Dusk as a Long-Term Infrastructure Bet

In crypto, there’s a huge gap between trading for a quick profit and betting on real infrastructure. Trading chases stories, hype, and whatever’s hot in the moment. Infrastructure plays are slower—they’re about whether a protocol can quietly become essential, the kind of thing people end up relying on without even realizing it. Dusk falls squarely into that second camp. It’s not built to grab retail attention or ride fleeting DeFi waves. Instead, it’s aiming to fix problems that keep coming up in blockchain: privacy, compliance, and actually connecting to real-world finance.

The heart of Dusk is a simple idea that most people overlook—privacy and regulation don’t have to be at odds. Most blockchains pick a side: you either get privacy, or you get compliance, but rarely both. Financial institutions can’t work in a system where everything’s out in the open, but regulators still need to see what’s going on. Dusk isn’t about wild experiments or speculation. It’s about building the rails that the next generation of finance can actually run on.

Here’s the thing with most public blockchains—they overshare. Wallet balances, transaction histories, who’s paying who—it’s all out there for anyone to see. Retail users might not mind, but big institutions can’t risk leaking their strategies or customer info on a public ledger. Dusk solves this with zero-knowledge cryptography. Transactions are private by default, but still provable. This isn’t some surface-level privacy—it’s baked into the structure.

Dusk stands out because it’s built for compliance from day one. Instead of fighting regulation, it embraces it. With selective disclosure, users can prove they’re following the rules without giving up all their data. That’s huge for things like securities, regulated DeFi, and real-world asset tokenization. As regulators pay more attention to on-chain activity, blockchains that can’t adapt just won’t make the cut. Dusk is ready for that world, not scrambling to catch up.

Another big piece here: Dusk isn’t chasing broad consumer DeFi. It’s laser-focused on regulated financial assets—tokenized stocks, bonds, compliant instruments. That matters because real infrastructure value comes from where the serious money is. Retail speculation moves fast, but it’s gone just as quickly. Institutional money moves slow, but when it lands, it sticks. Even if a small chunk of traditional finance moves on-chain, the tech has to be solid. Dusk is setting itself up for exactly that migration.

Tech-wise, Dusk uses a privacy-friendly proof-of-stake system. Validators don’t have to show all their cards to participate, which lowers risk and lines up with what institutions want out of security and privacy. Over time, the networks that balance decentralization with operational privacy will win out over the ones that force everyone into the spotlight.

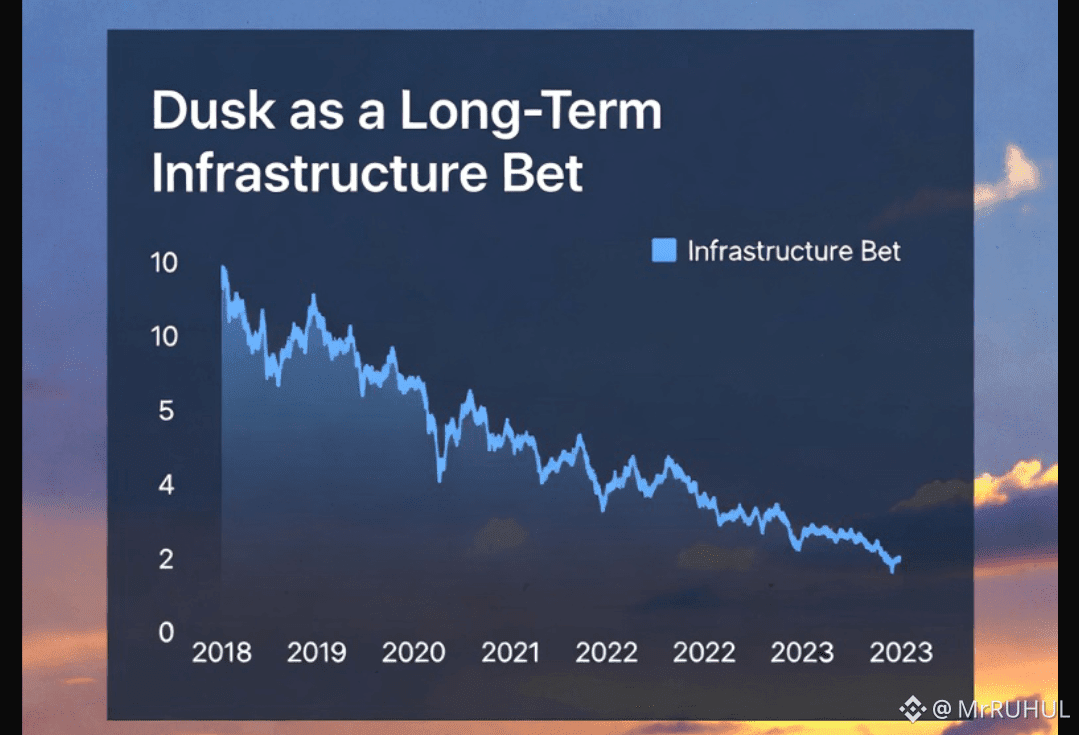

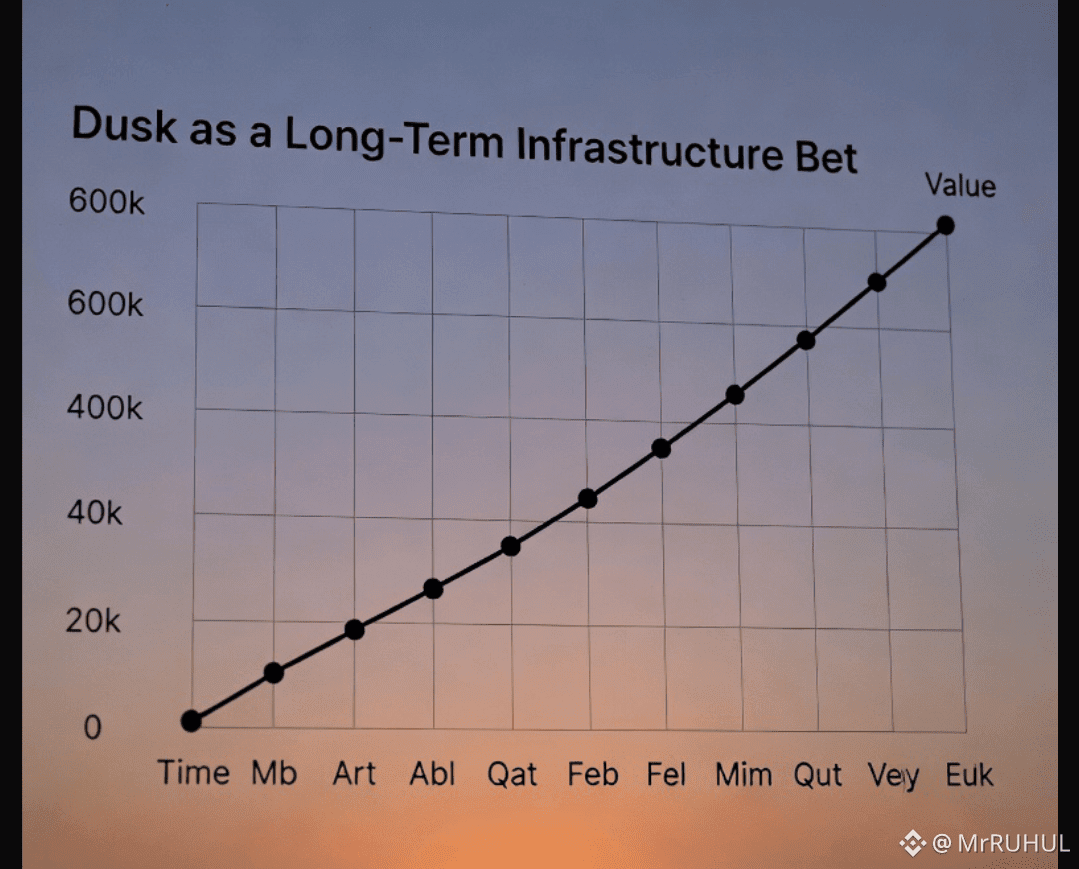

Economically, infrastructure plays aren’t about the next pump. They’re about lasting relevance. If Dusk becomes the go-to for compliant financial settlement, demand will come from real use, not just traders chasing the next big thing. Usage, staking, fees—they’ll all tie back to actual economic activity. It’s slower to take off, but way more stable through market ups and downs.

One more thing—Dusk isn’t trying to be everything for everyone. It’s not chasing meme coins, viral apps, or high-speed retail DeFi. That focus is a strength. A lot of Layer 1s get stretched thin trying to please everyone. Dusk is picking its lane and aiming to be the best at confidential, compliant finance. In tech, being specialized usually wins in the long run.

As tokenization, on-chain securities, and regulated DeFi grow up, the infrastructure behind it all will matter more than the latest flashy app. Most people won’t even know they’re using Dusk—just like nobody really thinks about what powers the financial system today. That’s not a flaw; it’s what real infrastructure looks like.

So, betting on Dusk is less like buying into a consumer trend and more like investing in the underlying plumbing of finance. The wins don’t come from hype—they come from steady adoption, clear regulation, and the trust of institutions. It takes time, but when it happens, it tends to last.

In the end, Dusk is a bet on where crypto is actually heading.@Dusk #Dusk $DUSK