Fasten your seatbelts. Global markets are entering an extreme volatility zone, where policy risk and macro data are colliding head-on. This is not a routine trading session — it’s a pressure test for sentiment across stocks, bonds, and crypto.

Two critical U.S. events are about to hit within hours, and together they could reset expectations around growth, recession risk, and interest rates.

---

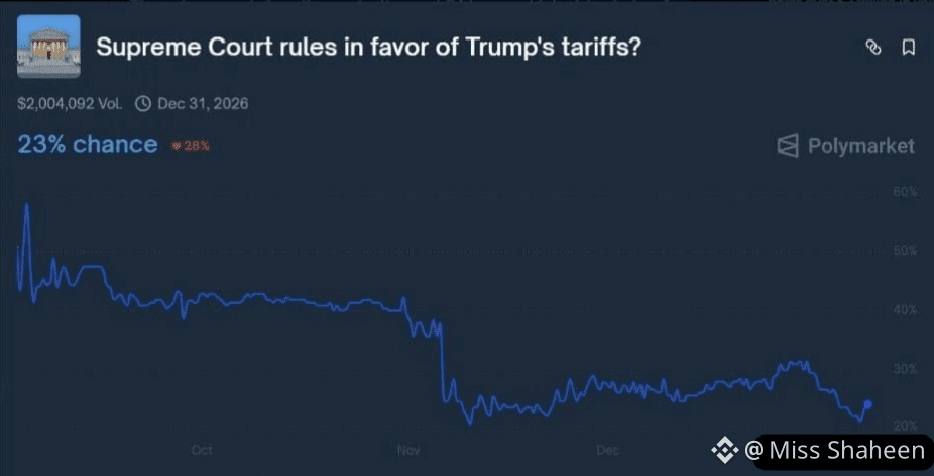

⚖️ EVENT #1: U.S. SUPREME COURT — TRUMP-ERA TARIFF RULING

The U.S. Supreme Court is set to decide on the legality of Trump-era tariffs — a decision markets have been quietly pricing in.

📉 Current market pricing suggests ~77% probability that the tariffs are struck down.

If that happens, the implications are significant:

• The U.S. government could be forced to refund a portion of the $600B+ already collected

• While the President may pursue alternative legal routes, those paths are slower, weaker, and far less predictable

👉 But the real risk isn’t policy mechanics — it’s market psychology.

Markets have treated tariffs as a form of structural support. A ruling against them could trigger a rapid repricing of downside risk, spilling over into crypto assets like $ETH.

---

📊 EVENT #2: U.S. JOBLESS DATA — 8:30 AM ET

Just hours earlier, U.S. unemployment data drops — and it’s a classic macro trap.

• Expected: 4.5%

• Previous: 4.6%

Here’s why both outcomes are dangerous:

🔻 Higher unemployment → recession fears intensify

🔺 Lower unemployment → recession fears ease, BUT rate cuts get delayed

The probability of a January rate cut is already extremely low (~11%). Strong labor data could erase that hope entirely, reinforcing a “higher for longer” rate narrative.

⚠️ THE MARKET SETUP: NO EASY ESCAPE

Markets are effectively boxed in:

• Weak data → rising recession anxiety

• Strong data → tighter monetary policy for longer

There is very little room for a bullish surprise.

With these two events landing almost back-to-back, the next 24 hours represent a critical volatility window. Expect fast reactions, sharp moves, and emotional price swings — especially in crypto and high-beta assets.

---

🧠 FINAL THOUGHT

This is where discipline, position sizing, and risk management matter more than predictions.

📌 Stay alert

📌 Stay flexible

📌 Protect capital first

Because when macro risk converges like this — markets don’t whisper, they move.

$ETH #ETH #DonaldTrump #MarketRebound #USNonFarmPayrollReport #CryptoNews