XRP has returned to the center of discussions about its long-term valuation, as investors look beyond short-term price fluctuations and focus on the mechanisms quietly shaping the asset's future.

Although daily charts attract attention, deeper structural forces often determine whether a digital asset can scale to meet institutional demand. For XRP, these forces revolve around supply dynamics, transaction design, and real-world settlement capacity.

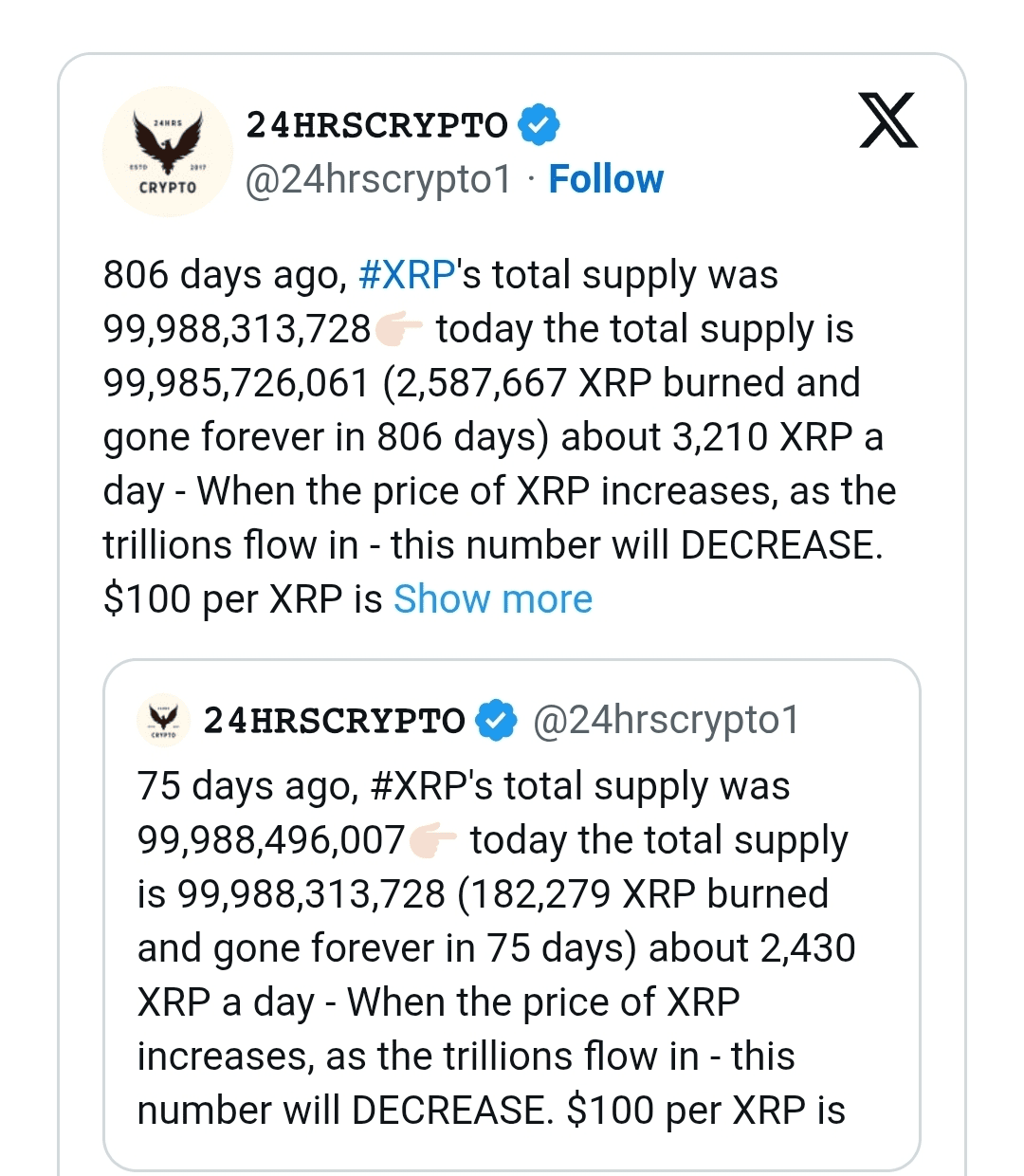

A market analysis shared by 𝟸𝟺𝙷𝚁𝚂𝙲𝚁𝚈𝙿𝚃𝙾 highlights a measurable and verifiable trend on the XRP Ledger. Over the past 806 days, the total XRP supply has decreased from 99,988,313,728 to approximately 99,985,726,061. This change confirms that around 2,587,667 tokens have been permanently removed from circulation through the network's native burn mechanism.

XRP's deflationary design

The XRP ledger destroys a small amount of XRP with each transaction. This mechanism prevents spam on the network and ensures efficient resource use. Based on observed supply variation, the ledger burned an average of approximately 3,210 XRP per day over the past 806 days. This burn rate does not depend solely on time; it increases as transaction volume grows.

As adoption expands and on-chain activity grows, the rate at which XRP exits circulation accelerates. This link between usage and supply reduction places XRP in a distinct category among large-cap digital assets.

Why is price important for global settlement

𝟸𝟺𝙷𝚁𝚂𝙲𝚁𝚈𝙿𝚃𝙾 emphasized that the discussion on asset valuation must consider scale. XRP targets high-value, high-speed settlement use cases, particularly in international payments. At lower prices, moving tens or hundreds of billions of dollars would require transferring enormous quantities of tokens, which would overwhelm liquidity and operational efficiency.

A higher XRP price reduces the number of tokens needed to move large amounts. From this perspective, price appreciation favors functionality over speculation. As transaction sizes grow, network efficiency increasingly depends on a higher unit value.

A banking-sector-oriented supply model

The fully pre-mined XRP supply often generates controversy, but its supporters argue this reflects a deliberate institutional design. Banks and financial institutions prioritize predictable supply, fixed issuance, and transparent monetary structure. The asset offers these attributes by eliminating mining variability and inflation uncertainty.

Ripple designed XRP from a banking and payments perspective, prioritizing deterministic settlement over open emission models.

Evaluating the $100 claim for XRP

The claim that the asset will reach $100 remains an opinion, not a guaranteed outcome. However, the argument presented by 𝟸𝙷𝚁𝚂𝙲𝚁𝚈𝙿𝚃𝙾 is based on observable mechanisms, not exaggerations. XRP supply continues to decrease, and its utility model requires higher token value as transaction volume increases.

What remains undeniable is the core of the argument: XRP supply is decreasing, and its design directly links long-term value to real-world usage and scale.

🚀 FOLLOW for early alerts 🙌🏽🚀💰💰💰

Remember folks, nothing said here constitutes a buy, sell, or hold recommendation for assets.

Thank you everyone!