Polygon Labs has made one of its most decisive moves to date, completing the acquisition of two crypto-native companies, Coinme and Sequence, in a combined transaction valued at $250 million. The deals mark a clear shift in Polygon’s strategy. This is no longer just about scaling Ethereum more efficiently. It is about owning the full stack that sits between blockchain technology and real-world usage.

Instead of chasing short-term narratives, Polygon is methodically assembling the pieces required for long-term relevance. On-ramps, wallets, compliance, and user experience are now central to its expansion plan.

Why Coinme Is a Strategic Asset, Not Just an Acquisition

Coinme solves a problem that many blockchain networks never fully address: access. As one of the earliest crypto cash-to-digital platforms, Coinme operates a regulated crypto ATM and payments network that directly connects fiat systems with digital assets.

By acquiring Coinme, Polygon gains more than infrastructure. It gains a proven distribution channel. Fiat on-ramps, compliance-tested operations, and real transaction flow are now part of the Polygon ecosystem rather than external dependencies.

This materially reduces friction for new users. Instead of routing through third-party providers, Polygon can integrate native fiat access for POL-based assets and applications. In practice, this strengthens Polygon’s position in payments, remittances, and consumer crypto use cases where convenience and trust matter more than raw throughput.

Access is leverage. Coinme gives Polygon exactly that.

Sequence and the Battle for Web3 User Experience

If Coinme strengthens the entry point, Sequence defines what happens after users arrive.

Sequence is best known for its smart wallet infrastructure and its role in blockchain gaming and interactive applications. Its technology focuses on removing the friction that has historically kept mainstream users away from Web3. Private key management, gas fees, and complex wallet flows are abstracted away without undermining security.

For Polygon, this acquisition directly supports its push into gaming, NFTs, and consumer-facing decentralized applications. Developers gain access to tooling that simplifies onboarding and retention, two areas where most Layer 2 networks struggle despite technical efficiency.

As competition among scaling solutions intensifies, user experience is becoming the differentiator. Sequence gives Polygon a tangible edge in that race.

Beyond Scaling: Polygon’s Strategic Pivot

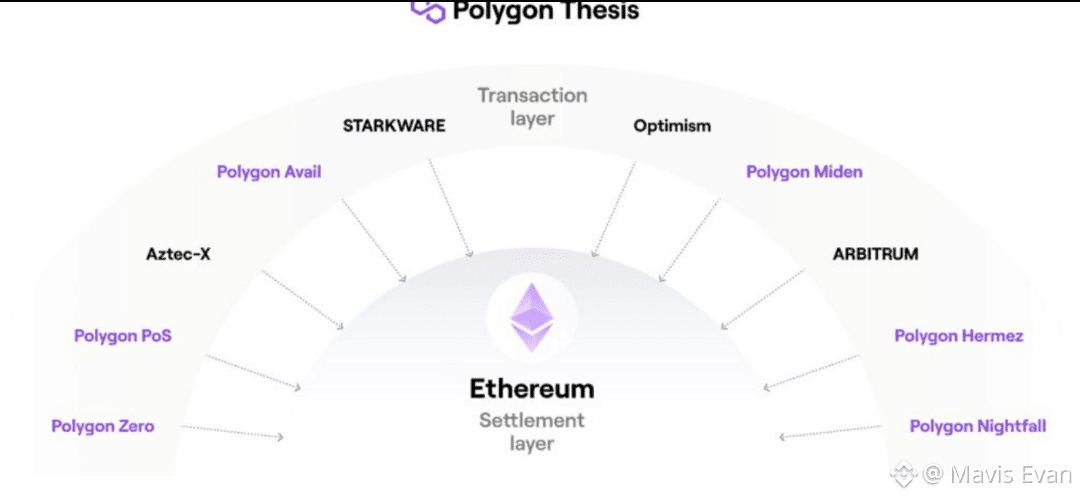

Polygon built its reputation as an Ethereum scaling solution. These acquisitions show that the company no longer views scaling as sufficient on its own.

In the next phase of adoption, the winners will not just offer cheaper transactions. They will control access, shape developer workflows, and integrate seamlessly with real-world financial systems.

With Coinme providing regulated fiat rails and Sequence delivering wallet and application infrastructure, Polygon is stitching together the layers that sit between protocols and end users. This level of vertical integration gives Polygon a structural advantage over ecosystems that remain dependent on external service providers.

Infrastructure is becoming strategic, not just technical.

Market Signal and Industry Implications

A $250 million combined acquisition is not a casual investment. It is a signal.

At a time when many crypto firms are downsizing or delaying expansion, Polygon Labs is deploying capital into foundational infrastructure. That suggests strong internal conviction about where the next growth cycle will come from.

The broader message to the market is clear. The next wave of adoption will be driven less by speculative token narratives and more by usable products. Payments, wallets, gaming, and consumer-grade applications are becoming the primary battlegrounds for ecosystem dominance.

Polygon is positioning itself early.

What This Means for POL and the Polygon Ecosystem

While the acquisitions do not directly alter POL’s token mechanics, they strengthen its long-term utility. More users entering through regulated on-ramps and remaining active through better applications ultimately increases network activity and relevance.

Polygon’s strategy suggests a future where Layer 2 networks function as full platforms, competing with traditional fintech and gaming infrastructure rather than simply complementing them. If execution matches ambition, Polygon could emerge as one of the few blockchain ecosystems capable of supporting mass adoption without compromising decentralization.

The Bigger Picture

The acquisition of Coinme and Sequence is not a one-off expansion. It reflects a structural shift in how Polygon Labs defines its role in the crypto economy.

Polygon is evolving from an Ethereum scaling solution into a comprehensive Web3 operating layer, spanning payments, wallets, compliance, and applications. That transformation is expensive, complex, and risky. It is also necessary.

As the industry matures, deals like this will likely determine which ecosystems endure and which fade into technical footnotes. Polygon has made its direction clear.

It is building for the next decade, not the next headline.