Solana (SOL) enters 2026 with strong upward momentum. After rebounding from its late-December low near $124, SOL pushed up to test key resistance around $143.

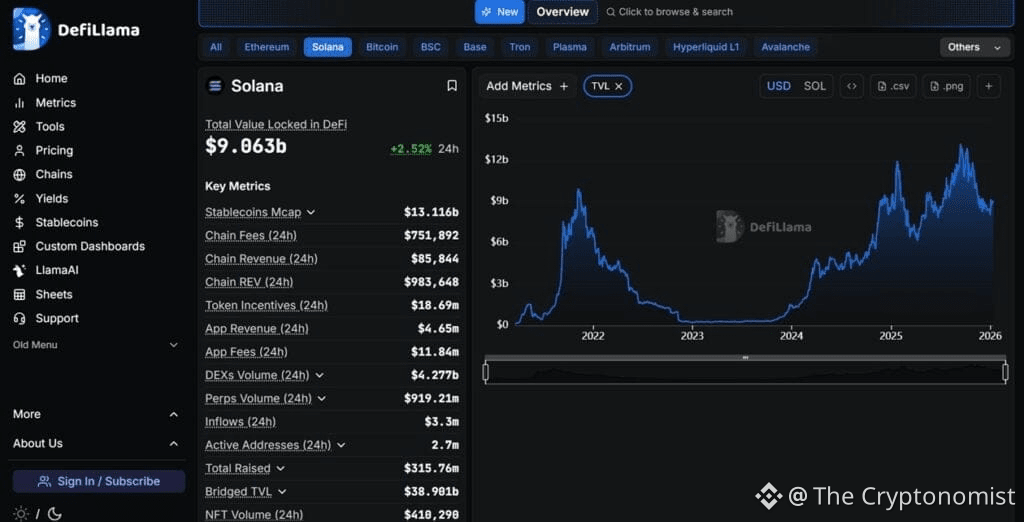

This move reflects growing network strength, with total value locked rising above $9 billion and steady institutional demand flowing through U.S.-listed spot Solana ETFs.

Traders are now watching whether SOL can turn the $144 level into support and open the path toward higher targets at $150 and $162.

At the same time, the Solana network continues to strengthen its foundation. Recent validator updates and the upcoming Alpenglow upgrade demonstrate a clear focus on handling higher transaction volumes and expanding institutional use.

As Solana cements its role as a leading institutional blockchain, Bitcoin Hyper (HYPER) is gaining attention as a best crypto pick for investors seeking higher-reward opportunities.

Source – Cilinix Crypto YouTube Channel

Solana Price Prediction

Solana (SOL) has shown strong momentum in recent sessions. After bouncing around $124 to $125 in late December and early January, the cryptocurrency broke out to key levels near $143.

The rally moved faster than many expected, though it followed predictions from December and early January.

SOL recently tested the point of control at $143 and the value area high formed since November 13, which caused an initial rejection. Analysts are now watching whether Solana can sustain the breakout and extend its rally.

In the short term, Solana trades near the two-month range’s point of control around $137, which matches last month’s value area high and the monthly VWAP. Key resistance sits at $144, matching the point of control since March 2024.

Critical support levels include last month’s VWAP, the previous quarter’s value area low on the 30-day rolling VWAP, and the value area low near $129 to $130. Holding $130 is essential for stability, while breaking above $144 could trigger a broader rally.

From a longer-term perspective, Solana remains near the bottom of a range that has persisted since March 2024. Analysts note that, despite broader market uncertainty, a breakout remains possible over time.

Short-term scenarios include either continuing the current consolidation, tapping support near $130 before moving higher, or attempting an immediate push above $144.

Subsequent targets include $150 from the 90-day rolling VWAP and $162 from the previous quarter VWAP, which also act as psychological resistance levels.

This trendline is everything for Solana $SOL.

A break could send it to $50. pic.twitter.com/oxaqyJZXlv

— Ali Charts (@alicharts) January 10, 2026

Today, Solana trades near $140 while testing a rising trendline that has supported price since 2024. Analysts, including Ali Charts, warn that a breakdown below this trendline could send SOL toward $50.

Why Solana (SOL) Remains Structurally Bullish Heading Into 2026

Solana’s (SOL) outlook remains structurally positive as 2026 begins, supported by stronger network fundamentals and rising institutional demand.

On-chain data shows a healthy ecosystem, with total value locked climbing above $9 billion and decentralized exchange volumes reaching their highest levels since late 2024.

At the same time, spot Solana ETFs continue to attract steady capital inflows, adding roughly $30 to $40 million last week alone.

These inflows have lifted total net assets in Solana ETFs to about $1.09 billion, showing that institutions are actively increasing exposure even as SOL consolidates near the $135 to $136 range.

While market interest stays firm, the network is also undergoing important technical upgrades to support continued growth.

URGENT RELEASE: The v3.0.14 release is now recommended for general use by Mainnet-Beta validators.

This release contains a critical set of patches and should be applied to staked and unstaked Mainnet-Beta validators.

— Solana Status (@SolanaStatus) January 10, 2026

The Solana Foundation recently urged all Mainnet-Beta validators to upgrade to version 3.0.14, which includes critical security fixes aimed at preventing network fragmentation.

The announcement spread quickly across validator channels and drew more than 31,000 views within hours during the early U.S. session.

This urgency highlights Solana’s focus on operational stability, especially as higher transaction throughput and new ecosystem launches such as the SKR token place greater demands on network infrastructure.

Historically, major validator upgrades often bring short-term price volatility, but they also strengthen long-term reliability and investor confidence.

By reinforcing the validator layer, Solana is positioning itself for larger protocol changes, including the Alpenglow upgrade expected later in 2026.

Together, improving on-chain activity, growing institutional participation, and proactive infrastructure management point to a steady and trend-driven recovery for Solana’s broader market outlook.

While Solana strengthens its institutional position, Bitcoin Hyper (HYPER) is emerging as the best crypto to buy for investors seeking higher-alpha opportunities.

How Solana Technology Is Powering Bitcoin Hyper (HYPER) for 2026 Growth

Bitcoin Hyper (HYPER) stands out as a top contender for major growth in 2026. The project has already raised about $30.3 million, and the $HYPER token currently sells for $0.013565.

Bitcoin Hyper operates as a Layer 2 network that tackles Bitcoin’s biggest limitations. It allows transactions to confirm in seconds and cost just fractions of a cent, while still relying on Bitcoin’s Proof-of-Work security.

After launch, the system locks BTC on the main Bitcoin network and mirrors those assets on the Layer 2 using proven cryptographic checks.

Instead of waiting minutes for confirmations, users get near-instant transactions. This speed opens the door to new Bitcoin use cases such as staking, decentralized swaps, and lending.

Fast and low-cost settlements also make everyday payments possible without stressing the main Bitcoin network. At set intervals, the network bundles transactions and settles them back on Bitcoin.

Anchoring frequency defines a rollup’s balance between cost, security, and finality. Bitcoin Hyper treats anchoring as a flexible parameter that adapts to load, fees, and user needs, while keeping Bitcoin as the final source of truth.

Read the article  https://t.co/kZ6qRAyJ4M pic.twitter.com/YYkuuV7kpj

https://t.co/kZ6qRAyJ4M pic.twitter.com/YYkuuV7kpj

— Bitcoin Hyper (@BTC_Hyper2) January 9, 2026

$HYPER boosts performance by using the Solana Virtual Machine, combining high speed with Bitcoin’s core security. This setup enables high-volume activity and smart contracts, two features Bitcoin needs to stay competitive in 2026.

Analysts see $HYPER as a best crypto to buy, and many investors already stake their tokens to earn up to 38% APY while the presale runs. Bitcoin is here to stay, but wider real-world use could power the next bull run. If $HYPER makes that happen, many traders may wish they had entered earlier.

Early buyers can purchase $HYPER on the Bitcoin Hyper website using ETH, USDT, BNB, or a credit card. They can also buy directly through the Best Wallet app.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.