Upon analyzing the Dusk Network in greater depth, I realized the project's differentiator isn't just the talk about privacy or compliance, but rather how the entire architecture was designed to serve a specific type of market. When I look at charts, metrics, and comparisons, Dusk's proposition becomes even clearer.

She doesn't compete for attention in the same arena as generalist blockchains. She builds infrastructure for a niche that handles vastly larger volumes: the regulated financial market.

Where Dusk positions itself in the blockchain ecosystem

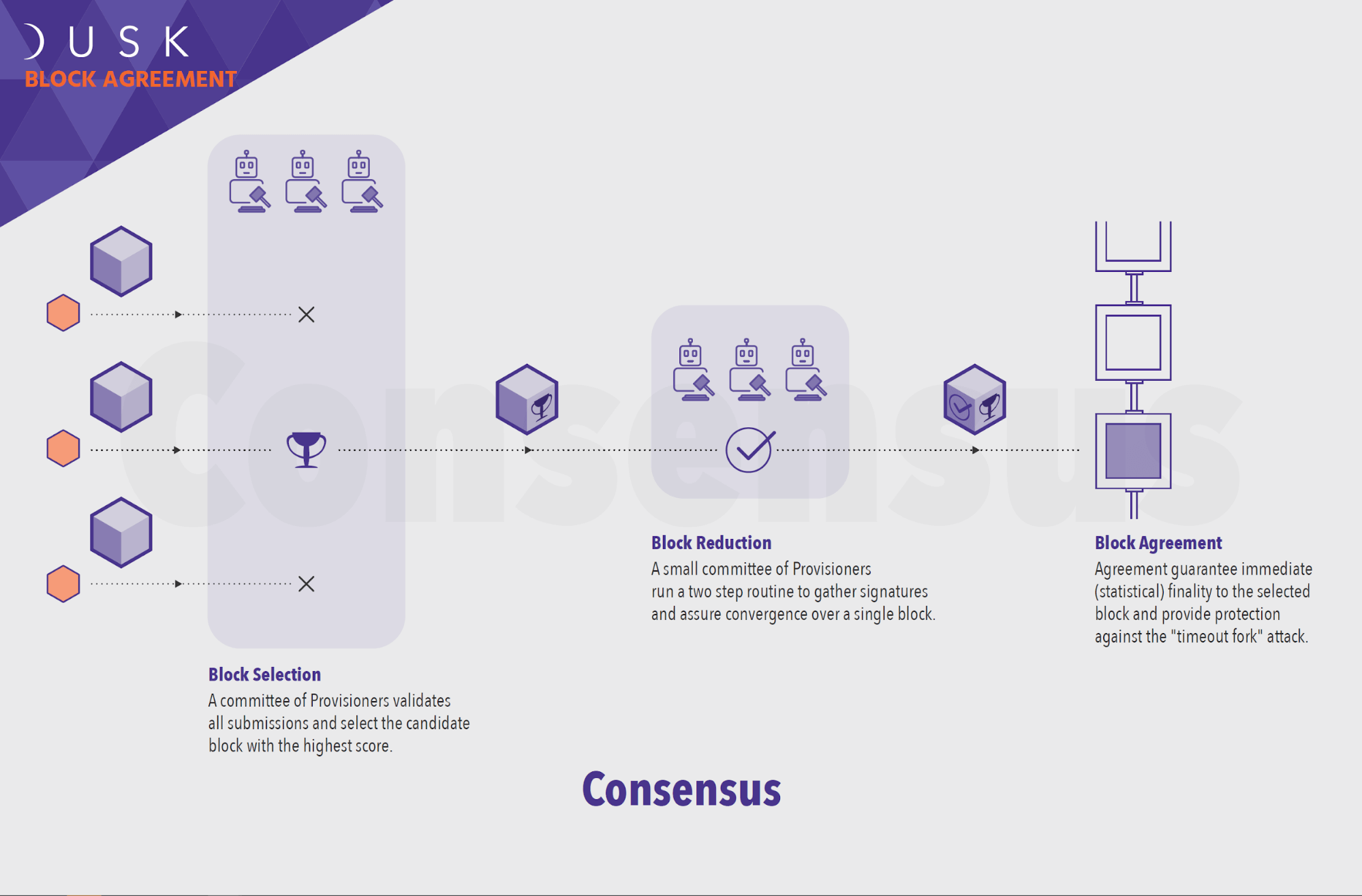

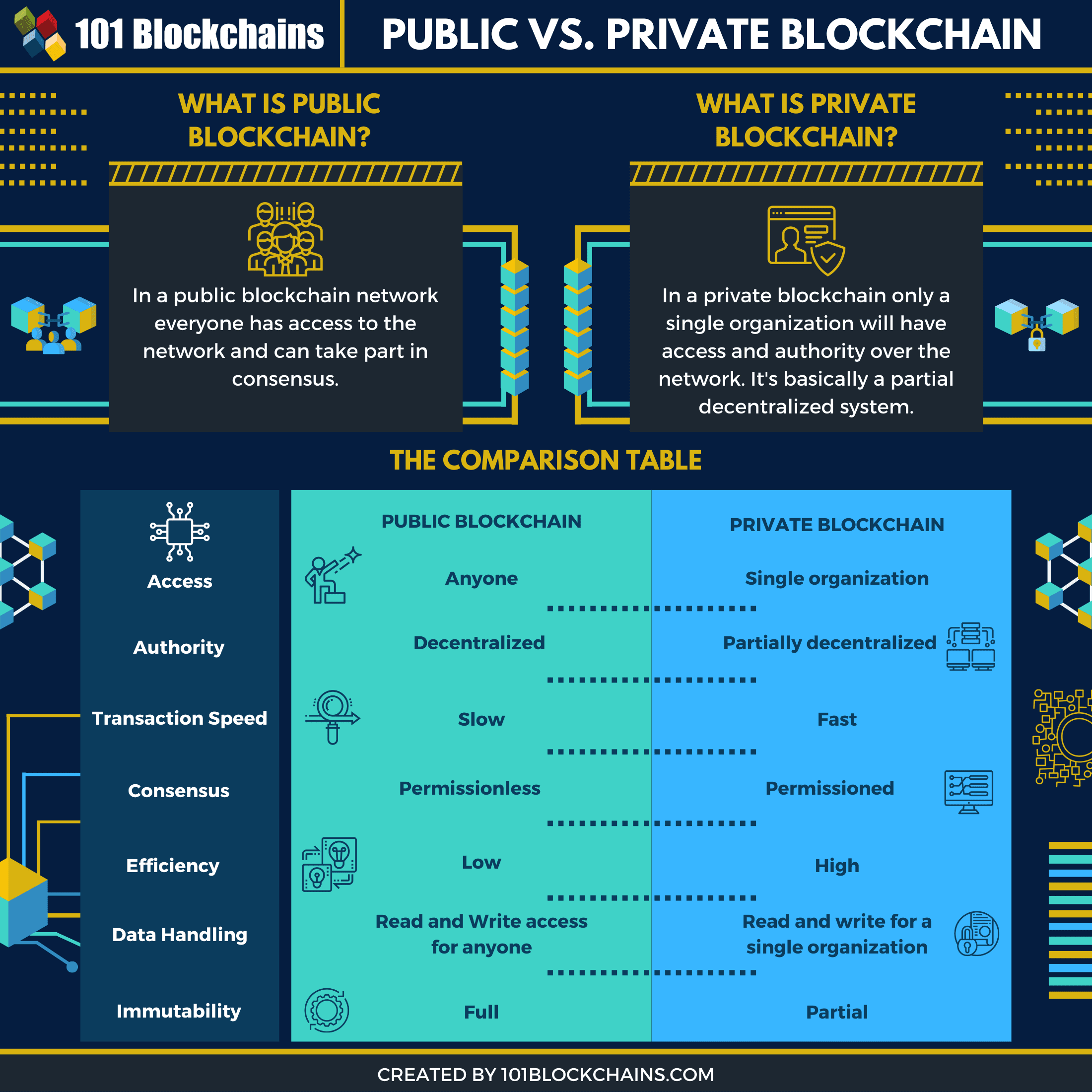

When comparing different blockchains, I like to observe three factors: application type, privacy level, and regulatory adherence. Most networks focus on open applications, permissionless DeFi, or NFTs. Few were designed from the start to handle regulated financial assets.

Dusk precisely occupies this intermediate space, where the blockchain must deliver technological efficiency without breaking existing rules. This fundamentally changes the profile of users and applications that can emerge on the network.

Privacy as a technical requirement, not a marketing gimmick

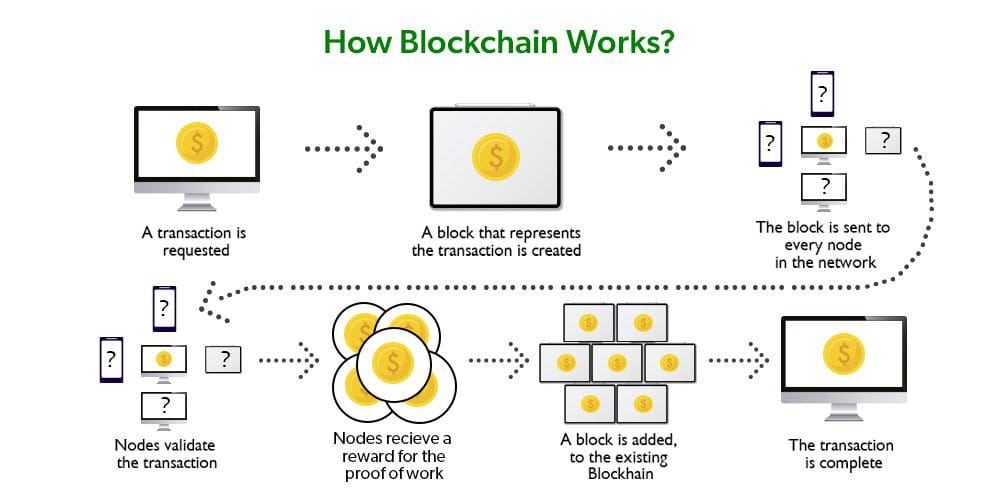

A recurring theme in financial sector data is the cost of improper information exposure. Leaks, front-running, and lack of confidentiality lead to real losses. When examining charts comparing public blockchains with privacy-focused solutions, it becomes clear that financial environments require a higher level of control.

Dusk was designed to ensure sensitive data remains invisible by default, while still allowing for auditing when necessary. This combination emerges as a structural advantage when analyzing institutional use cases.

The relationship between compliance and institutional adoption

Another important insight I've observed is the correlation between regulatory clarity and institutional adoption. Projects that ignore compliance tend to attract only individual users. In contrast, infrastructures that consider regulations from the outset are able to engage with companies, funds, and asset issuers.

Dusk fits into this second category. Its proposal allows financial assets to be issued, traded, and settled on a blockchain without violating legal requirements. This reduces entry barriers and accelerates processes that are currently slow and costly in the traditional system.

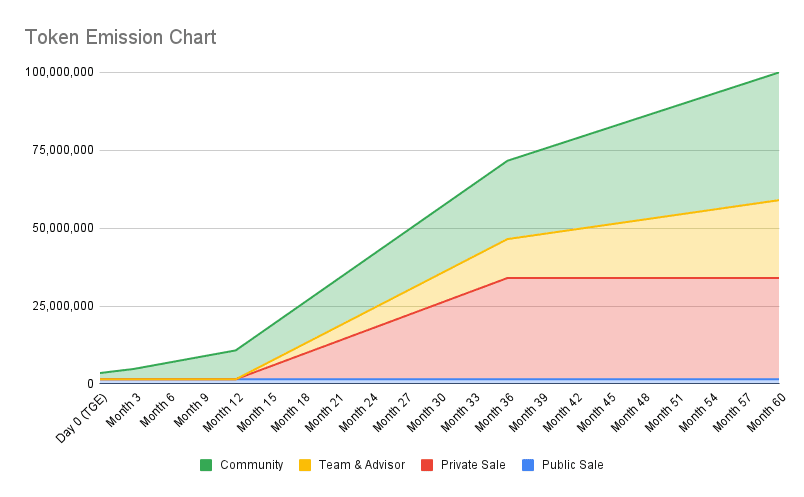

The practical economic role of the DUSK token

When I look at the DUSK token through a data-driven lens, what stands out is its role within the ecosystem. It is directly tied to network security, incentives, and protocol functionality. It is not a token created solely to capture market attention.

This direct relationship between token and infrastructure tends to create a healthier usage cycle. The more the network is used, the greater the functional demand for the token, creating alignment between ecosystem growth and economic value.

Scalability focused on real-world use cases

Another clearly visible aspect when analyzing comparative data is that scalability is not just about more transactions per second. In Dusk's case, scalability is linked to the ability to process complex financial operations while maintaining privacy and compliance.

This includes asset issuance, trading in secondary markets, and efficient settlement. When these processes are moved to the blockchain without losing control, the operational gain becomes significant.

Why the numbers reinforce the Dusk thesis

After reviewing charts, structures, and sector data, my assessment is that Dusk Network occupies a niche that is little contested yet extremely relevant. It does not rely on constant hype to justify its existence. Its value lies in clear utility and adherence to a market that already moves trillions.

Such projects tend to grow in a less explosive but more consistent manner. Adoption comes from necessity, not from trends.

Personal conclusion

When combining data, architecture, and proposition, Dusk stops being just 'another blockchain' and becomes a piece of infrastructure. For me, this completely changes the level of analysis.

This is not about future promises, but about solving problems that already exist in today's financial market. And when a project addresses these issues in a structured way, data typically confirms the thesis over time.