If Bitcoin really breaks through the $114,000 threshold, it will most likely surge above $150,000, and there’s even a chance to reach $161,000 or more aggressively around $190,000. But here’s the problem—once this line is lost, it will face a downside space of $76,000. There’s no buffer in between.

Using Fibonacci retracement theory, Bitcoin’s average price indicator is actually a good reference tool. This indicator mainly measures Bitcoin’s historical average price trend, clearly outlining potential support and resistance levels.

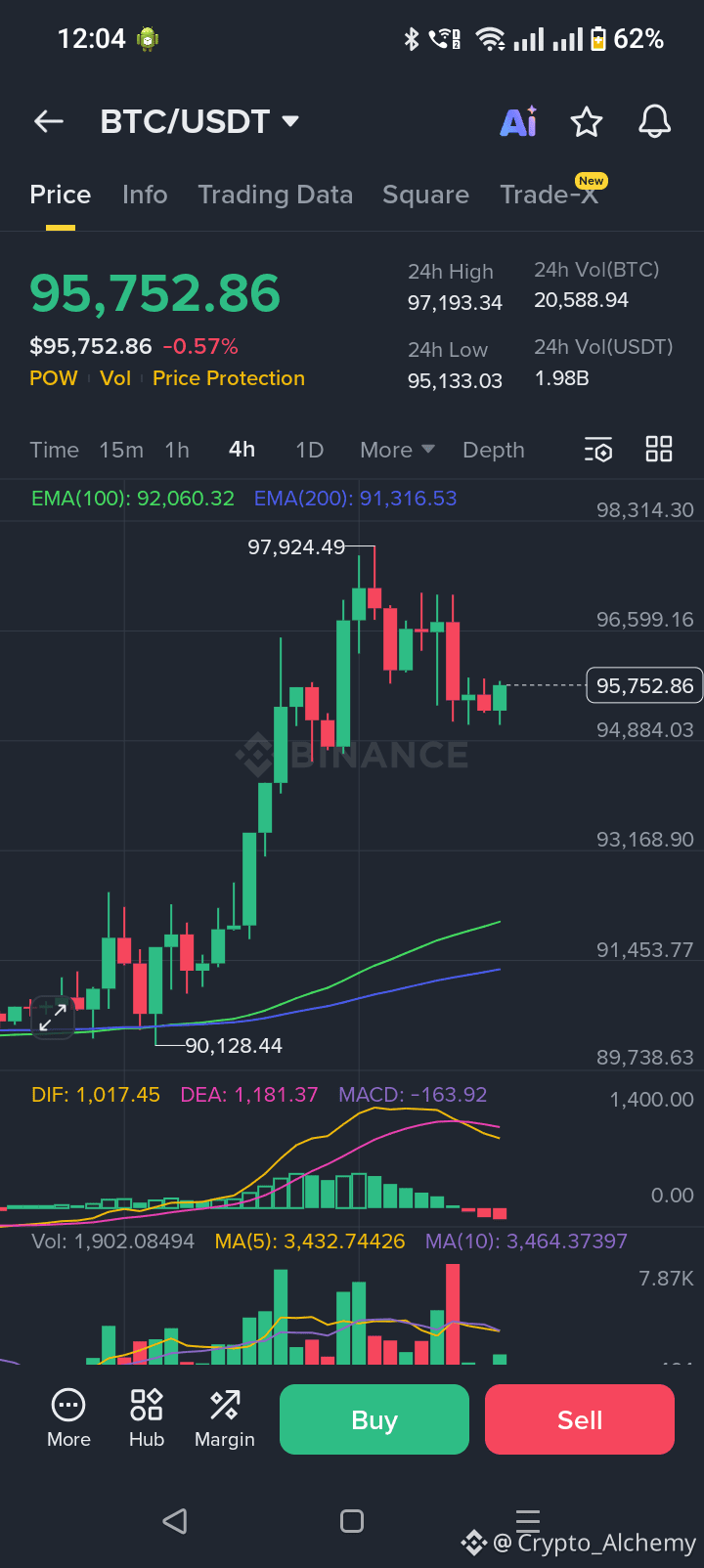

So where is the current difficulty? Recently, Bitcoin has been repeatedly testing an old opponent—the resistance level that it failed to break through in 2019, late 2021, and March 2024. This challenge is not easy either. The reason behind it is quite painful: long-term holders keep selling at high levels, and exchange leverage positions have already accumulated aggressively. The market simply doesn’t have enough incremental funds to continue rallying.

The current market average price forecast is around $61,500. If a deep bear cycle really occurs, this could very well be $BTC bottom price. In other words, the fluctuation space between $114,000 and $61,500 is quite large.