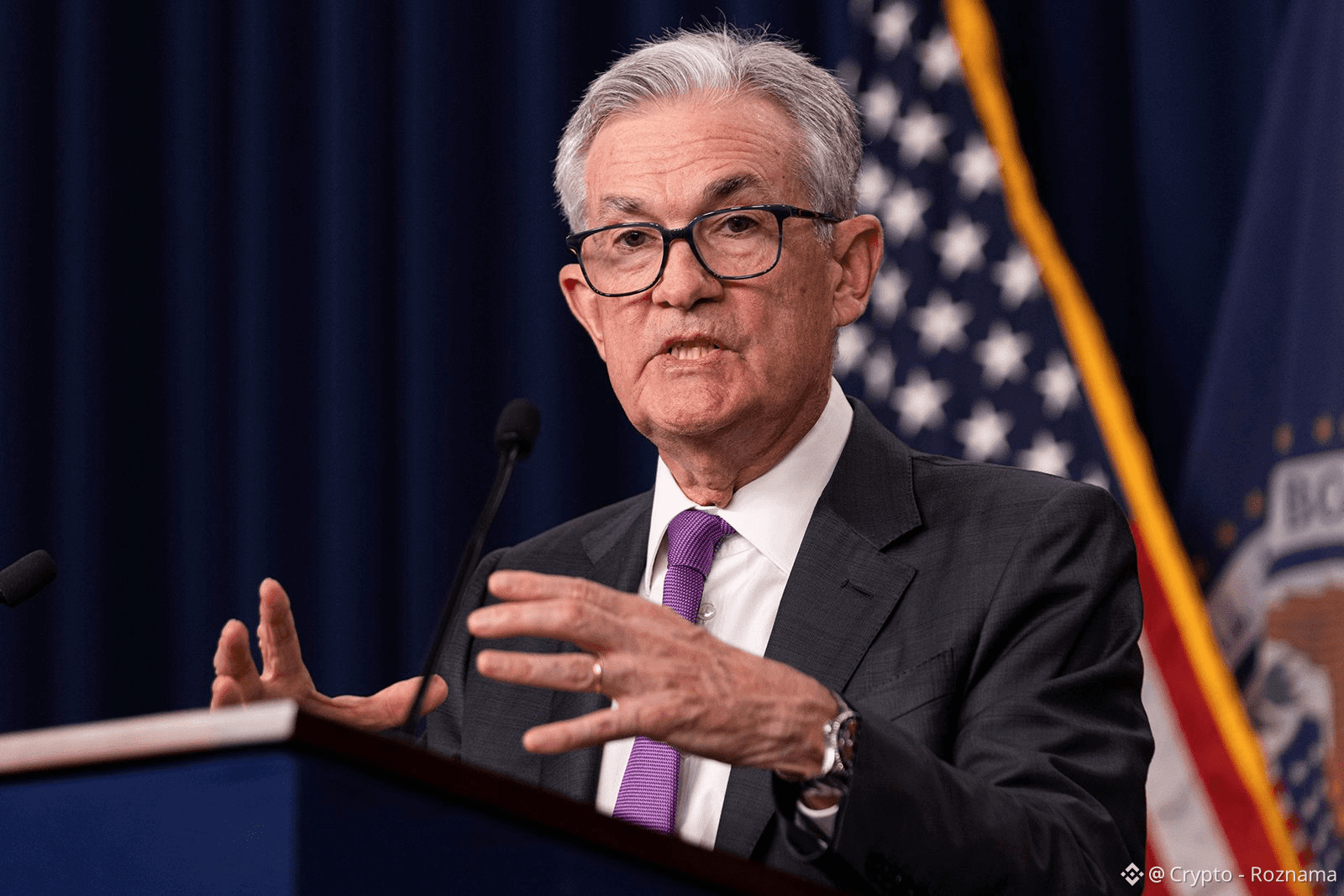

🇺🇸 All eyes on the Federal Reserve as U.S. Producer Price Index (PPI) data drops today at 8:30 AM ET — a key inflation signal that can ignite or extinguish market momentum in seconds.

📊 Why PPI matters:

PPI measures inflation at the producer level — the first ripple before price pressures reach consumers. Markets watch it closely because today’s factory costs become tomorrow’s CPI prints.

⚡ Here’s how markets may react:

🟢 Below 0.3% → Bullish Explosion 🚀

Inflation cooling faster than expected.

Rate-cut hopes revive.

Stocks, crypto, and risk assets could rip higher as confidence floods back in.

🟡 0.3% – 0.4% → Already Priced In ⚖️

No major shock.

Markets may chop, consolidate, or wait for the next catalyst.

Volatility stays muted… for now.

🔴 Above 0.4% → Bearish Shockwave 🌪️

Sticky inflation refuses to fade.

Higher-for-longer fears return.

Stocks wobble, yields jump, and risk assets feel the pressure.

⏱️ This is a moment that moves markets fast.

Algorithms react in milliseconds.

Narratives shift in minutes.

Trends can change in hours.

🔥 PPI isn’t just data — it’s a trigger.

Buckle up. Volatility is loading.

📈📉 Which side wins today — bulls or bears?

Drop your view, share the post, and stay sharp ⚡

#MarketRebound #PPI #Powell #WriteToEarnUpgrade #CPIWatch