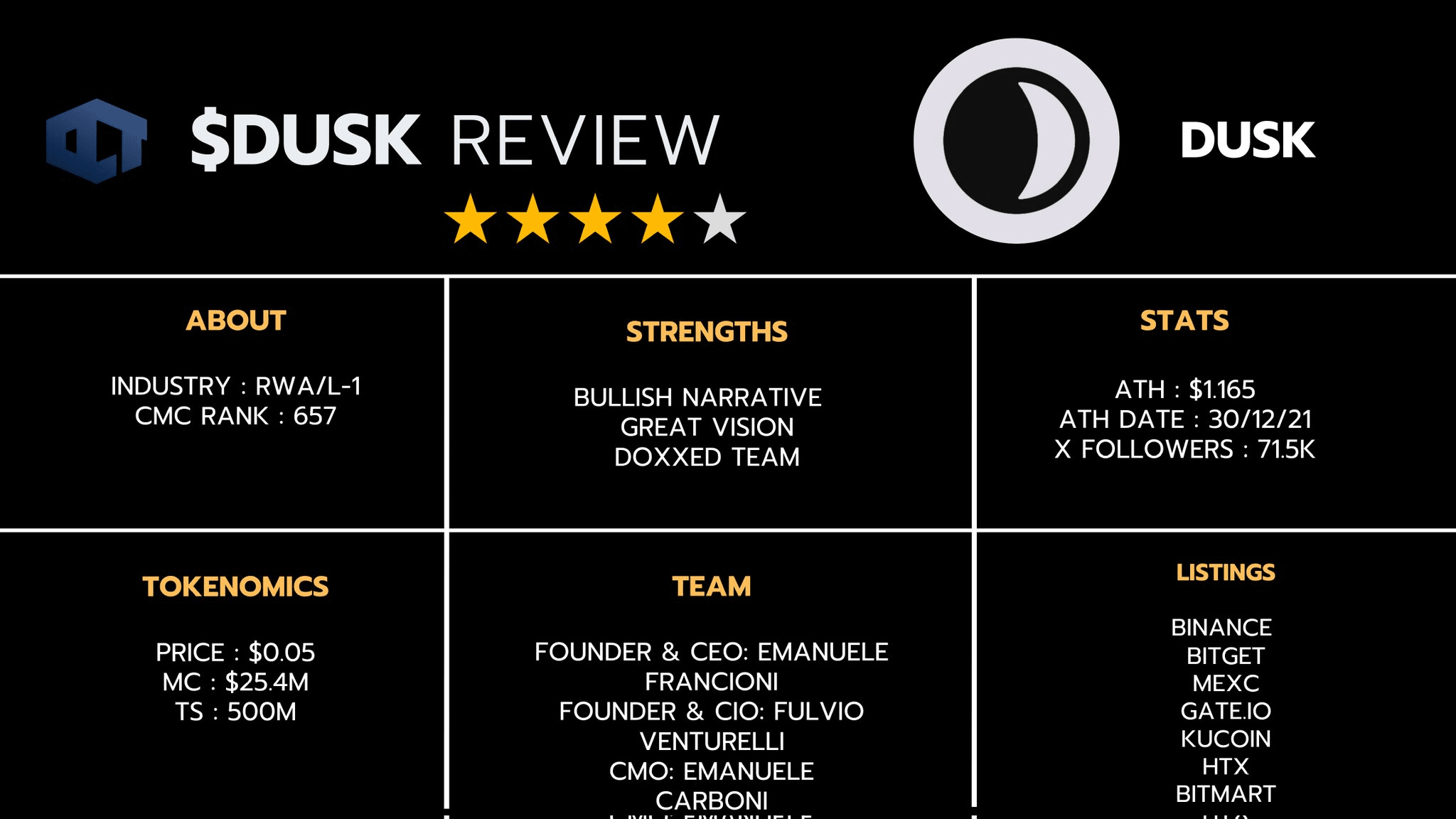

DuskTrade and NPEX: How Dusk Network is bringing €300 million in real-world assets to blockchain in 2026

2026 marked a turning point for real-world asset (RWA) tokenization. While most protocols are still in pilot stages, **Dusk Network** has moved to industrial-scale deployment. Thanks to the launch of the **DuskTrade** platform in collaboration with the Dutch exchange **NPEX**, over **€300 million** in the form of bonds and shares of private companies are now being traded directly on the Dusk network.

#### **Direct tokenization instead of synthetic assets**

Unlike many competitors that create 'wrapped' copies of assets, Dusk enables **direct issuance** of financial instruments. This means the record on the Dusk blockchain is a legally recognized document of ownership. Thanks to NPEX licenses (MTF, Broker, and ECSP), DuskTrade has become Europe's first fully regulated platform where traditional securities meet Web3 liquidity.

#### **Why institutions choose Dusk?**

The main barrier for banks in public networks is the lack of privacy. No hedge fund wants competitors to see its positions in the blockchain ledger. Dusk solves this through **Zero-Knowledge Proofs ($ZKP$)**: transactions are mathematically verified without revealing the amount or participants to the public. For regulators, special 'viewing keys' are provided, making the network fully compliant with MiCA regulations.