Below is an ultra-short trading plan for the ZAMA crypto (based on current project and market information).

Brief overview of ZAMA

What is it:

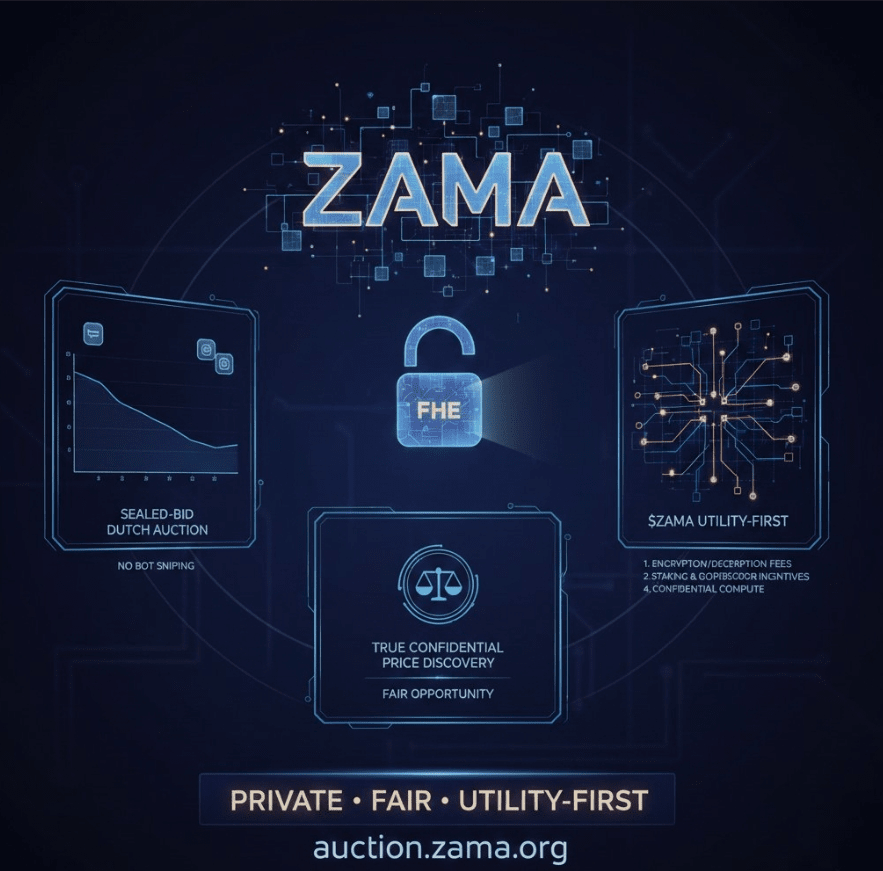

$Zama - a project building a privacy layer using fully homomorphic encryption (FHE) on Ethereum and other EVM chains. The mainnet is already live, and the token will soon be listed on exchanges (main listing planned for April 2026).

What is happening now:

The Dutch auction for ZAMA token distribution is ongoing (Jan 21-24), with token delivery on February 2.

This means: the token's primary price is still forming, and secondary market trading is unstable.

Entry Point

Approach 1 - Short position (until listing generation):

Enter at auction or slightly above the initial pre-sale level.

Usually this is a price slightly below the expected market price (target ~0.10-0.13💲 before listing).

Approach 2 - after listing on exchange:

If listing is confirmed and liquid order books form, you can enter during a pullback after the initial volume spike. Support levels may form at early lows after listing.

Note: current price data varies across sources – some platforms show preliminary quotes at ~0.15-0.16💲, others haven't updated data yet.

Take Profit (TP) / Stop Loss (SL) - ultra-short (by end of January)

Entry point:

≈ buying at auction / immediately after or on retests after the initial peak.

TP (targets) options:

TP1: weak/quick rise: take profit at +15-30% from entry point (e.g., after market opening on exchange).

TP2: more aggressively: +40-70% on the continuation of the initial momentum, if liquidity increases and volumes are active.

SL (stop-loss):

Conservative SL: ~10-15% below entry (up to critical level, if price sharply reverses).

Aggressive SL: ~20% below entry – for those who accept large fluctuations.

Need to consider: volatility can be very high during pre-market / preliminary trading, and SLs trigger more frequently due to spreads and low liquidity.

Risks (quick and clear)

Extremely high volatility before and after listing.

The protocol is still new – technical news can drastically change the price.

$ZAMA is technically oriented toward long-term cases (privacy), not short-term speculation.

Liquidity on DEX/CEX may be weak at launch.

In summary (TL;DR)

Plan image:

Entry: now / at auction or on retests after market opening.

TP: +15-70% depending on the speed of movement.

SL: −10-20% from the entry point.

#Zama #ZamaProtocol #MarketRebound #币安HODLer空投BREV #BinanceHODLerMorpho

P.S. This is not financial advice, but a structured review of entry/exit ideas.