and settlement roles are cleanly separated, you reduce the chance that an application upgrade introduces unexpected settlement risk. When data availability and consensus sit in a stable layer, you reduce the surface area for “unknown unknowns” that create outages and liquidity shocks. That’s not just comforting, it’s economically meaningful. More reliability tends to attract more serious flow, and more serious flow tends to narrow spreads over time.

What really makes Dusk’s approach distinct, however, is that modularity is paired with a very specific target customer: regulated finance. Dusk’s positioning is not “build anything.” It’s to support tokenized securities, compliant DeFi, and real-world assets in a privacy-preserving way. In institutional finance, privacy is not rebellion. It’s market integrity. A bank cannot disclose client positions to the public. An asset manager cannot run a strategy if every trade leaks before it finishes. In public DeFi, that leakage is normal. In real markets, it’s unacceptable.

This is where the modular roadmap matters again. A privacy layer that can operate alongside a widely compatible execution layer is far more institution-friendly than forcing every application to live inside a single privacy framework that developers struggle to adopt. You can imagine how a bank’s internal process works: compliance wants strict rule enforcement, engineers want familiar tooling, business teams want faster deployment, and legal wants clean audit trails. Modularity gives you a way to satisfy those groups without forcing one compromise that breaks the whole adoption effort.

You can see Dusk leaning into the “institution rails” narrative through partnerships and standards. For example, Dusk and NPEX announced adoption of Chainlink interoperability and data standards, including Chainlink CCIP as an interoperability layer for regulated assets issued on DuskEVM, and Chainlink’s Cross-Chain Token standard for cross-chain transfers of DUSK. In practical terms, this is a signal: Dusk wants compatibility with institutional-grade middleware rather than reinventing every integration from scratch.

From an investor perspective, the most grounded way to think about this is not “Will modularity pump the token?” but “Does modularity reduce adoption friction?” Adoption friction is what kills most enterprise blockchain narratives. The tech can be good, but the integration cost is too high, or the upgrade risk is too scary, or the compliance story is incomplete. Modular architecture is one of the few strategies that directly lowers that friction over time.

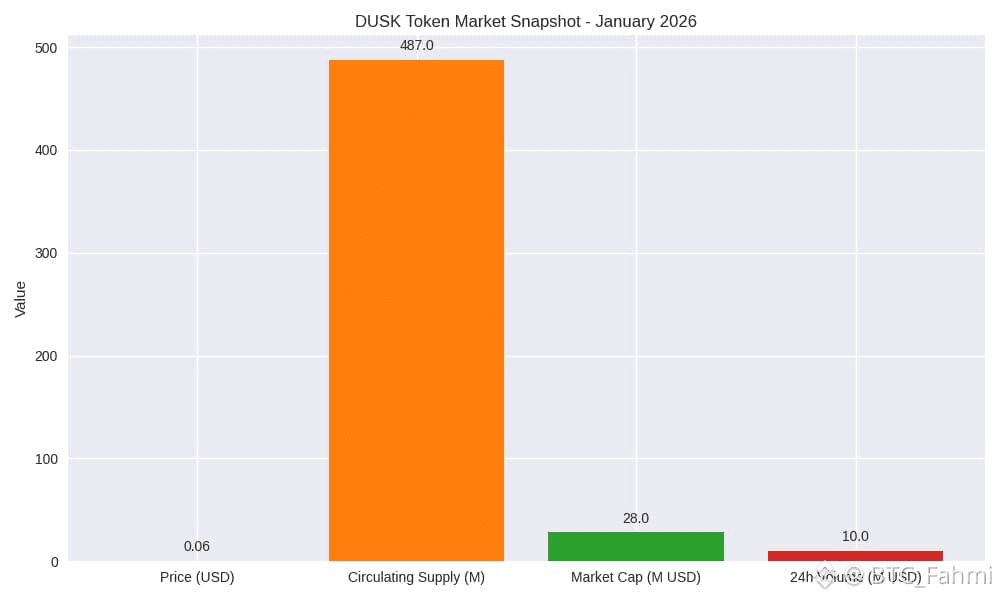

As of today’s market snapshot, DUSK is trading around $0.06, with circulating supply near 487 million and market cap around $28 million, with 24-hour volumes in the low tens of millions depending on venue. That is small-cap territory, which carries a simple implication for traders: narratives will be volatile, and liquidity depth will not behave like a large L1. But it also tells you something useful: if Dusk’s institutional thesis plays out, it does not require winning retail mindshare first. It requires winning a narrow lane where compliance, privacy, and structured finance workflows actually matter.

My honest opinion is that modularity is one of the most “quietly important” ideas in crypto, because it replaces a belief system with an engineering discipline. Instead of pretending a base layer can be everything for everyone, modular design admits the truth: financial systems mature by specialization. Settlement systems, execution venues, data layers, and privacy controls evolve on different timelines and under different constraints. When those timelines are forced into one track, you get either stagnation or chaos. Neither works for institutions.

So if you’re a trader, modularity is not something you trade directly. It’s something you watch as a proxy for whether a network can graduate into real infrastructure. And if you’re an investor, modularity is not a buzzword, it’s an adoption strategy. Dusk’s bet is straightforward: institutions won’t adopt a chain because it’s loud, they’ll adopt it if it behaves like a system that can survive regulation, upgrades, audits, and real money moving through it. Modularity is how you build that kind of system without breaking it every time you improve it.