Data from Bloomberg and Wintermute confirms what was considered 'speculation' just a year ago: the crypto market is no longer an autonomous casino. In 2025, it has fully become a macro-sensitive financial market, where liquidity, risk, and exposure behave just like in traditional assets.

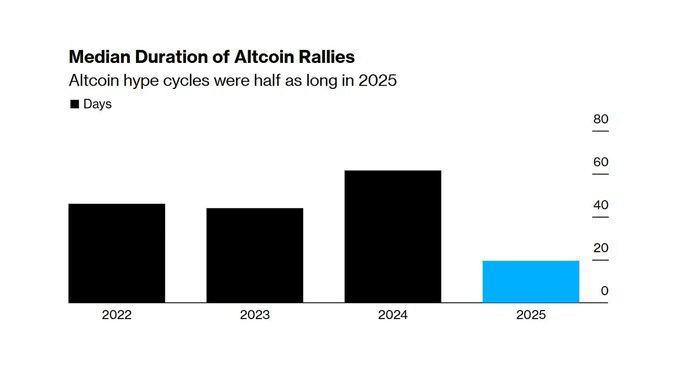

1️⃣ Alt-rallies no longer last for months

According to Wintermute, the median duration of alt rallies in 2025 is around 20 days.

This is a fundamental shift:

Previously, alts shaped cycles;

now — short tactical impulses.

Alts are no longer a long-term risk environment. They've become a tool for quick bets.

2️⃣ Derivatives are speaking louder than prices

Since October 2025:

open interest on alt futures ↓ ~55%

reduction in exposure > $40 billion

This means more than just a drop in interest.

This means capital is consciously reducing leverage and lowering risk.

The market doesn't 'fear'.

The market is repositioning.

3️⃣ Where is the risk going

Bloomberg clearly identifies the trend:

Capital is exiting small and illiquid alts and concentrating in:

Bitcoin

BTC77,201.08-1.76%

BTC77,201.08-1.76%Ethereum

The reason is simple:

In a world of macro uncertainty, investors want assets that:

liquid,

clear,

sensitive to macro factors,

integrated into the global financial system.

4️⃣ This is not 'the end of alts'

This is the end of mass alt risk.

Alts now:

not the default rate,

not an obligatory stage of the cycle,

not a 'calendar rotation'.

They are selective venture risk.

And precisely for this reason, most capital is behaving much more cautiously.

Conclusion from @MoonMan567

The crypto market no longer lives by its own laws.

It has become part of the global macro system — with risk management, liquidity, and discipline.

Alts haven't disappeared.

But they've lost their status as 'mass beta assets'.

And this is not a market weakness — it's its maturation.

👉 Follow Moon Man 567 if you want to understand how capital actually moves, not just watch charts.