What interesting times we live in.

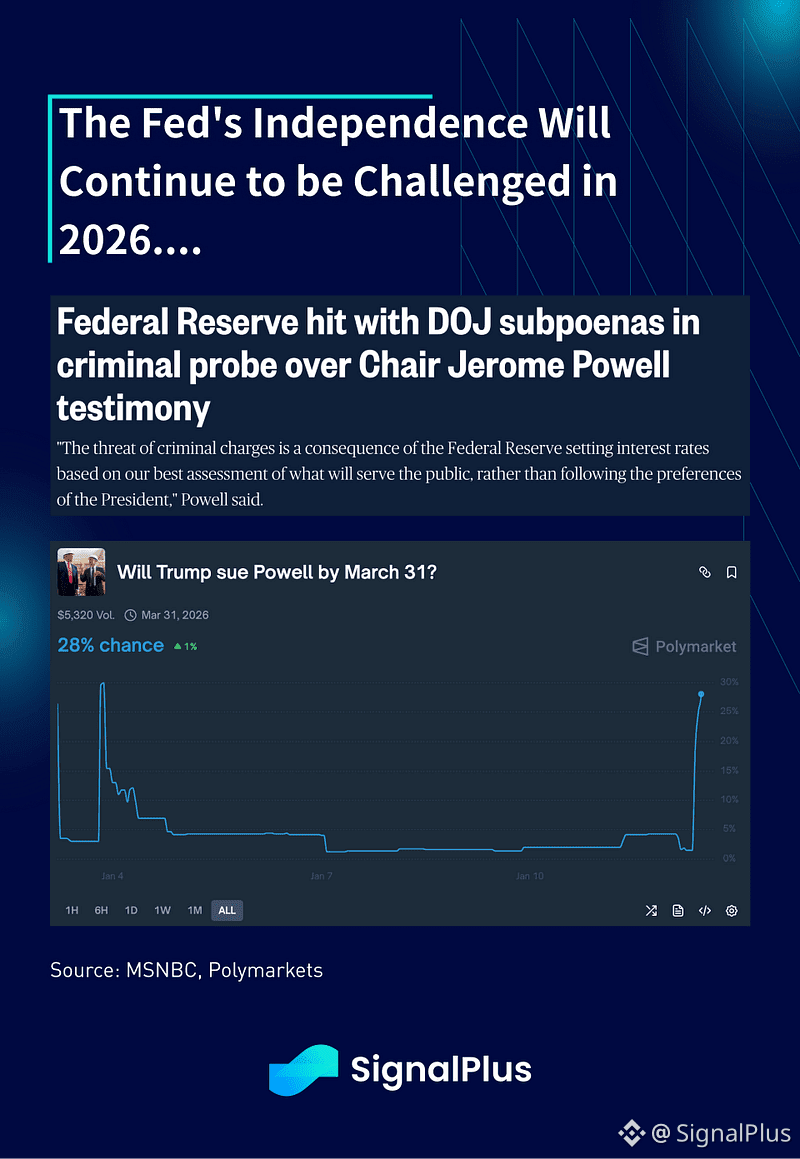

With the markets closing near all time highs (again) just as the US administration is busy enacting operation regime change 2.0 around the world, we woke up to news of the Federal Reserve getting slapped with a DoJ subpoena as Fed independence continues to be challenged:

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.” — Jerome Powell, January 11th, 2026

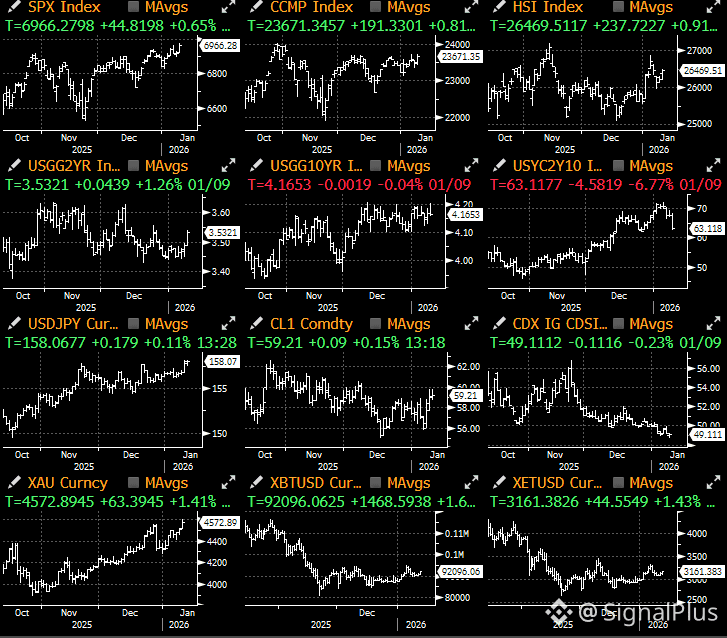

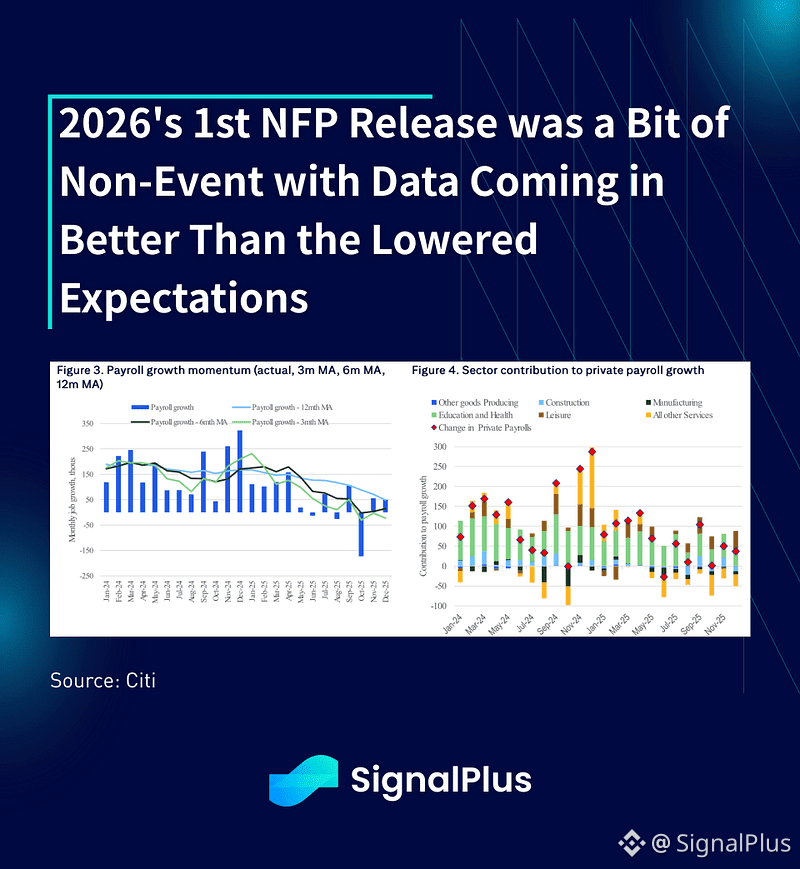

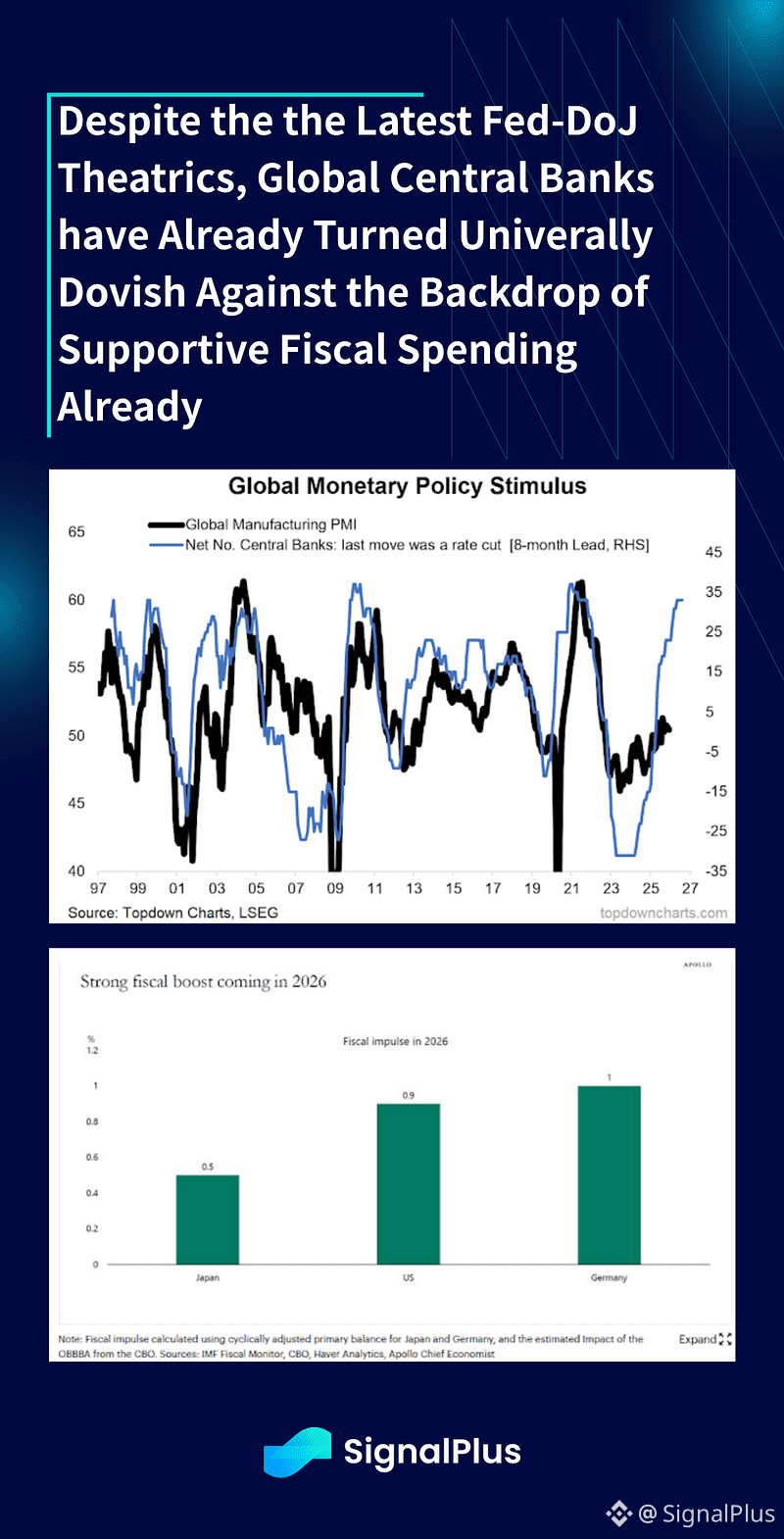

This is happening while the latest employment data shows that the US remains in a goldlock-like growth scenario, with lukewarm labour figures supporting the (already) easy monetary policy stance, and the fiat-debasement belief keeping assets at a ‘permanently high plateau’. A 50k miss on the NFP headline was made up with a decent 4.4% unemployment rate, and a solid bounce in average hourly earnings to 3.8% YoY.

All in all, a decent growth number which saw US rates priced out a bit of cuts in the very front-end of the curve, while the SPX, oil, and even the USD were well supported by the print.

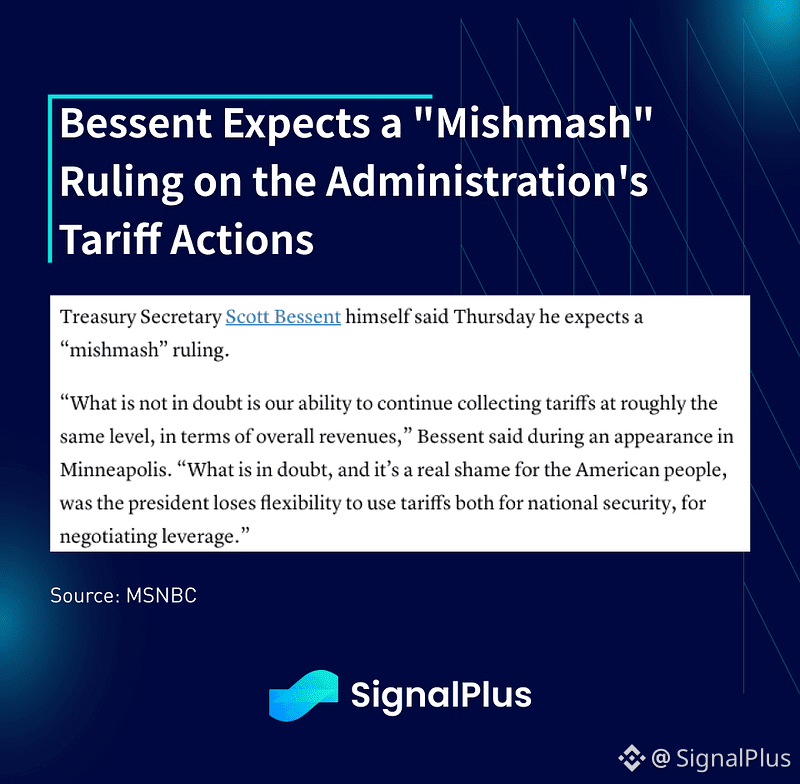

Elsewhere, the big focus this week was on the US Supreme Court ruling on IEEPA (Trump’s tariffs), which we have yet to see news of yet. A ‘best case’ outcome would be for the court to prevent the administration from levering unilateral tariffs going forward, but allowing the existing tariffs to stay as a one-off for a political compromise. According to Street analysts, the next opinion day when a decision might be released could be on Wednesday of this week.

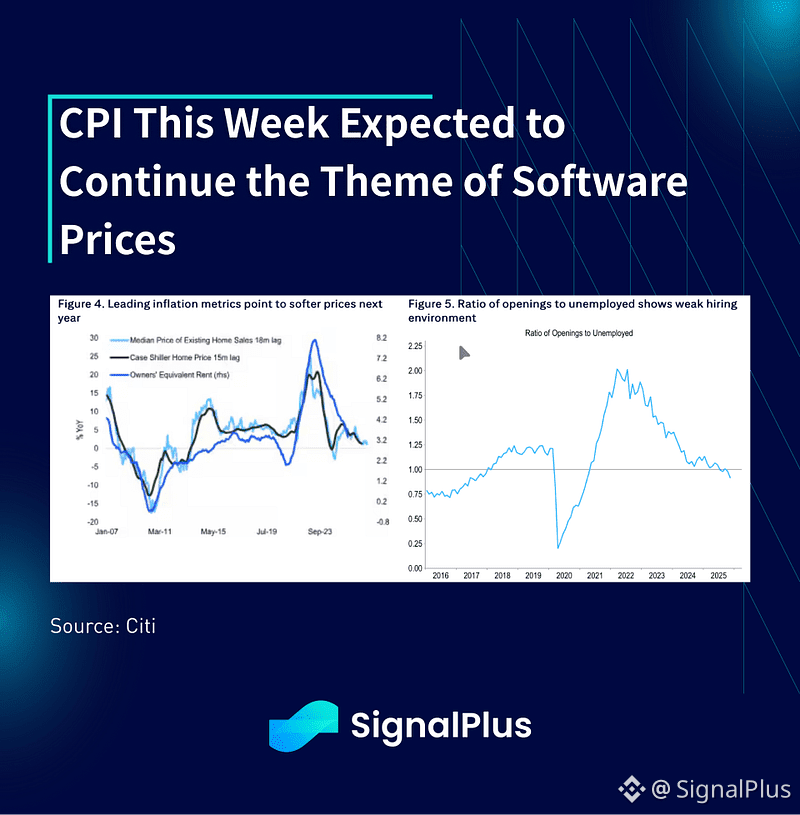

On the data side, CPI release tomorrow will be the big release, with core expected to increase by 0.27% MoM and 2.7% YoY. Focus will be on shelter inflation, especially with the administration’s recent focus on housing affordability. PPI will follow with a double release (October & November), followed by retail sales (0.4% MoM) and industrial production to end the week.

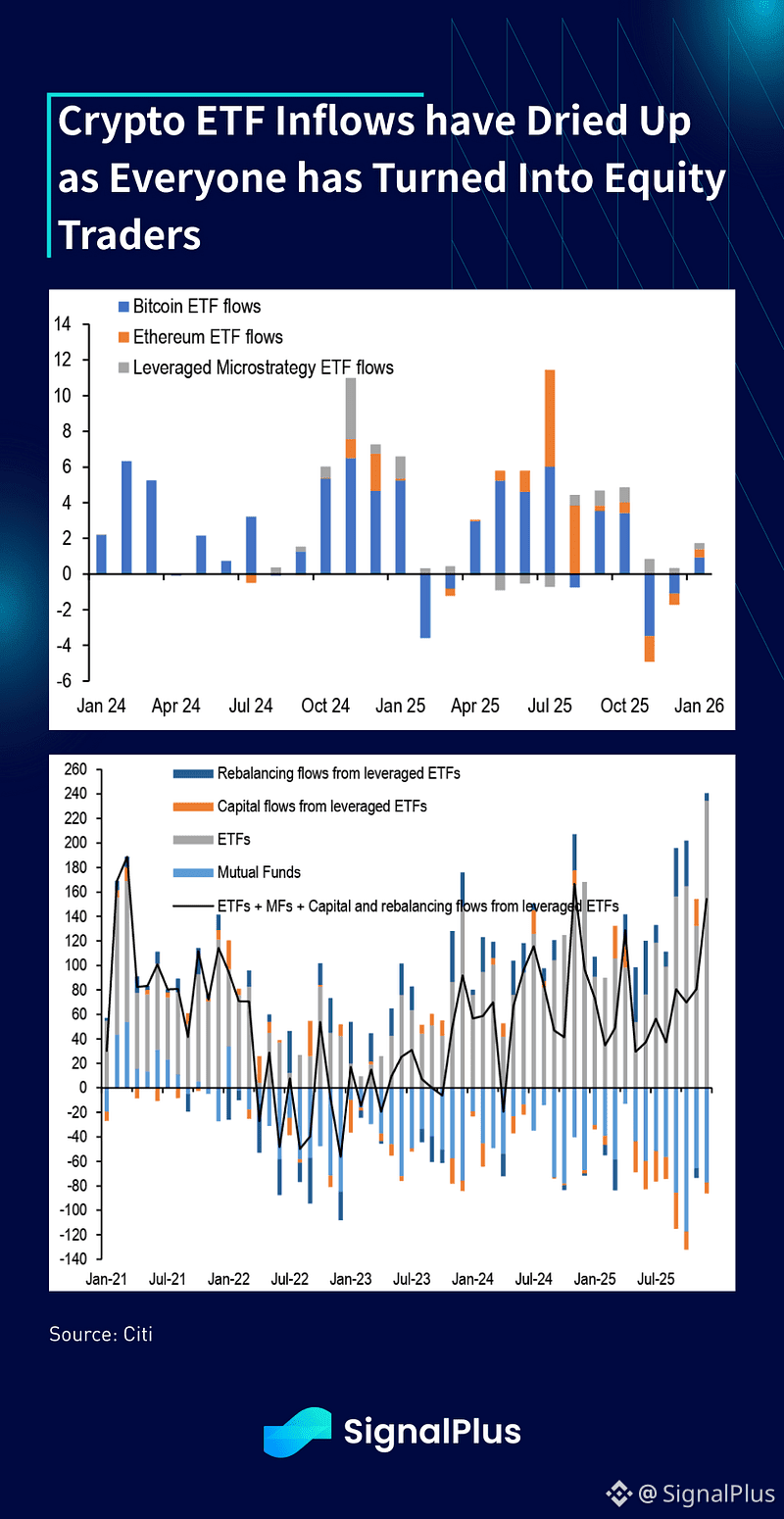

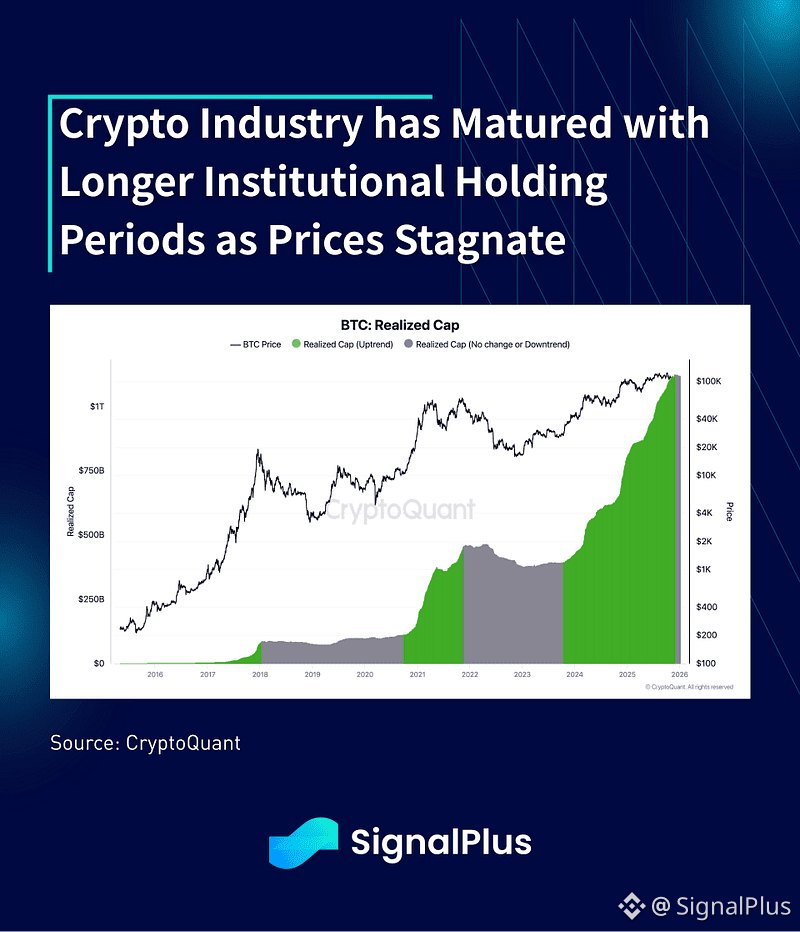

Crypto saw another very meandering week with BTC hovering around $92k on very little excitement. BTC/ETH ETF inflows have been disappointing in December and thus far in January, with inflows barely seeing any rebound after the horrendous October period. On the other hand, TradFi equity ETFs saw record monthly inflows of $235bln to end 2025 as investors have all but pivoted their degen habits into equity trading, and it’s not clear what immediate catalysts we have to reverse that trend in the near-term.

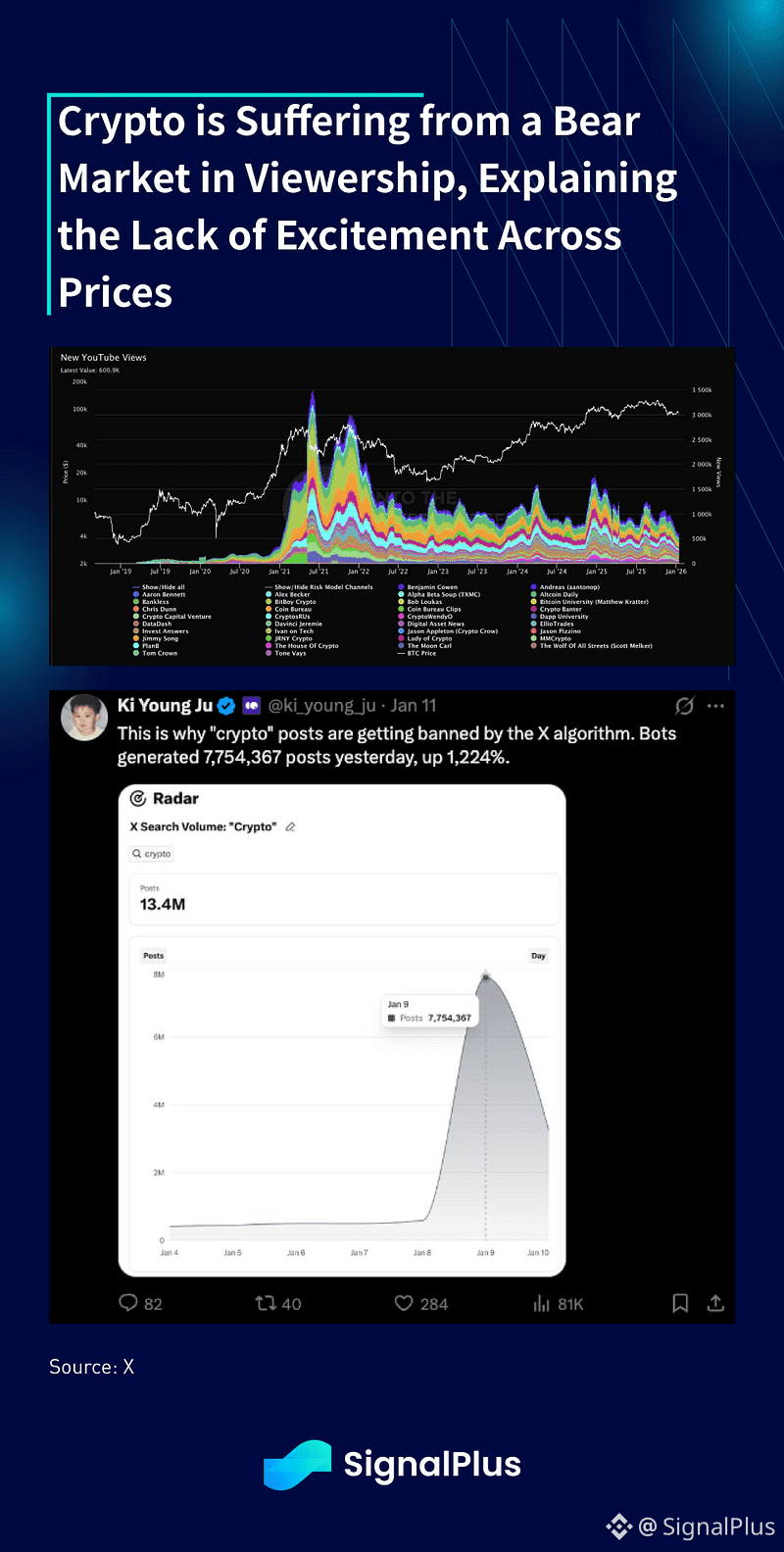

Outside of prices, viewership and excitement around crypto has died down measurably, with the 30d average views of crypto content on YouTube crashing to the lowest levels since Jan 2021, while X has also started to limit and filter out crypto-related content due to an influx of bots.

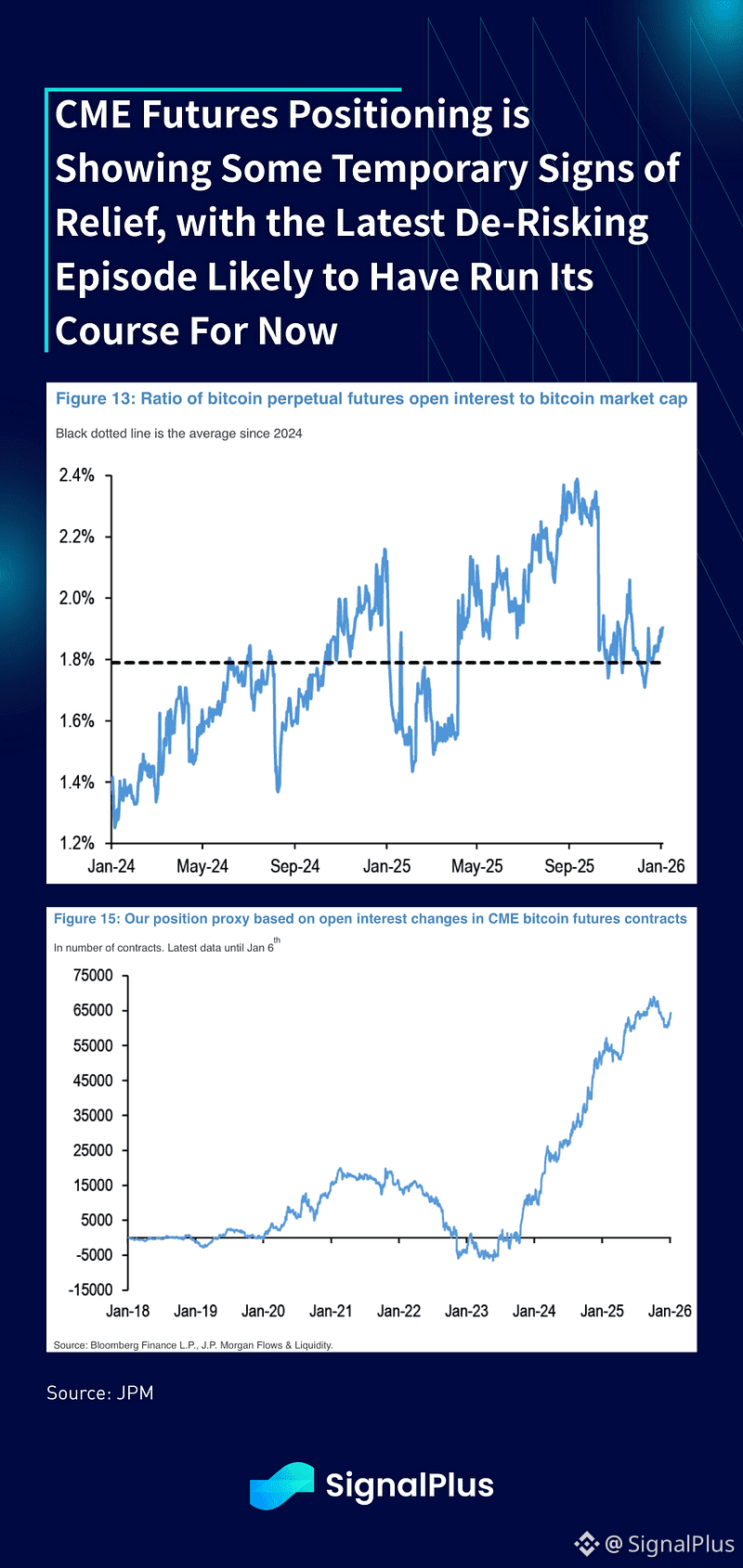

On a slightly more positive note, there are some signs of stabilization in outflows as CME futures are showing a small rebound in open interest (vs market cap), with futures position proxy also suggesting that the latest round of de-risking might have mostly run its course, for now.