What Is Risk Management in Crypto?

Risk management simply means protecting your money before trying to grow it.

> “The first rule of investing is don’t lose money. The second rule is don’t forget the first rule.”

Warren Buffett (Investor)

In crypto, prices move fast. Without a plan, one bad trade can wipe weeks or months of gains. Risk management is what keeps you alive in the market.

Think of it like this:

👉 Trading is not about winning every trade. It’s about surviving long enough to win big later.

What Kind of Risks Exist in Crypto?

Crypto risk is not only price going down.

• Price volatility – coins can move 10–30% in hours

• Liquidity risk – you can’t exit when you want

• Emotional risk – fear, greed, revenge trading

• Security risk – hacks, fake links, rug pulls

• Regulatory risk – sudden news, bans, restrictions

> “Risk comes from not knowing what you’re doing.”

Benjamin Graham (Author: The Intelligent Investor)

Most beginners lose not because the market is bad but because they enter without understanding these risks.

Why Beginners Lose Money Fast

New traders usually think like this:

“I’ll go all-in, catch one big move, and my life changes.”

Reality is different.

• No stop-loss

• Over leverage

• Over trading

• Emotional decisions

• Chasing pumps

> “You don’t need to make money fast. You need to avoid losing it fast.”

Mark Douglas (Author: Trading in the Zone)

Risk management slows you down and that’s a good thing.

Core Principles of Risk Management (Simple)

1. Never go all-in

Spread your capital. One trade should never decide your future.

2. Control position size

Small size = small stress.

3. Risk before reward

Ask this BEFORE entering:

“How much can I lose if I’m wrong?”

> “Amateurs focus on how much they can make. Professionals focus on how much they can lose.”

Paul Tudor Jones (Hedge Fund Manager)

Simple Example (Beginner Friendly)

You have $1,000.

Bad trader mindset:

❌ Goes $1,000 into one trade

❌ No stop-loss

❌ Panic when price drops

Risk-managed mindset:

✅ Risks only $20 (2%) per trade

✅ Uses stop-loss

✅ One loss doesn’t affect emotions

If you lose $20, you’re still calm.

If you lose $500, you start revenge trading.

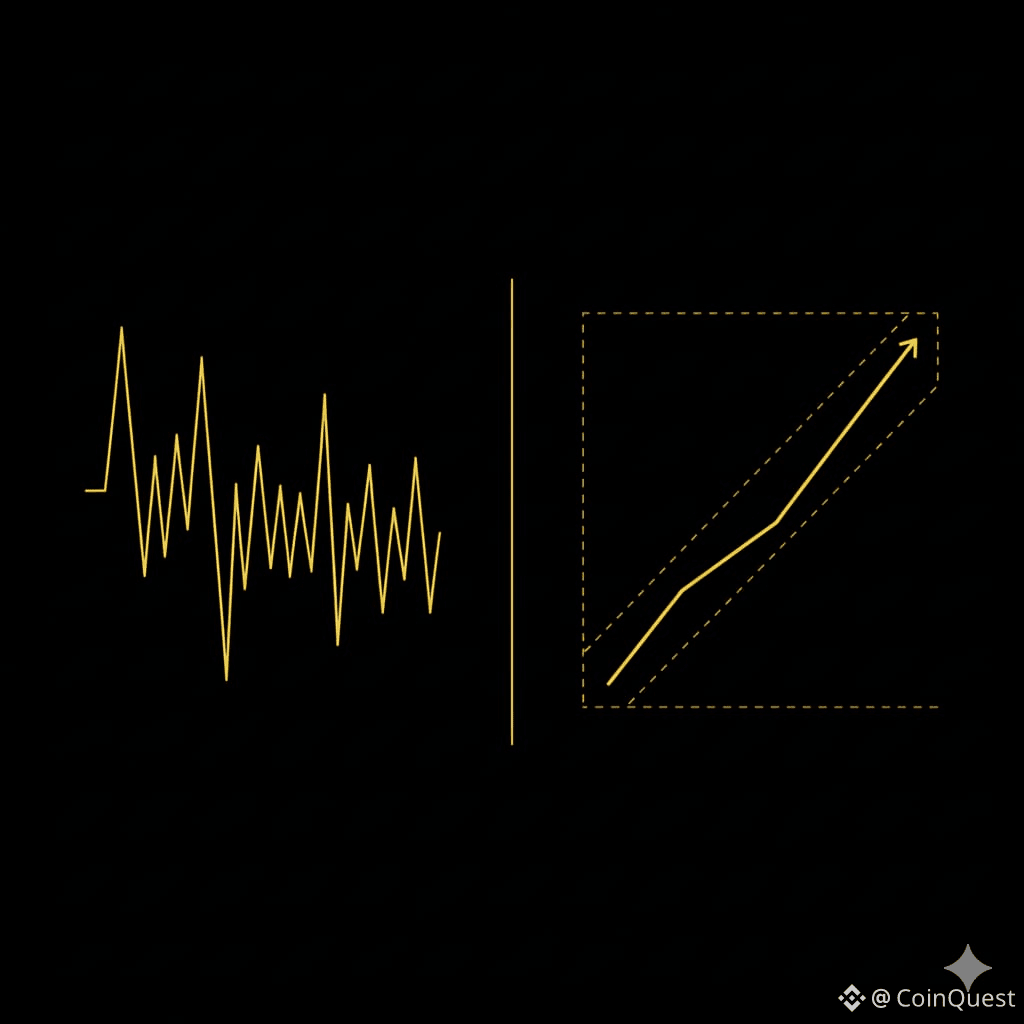

Understanding Volatility (Why Crypto Feels Crazy)

Crypto moves faster than stocks.

Bitcoin dropping 8–10% in a day is normal.

Altcoins dropping 20–40% is also normal.

> “Volatility is the price you pay for performance.”

Morgan Housel (Author: The Psychology of Money)

Risk management doesn’t remove volatilityit prepares you for it.

Setting Realistic Goals (Very Important)

Most beginners aim for unrealistic returns.

Bad goal:

❌ “I want to double my money this month”

Good goal:

✅ “I want to protect capital and grow slowly”

Even 5–10% per month consistently beats most traders.

> “Getting rich slowly is boring but it works.”

Common trading wisdom (X traders)

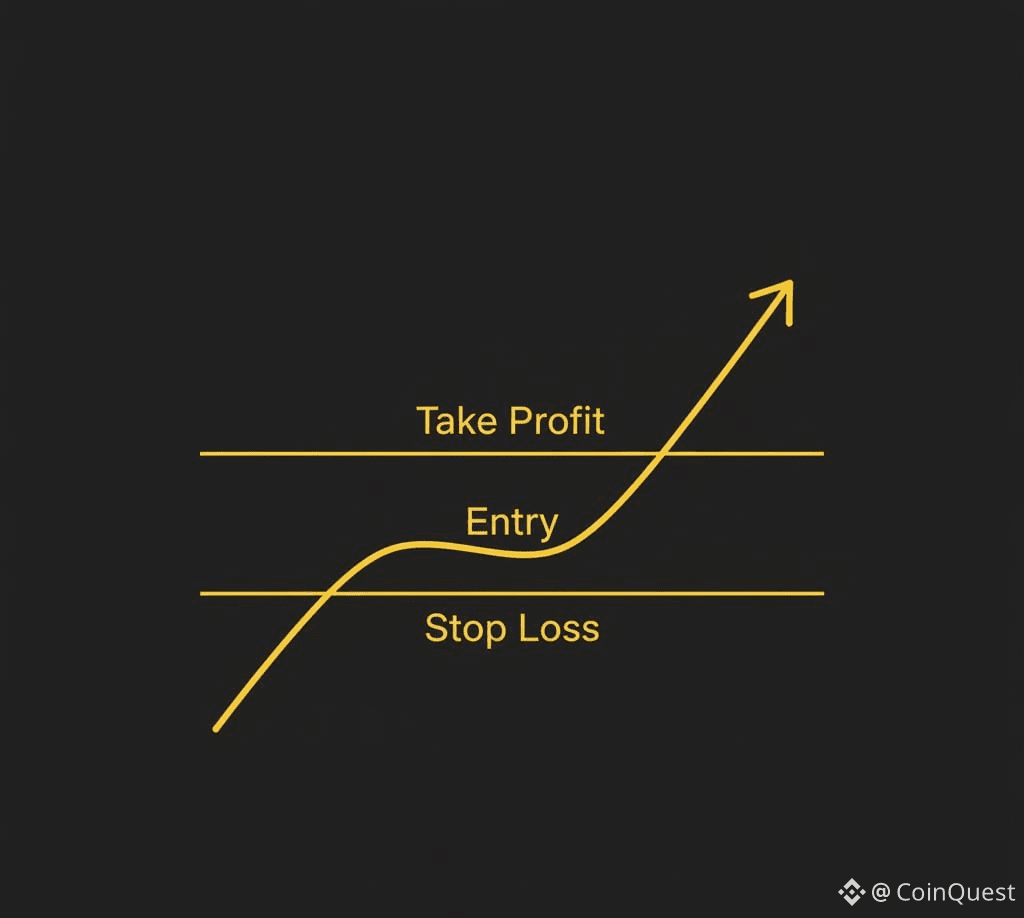

Tools That Control Risk (Use Them)

• Stop-loss – cuts loss automatically

• Take-profit – locks profit without emotions

• Alerts – prevents screen addiction

> “A stop-loss is not admitting you’re wrong. It’s proving you’re disciplined.”

Professional trader quote (X)

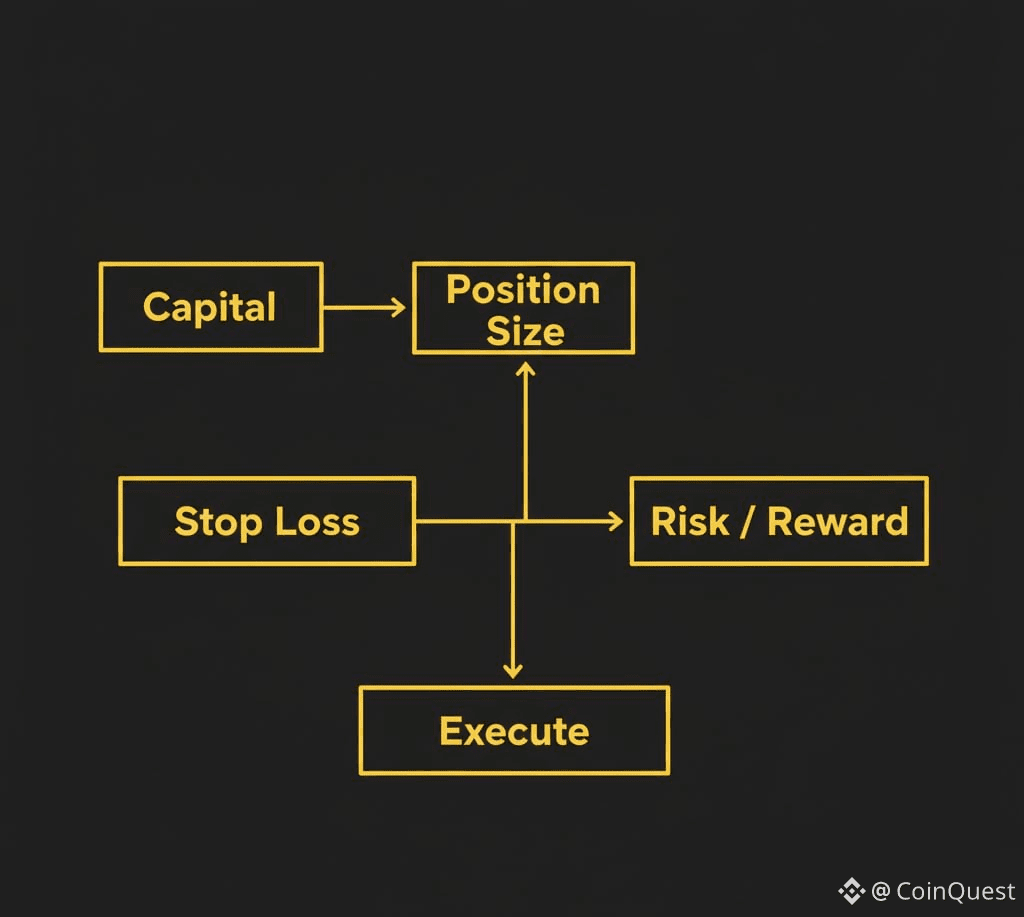

Stop-Loss & Take-Profit (Easy Numbers)

You buy a coin at $100.

• Stop-loss: $92

• Take-profit: $130

Risk = $8

Reward = $30

That’s a good trade, even if it fails.

Position Sizing Rule (Golden Rule)

> “Never risk more than you’re comfortable losing.”

Trading psychology principle

Common rule:

• Risk 1–3% per trade

If account = $1,000

• 1% = $10

• 2% = $20

This keeps emotions low and discipline high.

Diversification (Don’t Marry One Coin)

Bad habit:

❌ 100% money in one altcoin

Better approach:

✅ BTC + ETH

✅ Few strong altcoins

✅ Some stablecoins

> “Diversification is protection against ignorance.”

Warren Buffett

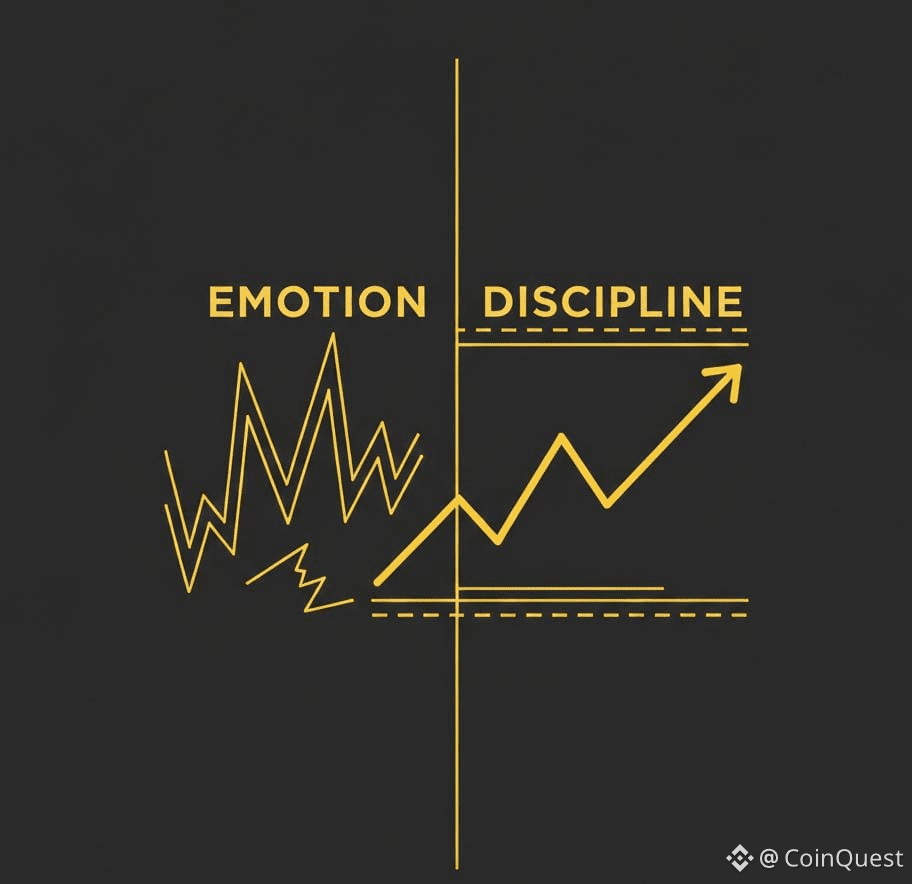

Emotional Control (Real Enemy)

Markets don’t destroy accounts.

Emotions do.

• Fear makes you exit early

• Greed makes you hold too long

• Revenge makes you overtrade

> “The market is a mirror it shows you who you really are.”

Mark Douglas

A written risk plan protects you from yourself.

Security Is Also Risk Management

Risk is not only charts.

• Never share private keys

• Avoid random links

• Use trusted wallets

• Double-check everything

> “Not your keys, not your coins.”

Crypto community principle

Risk Management by Trading Style

Long-term holders

• Focus on asset security

• Less leverage

• Strong projects only

Swing traders

• Clear stop-loss

• Patience over frequency

Day traders

• Tight risk

• No emotional trades

• Fewer, cleaner setups

About Leverage (Warning for Beginners)

Leverage multiplies both profit and loss.

> “Leverage is a tool. In the wrong hands, it’s a weapon.”

Experienced futures traders

Beginners should avoid or use very low leverage.

Final Truth (Read This Twice)

> “It’s not about how much you make in one trade. It’s about how long you stay in the game.”

Professional trading wisdom

Risk management won’t make you rich overnight.

But lack of it will make you poor very fast.

Protect capital → Control emotions → Stay consistent.

That’s how real traders survive.

#RiskManagement #Binance #CZ #BinanceSquareFamily @CZ #tradingtechnique