Just as I was about to post this article, I saw the official announcement of TGE. Perfect timing to dive into ETHGAS with everyone, especially with the snapshot coming up in just a few days. I'll take the chance to connect my wallet and complete the points activity—odds are still quite good.

Let's look back at the mainnet Gas we lost over the years

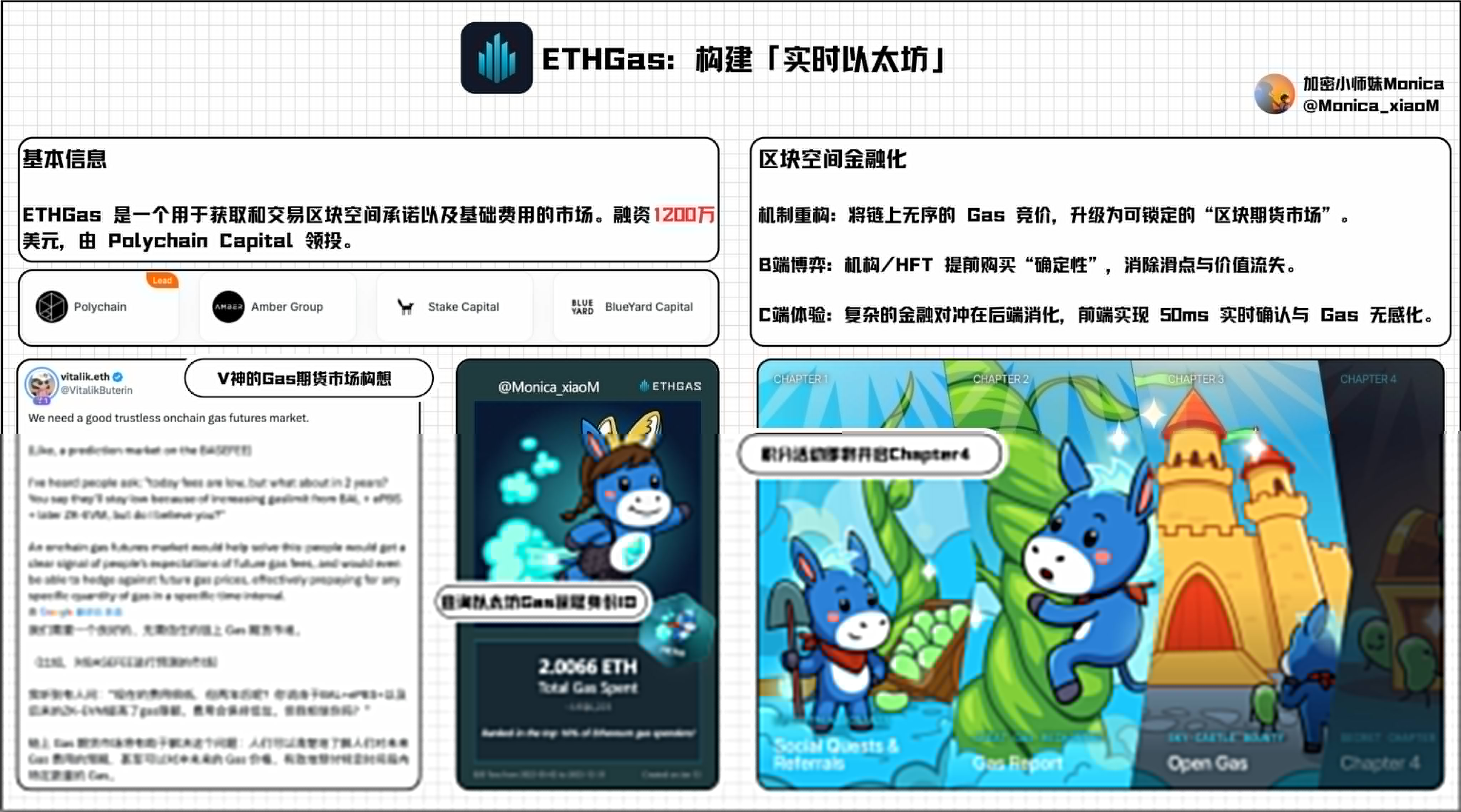

A while ago, I saw Fungmi mention ETHGas, which seemed quite interesting. The project mainly focuses on the block space market, and its product vibe really aligns with the 'KUI' spirit of yield farmers. Today, I decided to check it out by participating in ETHGas's community activity and generated my Ethereum mainnet Gas consumption report. I connected an old, small wallet I rarely used, only to find I'd already accumulated 2 ETH in fees—back in the day, Ethereum truly was expensive.

The points activity of ETHGas, after this official announcement, is equivalent to advancing to Chapter 4.

Since the snapshot on January 16 has been officially announced, there are only a few days left in the window period. There are two things that must be done before the snapshot:

1. Update Gas ID

The official statement clearly explains that the airdrop will analyze the on-chain data of addresses, and the Gas ID will actually record your on-chain Gas consumption. Be sure to regenerate it once. This can be considered a blessing for Ethereum veterans, and those with old wallets should try to participate.

2. Complete all social tasks

Social tasks can earn Beans points, which are easy to complete without taking much time or effort, and you can also earn Beans points by inviting as many people as possible.

Link: https://ethgas.com/community/onboarding?referral=Monica

Overall, ETHGas's ideas and goals are to build a 'real-time Ethereum' infrastructure, ultimately achieving gas insensitivity.

So seeing this has triggered my thoughts:

After experiencing several expansions, Ethereum's transaction costs have already been reduced. In this situation, does it still make sense to continue lowering gas and transaction delays?

My question will be answered by Vitalik.

At this stage, what hinders wider applications of L2, dApps, and institutional users on Ethereum is no longer the 'high cost', but the 'unpredictability' of costs. Vitalik admits in his idea about the gas futures market that expansion itself cannot completely eliminate uncertainty, and financial tools are needed to provide risk management.

ETHGas has extended this concept to the application layer, with its core being the financialization of block space. Simply put, it is about establishing a secondary market to standardize and pre-sell the future block space of validators. Transforming the originally chaotic real-time gas bidding into a lockable financial market.

This means certainty of execution for institutions and high-frequency trading. Compared to costs, large funds are more averse to uncontrollable slippage and congestion. Locking in future blocks through financial instruments can eliminate the uncertainty risk of on-chain transactions, which is the foundation for large-scale on-chain traditional market-making strategies.

Complex financial hedging is digested at the application layer, returning to our user perspective, the experience will be simplified: transactions are no longer 'Pending', confirmations are quick to the millisecond level. Gas fees will eventually become an invisible cost handled by the protocol party in the background, just like internet bandwidth.

I feel that whether it can be embedded into Ethereum as a permanent infrastructure, ETHGas still needs time to verify. However, if it can be realized, my 2 ETH will definitely be able to create more 'impressive' explorations on the mainnet.