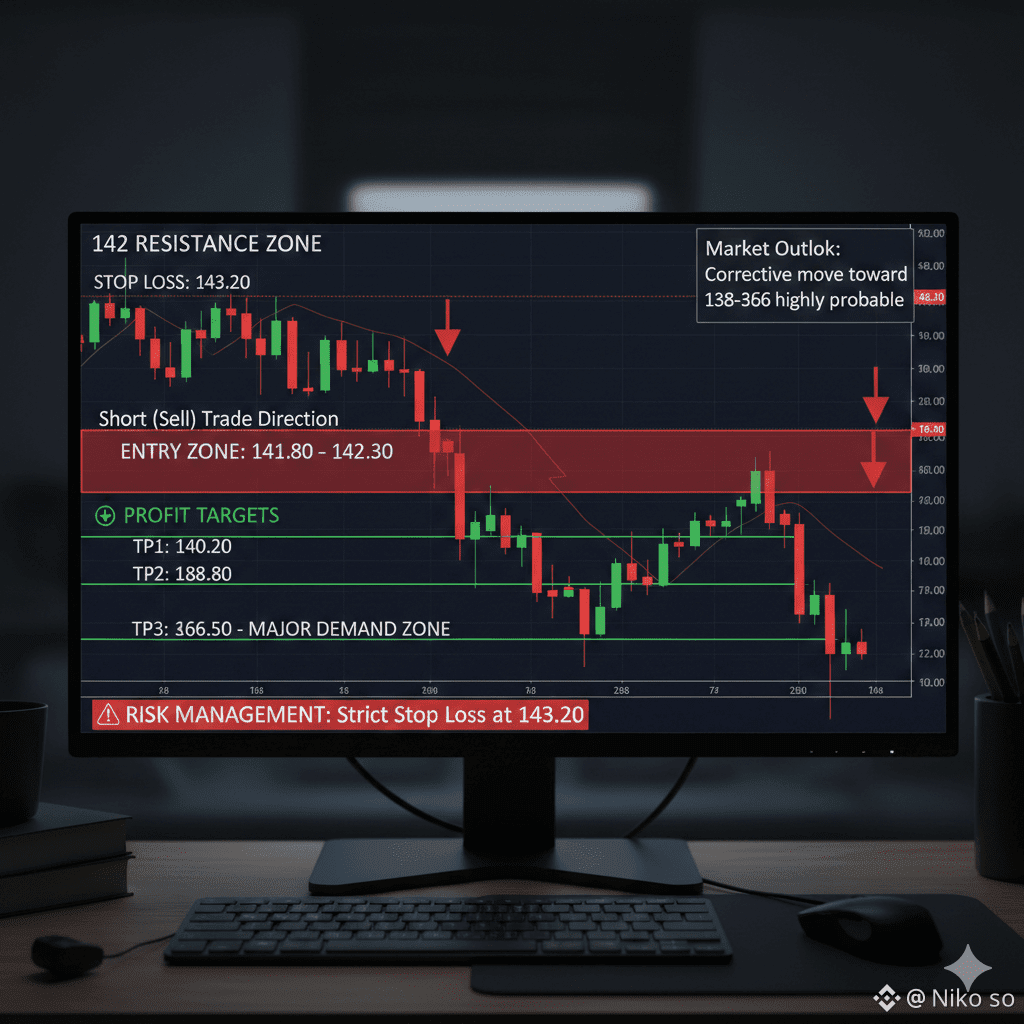

The market is currently showing signs of weakness near the 142 resistance zone, indicating a potential corrective move to the downside. Price action suggests that sellers are gaining control, especially if the market fails to sustain levels above 142.

📉 Trade Direction: Short (Sell)

Entry Zone: 141.80 – 142.30

Stop Loss: 143.20

A rejection from the entry zone would confirm bearish pressure and open the door for a deeper pullback.

🎯 Profit Targets

TP1: 140.20 – Minor support and first profit booking zone

TP2: 138.80 – Strong intraday demand level

TP3: 136.50 – Major demand zone and potential reversal area

These targets align with previous support levels, making them realistic areas for price reaction.

🔍 Market Outlook

If the price fails to hold above 142, it would signal a loss of bullish momentum. In such a scenario, a corrective move toward the 138–136 demand zone becomes highly probable. This zone has historically attracted buyers and may act as a temporary floor.

⚠️ Risk Management

Strict risk management is essential. The stop loss at 143.20 protects against unexpected bullish breakouts. Traders are advised to trail stops or book partial profits as targets are hit.#WriteToEarnUpgrade #Binance #solana