The rebound has arrived as expected! After prolonged low volatility, a significant rally has occurred. BTC reached a two-month high, and ETH surged by 7%. The key point is that this is a rebound, not a reversal, with a target around $100,000. Additionally, XMR led the privacy coin sector, with DASH, ZEN, ARRR, and DOLO following up. Coins related to the World Cup concept, such as CHZ, also started earlier.

In the past 24 hours, a total of 123,440 people across the entire network were liquidated, with a total liquidation amount of $682 million, including $90.2568 million in long positions and $592 million in short positions.

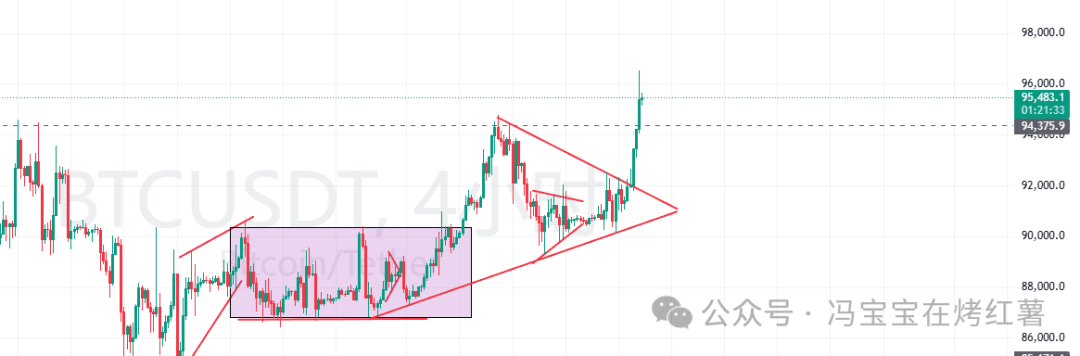

BTC

Bitcoin has successfully broken through the short-term triangle pattern, exactly as I predicted. Unfortunately, I didn't get long positions, missing out on this acceleration surge. The current momentum is still strong, but the rapid upward move has already been completed.

The plan is to wait for the next higher point to enter a short position, ideally in the range of 95500-96000. In terms of operation, you can enter a light position at the current price and add to the position when it rebounds to around 96000, with a short-term target looking towards 91000. Although there are signs of a bullish reversal on the daily chart, the price has reached the upper edge of the rising wedge, and the triangular pattern is close to completion, making it worth trying a short position.

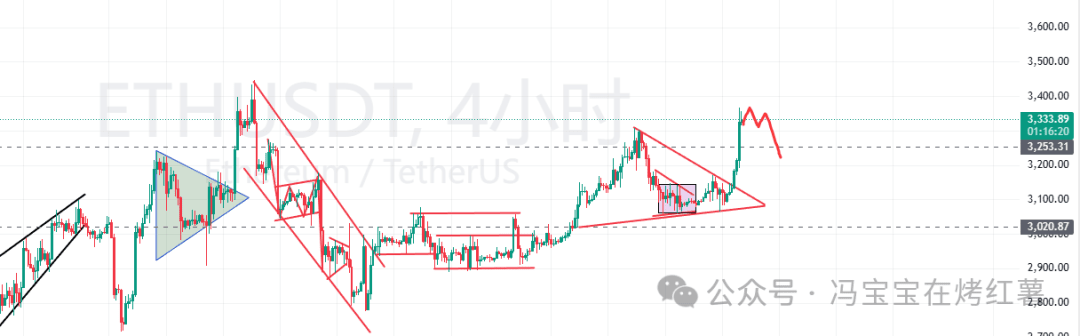

$ETH

Ethereum was predicted to be bullish yesterday when it was still within the triangular pattern. I intended to wait for a pullback to enter a long position, but it broke through directly, causing me to miss the opportunity. This wave rose both rapidly and vigorously, and although the momentum is strong, it may quickly retract, with daily prices nearing previous highs, creating selling pressure.

Plan to enter a short position in the range of 3350-3380, and do not hold overly high expectations for a reversal; be cautious of a false bullish market. Even with risks, I tend to try a short position.

Altcoin

Brothers, remember the core points of Alpha on BSC dog memecoins:

When BSC liquidity is sluggish, it is often a good time to start Alpha, which is the trump card against B's dogs and SOL's turf dogs. The market value should align with the current range; a market cap of tens of millions needs to be adjusted to the million level before layout, compatible with upward adjustments in a bull market and downward compatibility in a bear market.

Don't be biased; obscure coins may hide surprises. As long as they stabilize above a market cap of a million and have concentrated chips, there's a chance. Focus only on new coins; old coins can generally be ignored. Diversify layouts to play probabilities; don't heavily invest in one.

Last night, $DarkHorse and $OldMan went on Alpha but didn't generate much heat. $Life's K-line has dropped to the million level, and $GrassrootsCulture still has opportunities; it can also wait for the new coins brought by Ersheng. The BSC market still holds opportunities; select and filter based on these key points, and wait for takeoff!

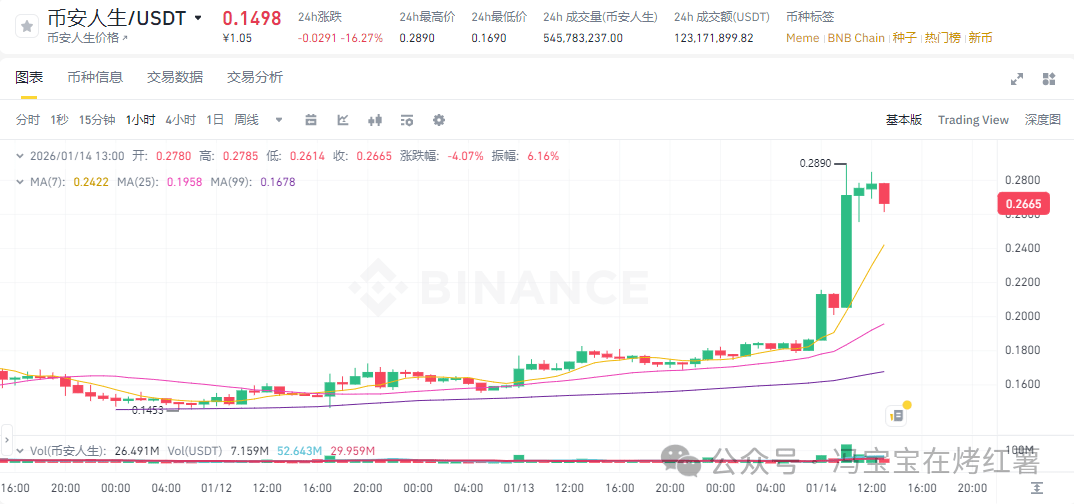

$BinanceLife

This wave of operations by Binance does not fall short on-chain or off-chain! Binance Life is pulling the market up aggressively. Previously, those who said Binance Life wouldn't rise and that Binance should stop can now relax, but it feels like this wave isn't for retail investors.

$DASH

Recently, some altcoins have surged significantly; prioritize monitoring strong coins that have established trends, waiting for pullbacks to support levels for a second entry. For example, enter when DASH pulls back to the EMA moving average and Fibonacci key levels. As long as the overall market doesn't collapse, these coins are likely not finished with their trends.

$ZEC

ZEC is currently building a mid-term bottom after the black swan crash. Privacy coins are generally warming up; this round of declines leans more towards a 'false breakdown' structure? In fact, as long as the price stabilizes within the channel range, focus on the 450 resistance level. Once it breaks and stabilizes, it can still be bullish in the first half of 2026.

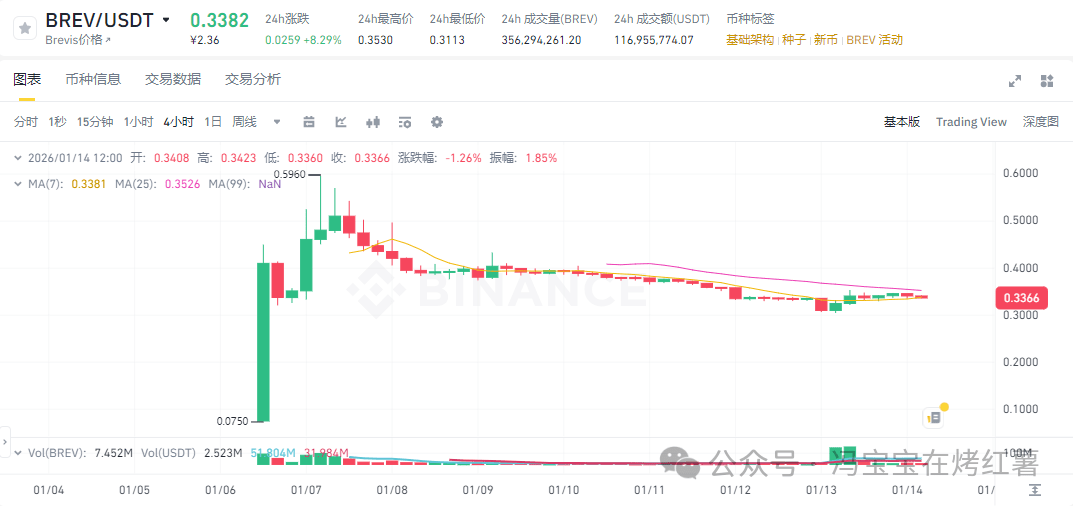

$BREV

I just checked Brev's price performance; it seems that even with 233000000 incentive coins, the price hasn't dropped too dramatically. The current FDV is still 339000000, which is quite resilient among the newly listed spot on Binance.

$ASTER

The on-chain exchange layout of Binance involves buybacks + burning, a deflationary model. Currently, you can go long on ASTER, and within 2x leverage, it can be held. I'm optimistic about it following the pattern of Binance Life, returning to the cz cost price within the week.

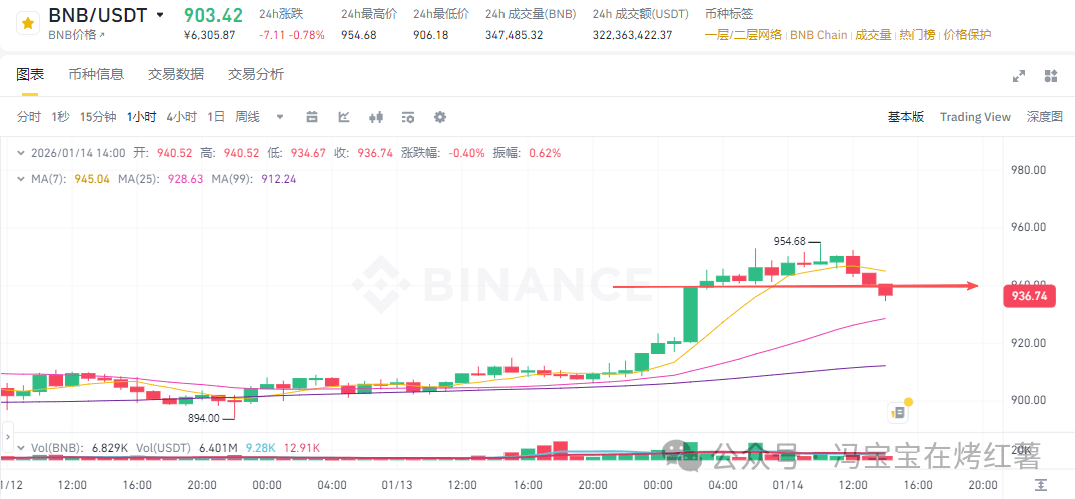

$BNB

If it stabilizes above 940, it maintains an upward trend, with upper pressure focusing on 955, 970, and 985 nearby. If it breaks below 940, it may turn weak in the short term, with lower support focusing on 929, 917, and 907 nearby.

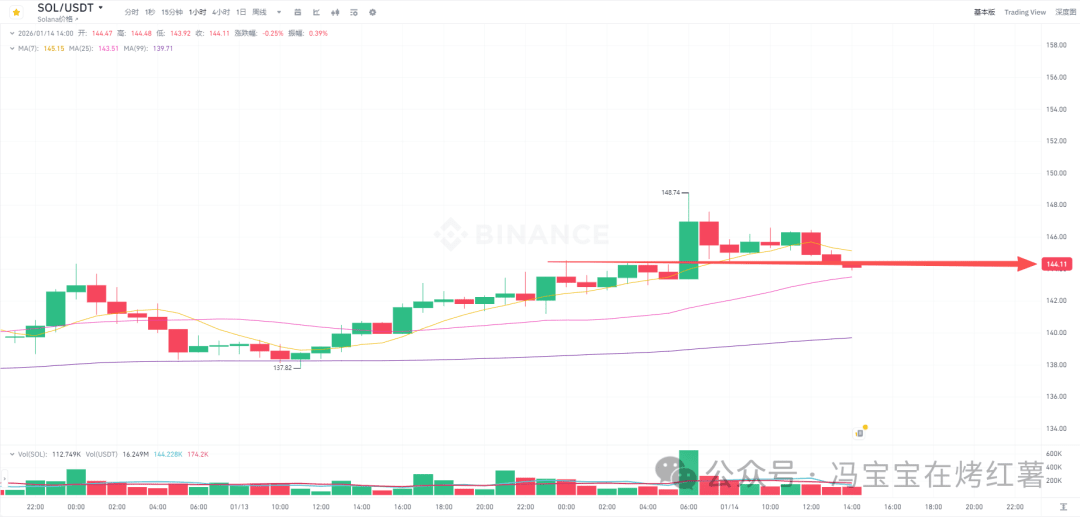

$SOL

If it stabilizes above 144, the trend is still bullish, with upper pressure focusing on 148, 152, and 157 nearby. If it breaks below 144, pay attention to short-term pullback risks, with lower support focusing on 141, 137, and 134 nearby.