If you've been following the world of cryptocurrencies for a while, you've probably noticed that there's one word that makes many people allergic: "Regulation."

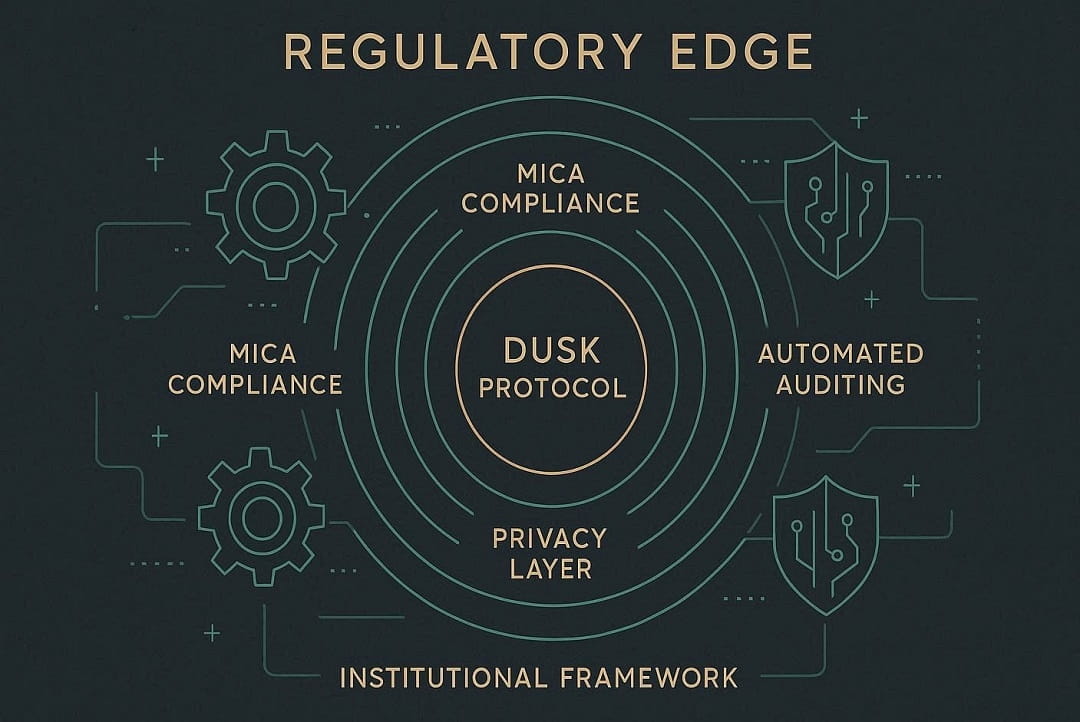

For years, the ecosystem operated under the motto that rules were obstacles, that bureaucracy kills innovation, and that the best way was to live in a digital "wild west." But let's be honest—this model has a very low ceiling. If we want the future of finance to be massive, we can't live outside the law. And this is exactly where@Dusk decided to do something brilliant: instead of running away from rules, they turned them into their greatest superpower through what they call the "Regulatory Edge."

But what does this mean in real life?

Imagine you want to build a house on a new plot of land. You have two options: start building walls randomly and hope nobody says anything, or construct following every building code from the very first brick. If you choose the first, sooner or later you'll face fines or even have your house torn down. If you choose Dusk, your house is born with all permits already approved. That's the Regulatory Edge: a competitive advantage where legal compliance isn't a heavy burden, but the engine that lets you play in the big leagues.

In Europe, for example, we have the famous MiCA (Markets in Crypto-Assets) regulation. Many projects are now desperately running around, trying to figure out how to patch their technology to stay out of legal trouble. In contrast, Dusk was designed from the ground up with these laws in mind. It's not that they adapt—they were born ready. This is exactly what financial institutions love. A large bank or fund manager doesn't just care if a network is fast; they care if it's legally secure. They want to know that if they tokenize a 100 million euro bond, they won't face a legal issue next month.

The most incredible part of this technology is how it achieves the impossible balance: privacy for the user and transparency for the regulator. Often, we think that if something is private, it must be "dark" or illegal. Nothing could be further from the truth! Think about your own health: your medical data is private—no one should see it on a public network—but if a doctor or health authority needs to audit it for a valid reason, there must be a legal way to do so. Dusk achieves exactly that in finance. Thanks to its cryptographic tools, transactions remain confidential from the public eye (protecting your business strategy and privacy), while enabling audit channels so regulators can verify everything is in order. It's literally having your cake and eating it too.

This completely transforms the game of RWA (Real World Assets). When we talk about bringing traditional assets onto the blockchain, the biggest barrier has always been legality. How do we ensure that a token truly represents a company's share and complies with all securities regulations? With Dusk's Regulatory Edge, that question already has an answer. The network allows you to program the rules directly into the code. If an asset can only be purchased by certified investors from certain countries, the network ensures that automatically and without human error.

The token $DUSK is the heart pumping this trust. By using an infrastructure already "friendly" to the law, companies save millions in legal fees and time-consuming manual compliance processes that take weeks. Here, everything happens at the speed of light and with the certainty that you're operating on an institutional-grade network. We're moving from the era of "move fast and break things" to the era of "move fast and build things that last."

Following this path isn't the easiest—it requires monumental technical effort that the Dusk team has been refining for years. But it's the only path leading to mass adoption. When real money—the kind managing pensions, insurance, and large funds—decides to fully enter the blockchain, they won't look for the most "rebellious" network; they'll look for the most solid and compliant one. And there, with its Regulatory Edge razor-sharp, Dusk will be waiting at the top. It's a long-term vision that understands true financial freedom doesn't come from ignoring rules, but from creating technology so advanced that it naturally, privately, and efficiently complies with them.