Institutional investors are doubling down on a "soft landing" scenario, betting aggressively that market volatility will remain suppressed. Net positioning in VIX futures among asset managers has collapsed to levels rarely seen in the last decade, signaling extreme complacency that could leave the market exposed to a violent reversal.

❍ The Big Short: -$36.6 Million

The "smart money" is overwhelmingly short volatility.

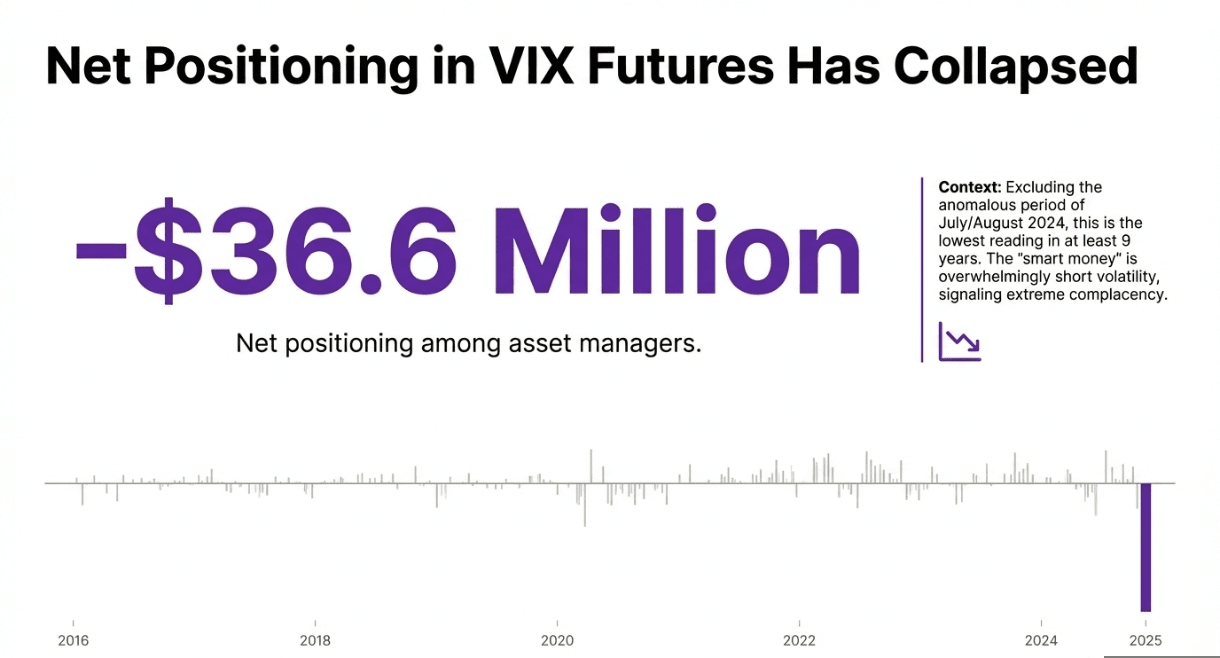

9-Year Low: Net VIX futures positioning among asset managers has dropped to -$36.6 million. Excluding the anomalous period of July and August 2024, this represents the lowest reading in at least 9 years.

The Bet: By shorting the VIX (the "fear gauge"), these managers are effectively selling insurance, betting that the S&P 500 will remain calm and stable.

❍ A Sharp Reversal

The speed of this sentiment shift is as alarming as the magnitude.

5-Week Swing: Just over a month ago, asset managers were net long +$20.0 million, positioning for potential turbulence.

Aggressive Pivot: In just 5 weeks, they have completely flipped their book to a deep net short, chasing the recent market rally and abandoning their hedges.

❍ Echoes of July 2024

The last time positioning was this one-sided, the market paid a steep price.

The Precedent: A similar "short vol" setup occurred in July-August 2024.

The Result: When a sudden shift in risk appetite struck, the crowded short trade unwound rapidly, fueling a nearly -10% market pullback in a matter of weeks.

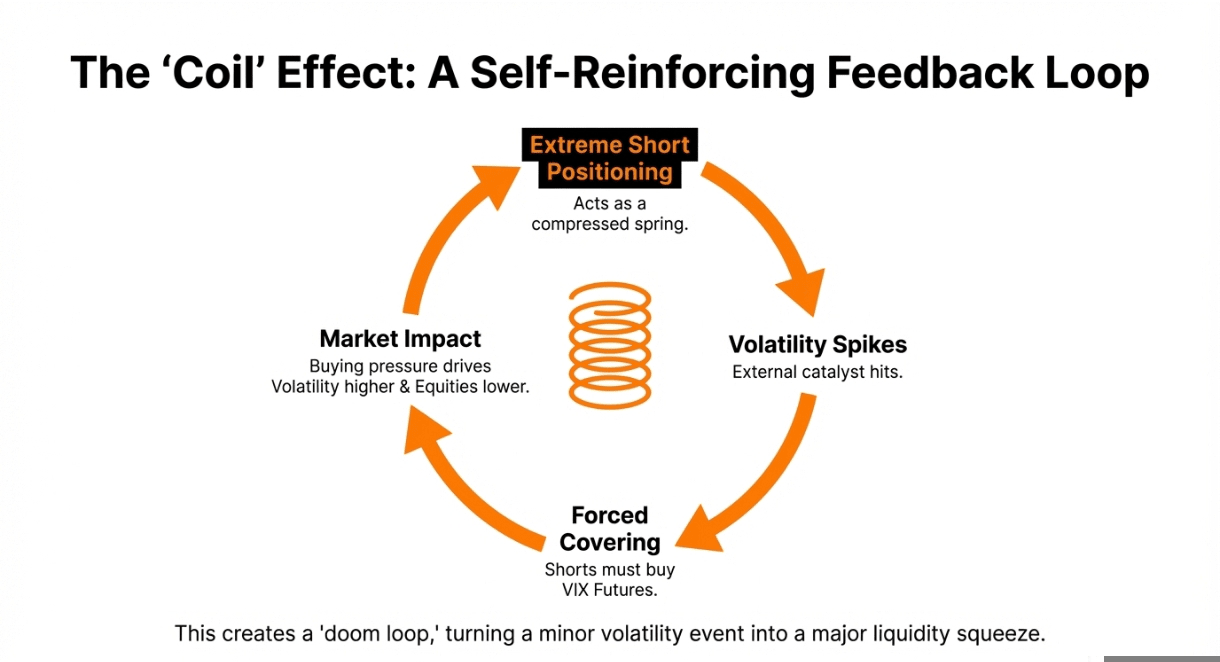

The Risk: Extreme short positioning acts as a "coil." If volatility spikes, short sellers are forced to cover (buy VIX futures), which drives volatility even higher and equity prices lower, creating a self-reinforcing feedback loop.

Some Random Thoughts 💭

This is the classic "picking up pennies in front of a steamroller" trade. When everyone is on the same side of the boat, betting on permanent calm, it takes very little to capsize it. The fact that managers flipped from long to record short in just five weeks suggests this is a momentum chase, not a fundamental view. If an unexpected headline hits (geopolitics, inflation, etc.), the rush to the exit could be chaotic, turning a minor dip into a major liquidity event.