When war between the US and Iran hits the headlines, most people panic but here is how you can benefit from the fear in the market.

The war situation between the US and Iran is affecting the market. One thing should be clear here that money does not disappear, it just flows and the right decision when the fear dominates can end up with profits. Now the most needed thing is to invest in the right asset at the right time. So in this article I will help you what to buy and what to avoid.

Why War Creates Opportunity, Not Just Fear

When geopolitics heats up, markets don’t wait for confirmation. They react first and ask questions later. Prices drop fast, volatility spikes, and emotions take over. This is where most retail traders lose money, not because the market is bearish, but because positioning is wrong.

This is not automatically a bull market or a bear market.

This is a volatility market.

And volatility is where prepared traders make money.

The First PhaseIs Where Most Lose

When war risk enters the conversation, the first move is almost always emotional. Crypto, equities, and other high-beta assets sell off quickly as leverage is reduced and uncertainty rises. These moves feel decisive because they are fast and aggressive, but they are rarely driven by long-term fundamentals.

Most of the damage here comes from forced liquidations, not informed conviction.

This is the phase where panic sellers exit, and where smart money waits.

The Second Phase Is Where Money Is Made

Once the initial shock fades, markets stop reacting to headlines and start pricing impact.

Institutions and experienced traders begin watching:

oil supply and energy risk

inflation pressure

central bank response

global liquidity conditions

If these remain contained, fear loses momentum and capital starts rotating into assets that historically hold value or recover first.

This is where buy decisions matter.

What to Buy When War Risk Escalates

These assets tend to attract capital and protect value once panic selling cools.

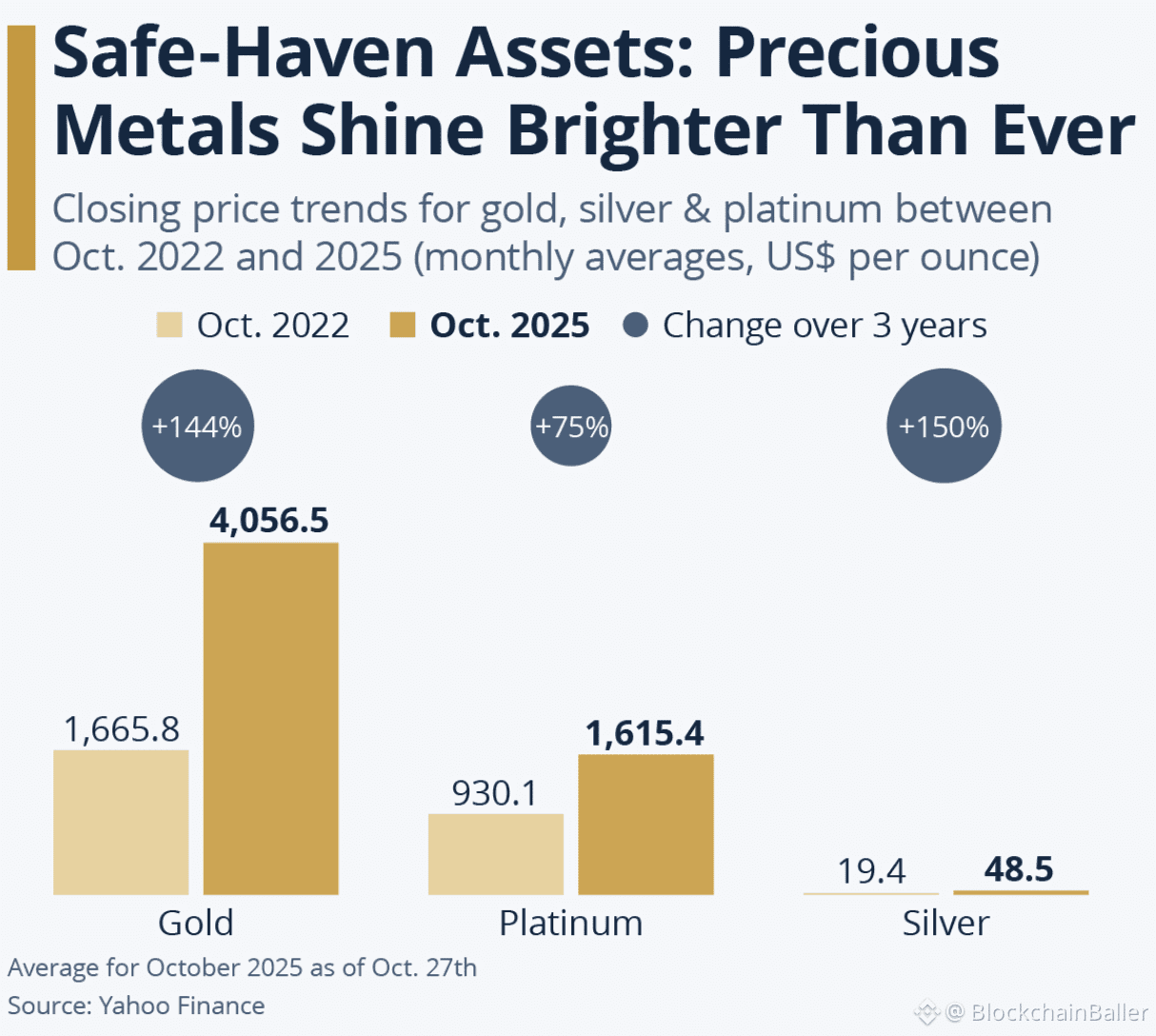

Precious Metals

XAU has consistently acted as the primary hedge during geopolitical stress. It does not need hype to perform. It preserves value when confidence drops.

XAG often follows gold with higher volatility, especially if inflation expectations rise alongside conflict risk.

Energy Exposure

Crude Oil is usually the first asset to price Middle East risk. Sustained strength in oil signals real supply concern, not just headlines. Energy-linked equities often follow when disruption risk becomes credible.

Crypto Majors

Bitcoin (BTC) typically sells off early due to leverage unwinds, then stabilizes first once forced selling ends.

Ethereum (ETH) usually follows Bitcoin’s recovery and benefits when liquidity conditions normalize.

Liquidity Positions

USDT and USDC act as strategic parking assets. They are not exits — they are positioning tools. Rising stablecoin usage often comes before re-entry into risk assets.

These assets benefit because capital prioritizes liquidity, credibility, and real demand during uncertainty.

What to Avoid If You Want to Stay Profitable

War-driven markets punish speculation.

High-risk meme coins, low-liquidity altcoins, and short-term hype narratives tend to underperform badly. Heavily leveraged positions suffer the most as volatility expands. Small-cap assets dependent on retail momentum often experience deeper drawdowns and slower recoveries.

Privacy-focused tokens and assets linked to sanctioned regions can also face additional pressure if geopolitical risk leads to tighter regulatory scrutiny.

During war risk, capital does not chase excitement.

It seeks safety and flexibility.

Why Bitcoin and Ethereum Matter More Than Everything Else

In periods of geopolitical stress, markets become selective.

Bitcoin is usually the first crypto asset institutions return to once volatility compresses. Ethereum follows as confidence stabilizes. Smaller altcoins recover later, and many do not recover at all until sentiment fully resets.

Crypto does not behave as a short-term safe haven during war.

It behaves as a liquidity-sensitive asset class that recovers after panic selling ends.

Understanding this prevents emotional mistakes.

When Does War Actually Turn the Market Bearish?

A true bearish regime only appears if real economic damage follows.

That includes prolonged oil supply disruption, regional escalation involving multiple producers, long-term sanctions impacting global banking, or inflation shocks that force central banks into aggressive tightening.

Without these, war headlines usually create volatility, not permanent damage.

The Real Strategy to Stay in Profit

Short term, expect volatility and sharp moves.

Medium term, markets stabilize if escalation remains contained.

Long term, capital rotates back to fundamentals.

The biggest losses happen when traders react emotionally.

The biggest gains happen when traders understand where money flows during fear.

Markets don’t reward panic.

They reward preparation, patience, and positioning.