Traders know that institutional moves often dictate liquidity flows and price action—large positions can swing markets if exposed. Dusk Network flips this script by embedding privacy as the default, allowing institutions to operate on-chain without broadcasting every detail. For retail traders holding DUSK, this means potential for steadier volumes as big players enter comfortably, with DUSK's utility tied to facilitating these secure transactions in the Dusk ecosystem.

Default Privacy: Redefining Institutional On-Chain Engagement

Dusk Network sets privacy as the baseline through its Layer 1 protocol, where transactions and contract states are obscured unless selectively disclosed. This design lets institutions handle sensitive data—like portfolio allocations or trade intents—without public exposure on Dusk's ledger. According to official sources, Dusk achieves this via zero-knowledge proofs, enabling verification of actions without revealing inputs or outputs. For traders, this shift encourages institutional adoption, as Dusk reduces risks like front-running that plague transparent chains, potentially increasing DUSK demand through higher transaction fees in the ecosystem.

What Changes for Position Management on Dusk

With privacy by default on Dusk Network, institutions can manage large positions discreetly, executing block trades or accumulations without tipping off the market. On Dusk, tools like Hedger use homomorphic encryption to compute on encrypted data, keeping balances and strategies hidden while ensuring auditability for compliance. This alters trading dynamics: retail traders might see less volatile dumps from exposed whales, as Dusk's selective disclosure allows regulators access only when needed. DUSK tokens fund these operations, with gas fees for proof generation creating a utility sink that could support price stability as institutional volumes grow in Dusk.

Liquidity Implications: Private Flows in Dusk's Ecosystem

Institutional privacy on Dusk Network fosters deeper liquidity pools, as firms can provide capital without fearing data leaks that erode competitive edges. Dusk's compliant DeFi applications, unlocked by DuskEVM's mainnet launch in the second week of January 2026, enable Solidity-based pools where trades settle privately on Dusk's Layer 1. Traders benefit from this, potentially facing tighter spreads in DUSK-paired assets, though the privacy overhead might introduce minor latency in order matching. DUSK's role as the staking token secures these pools, with rewards redistributing fees to validators, incentivizing robust liquidity provision in the Dusk ecosystem.

Risk Mitigation: How Dusk Protects Institutional Capital

Default data protection on Dusk Network minimizes risks like information asymmetry, where exposed on-chain activity could lead to targeted exploits. Institutions using Dusk can tokenize RWAs compliantly, with privacy ensuring that asset details remain shielded during transfers or lending. This setup, designed for regulated environments, changes how traders assess risk—Dusk's zero-knowledge mechanisms reduce the likelihood of correlated sell-offs from leaked positions. For DUSK holders, this translates to network resilience, as institutional trust boosts staking participation, enhancing Dusk's overall security and token utility.

Trading Strategies Adapted for Dusk's Privacy Layer

In Dusk Network, traders can leverage institutional privacy by focusing on momentum from aggregated flows rather than individual whale tracking. With DuskTrade launching in 2026 through collaboration with NPEX—a regulated Dutch exchange holding MTF, Broker, and ECSP licenses—institutions will bring over €300M in tokenized securities on-chain, traded privately. This opens strategies like arbitraging between Dusk's private DEXes and public signals, but requires monitoring DUSK gas trends for entry points. The default privacy in Dusk means less on-chain noise, allowing traders to rely on volume metrics from Dusk explorers for informed positions.

Compliance Without Exposure: Dusk's Edge for Institutional Traders

Dusk Network ensures institutions meet regulatory demands without sacrificing privacy, using built-in primitives for KYC and AML that prove compliance via proofs rather than full data reveals. This default protection changes audit processes—regulators verify through Dusk's selective disclosure, keeping operational details internal. For retail traders, this attracts more compliant capital to Dusk, potentially elevating DUSK's floor through sustained fee generation. However, the encryption layers in Dusk add computational steps, so traders should factor in slight delays when timing entries in fast-moving RWA markets within the ecosystem.

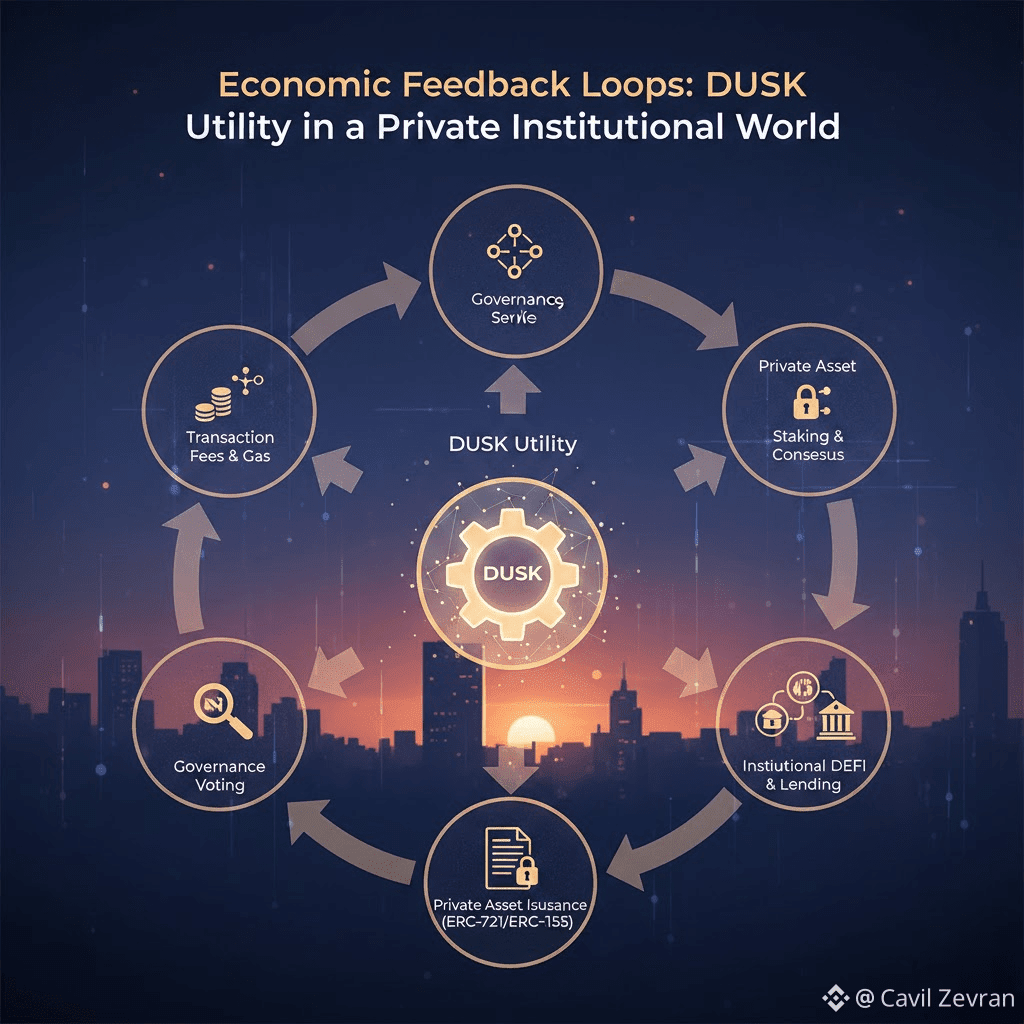

Economic Feedback Loops: DUSK Utility in a Private Institutional World

As institutions embrace Dusk Network's default privacy, DUSK tokens gain from amplified utility in fees and staking. Each private transaction on Dusk consumes DUSK for gas, with higher demands from institutional-scale ops feeding into reward pools. This creates positive loops: more secure capital inflows drive network activity, bolstering DUSK's value proposition. Traders can position around these cycles, watching staking yields as indicators of institutional confidence in Dusk, though fixed supply constraints require vigilance on fee spikes during peak privacy usage.

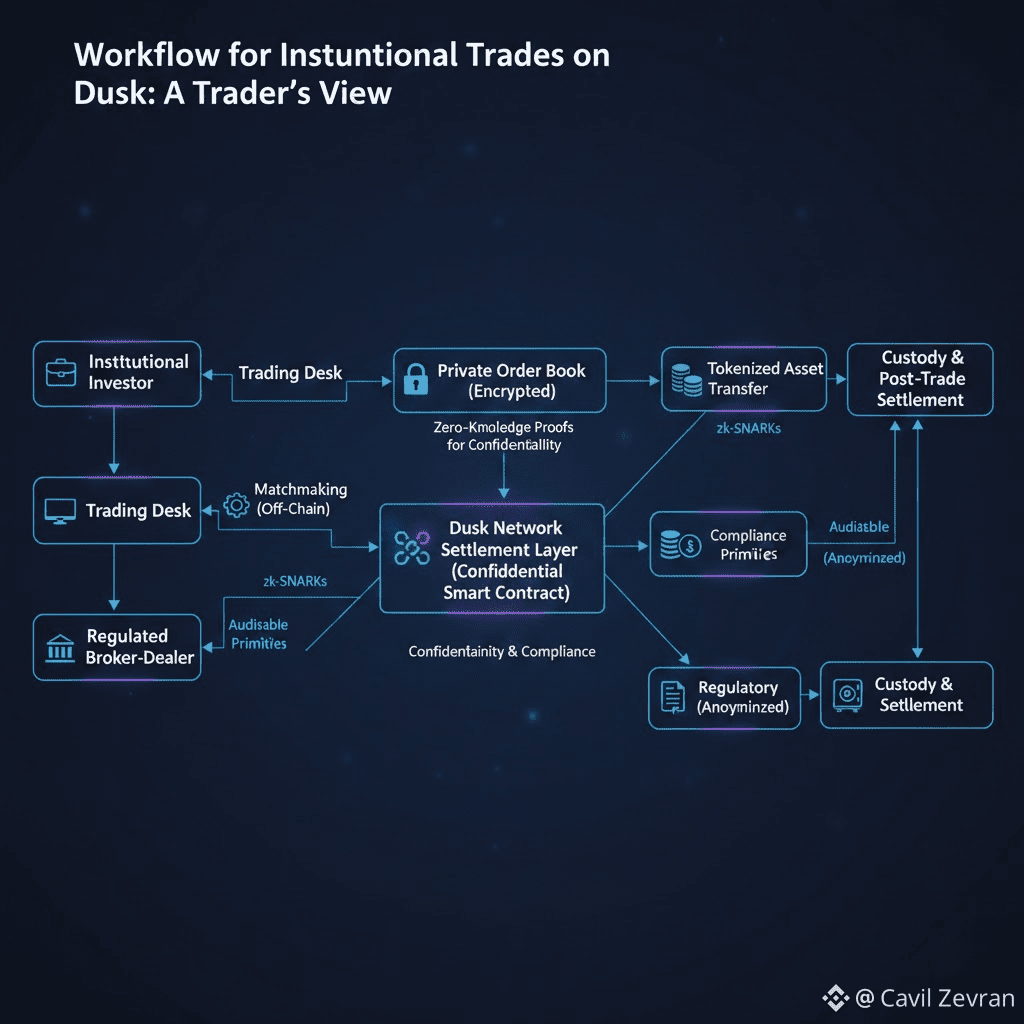

Workflow for Institutional Trades on Dusk: A Trader's View

Observing institutional shifts on Dusk Network involves understanding their private workflow. An institution starts by deploying assets via DuskEVM, using Hedger to encrypt trades with zero-knowledge proofs for validity checks. Settlement occurs on Dusk's Layer 1, obscured from view but auditable on request. Traders outside can gauge impact through aggregated metrics like total value locked in Dusk, adjusting DUSK holds accordingly. Constraints include proof verification times, which might buffer rapid institutional rebalances, but Dusk's design prioritizes this for regulated integrity.

Scalability in Privacy: Balancing Institutional Growth on Dusk

Dusk Network scales institutional privacy through modular components, separating execution from settlement to handle volume without compromising data protection. As more firms join, Dusk's succinct proofs keep verifications efficient, supporting thousands of private interactions daily. Traders should note potential bottlenecks in DUSK gas during institutional onboarding phases, like post-DuskTrade launch, which could create short-term volatility. Overall, Dusk's approach ensures privacy scales with demand, providing reliable liquidity for DUSK-based trading.

Long-Term Positioning: DUSK in an Institutional Privacy Era

For traders, Dusk Network's default privacy signals a maturing ecosystem where institutional participation stabilizes DUSK's fundamentals. With tools like Citadel for identity proofs integrated privately, institutions can expand into DeFi without exposure risks, driving organic growth in Dusk. This positions DUSK as a hold for those betting on regulated on-chain finance, though traders must account for evolving privacy tech updates that could influence fee structures.

Dusk Network's default privacy transforms institutional engagement, offering traders access to more secure, liquid markets. By protecting data inherently, Dusk encourages big-player involvement that enhances DUSK's utility and ecosystem depth. As this unfolds, Dusk provides a solid foundation for strategic trading in compliant spaces.