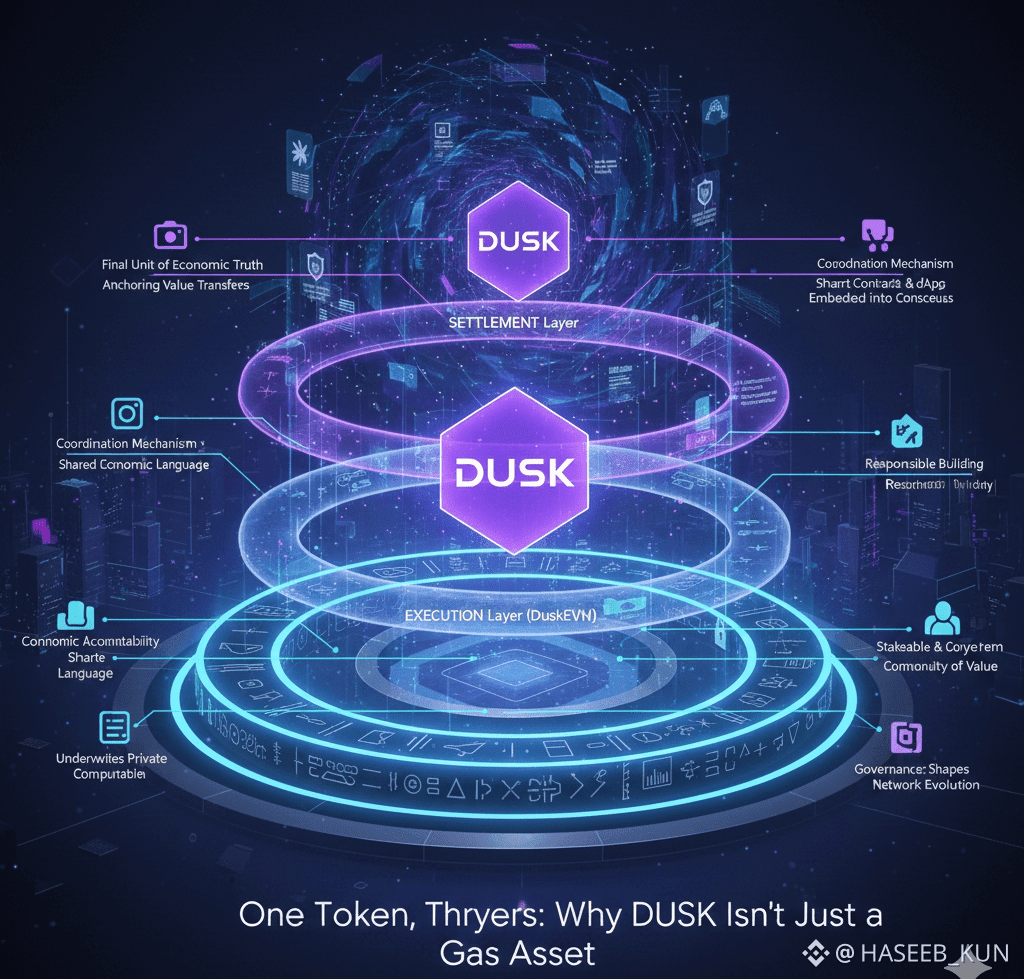

At first glance, DUSK looks like many other blockchain tokens, something you might assume exists primarily to pay transaction fees, move value, or occasionally stake for rewards, but that assumption quietly misses the point, because DUSK was never designed to live in a single role or a single layer, and once you trace how it moves through settlement, execution, and privacy, it becomes clear that its real purpose is economic coherence rather than convenience, sustainability rather than speculation, and alignment rather than fragmentation; on the settlement layer, DUSK acts as the final unit of economic truth, anchoring value transfers and ensuring that transactions resolve with cryptographic certainty, not just technical finality but economic closure, which matters because settlement is where trust ultimately collapses or holds, and by making DUSK the asset that resolves outcomes, the network ensures that every participant, from validators to users, is economically exposed to the same source of truth rather than a patchwork of incentives; this matters even more when privacy enters the picture, because in a privacy-preserving environment, where transaction details are intentionally obscured, the token that settles value must carry credibility on its own, and DUSK does this by being scarce, stake-secured, and structurally embedded into consensus rather than bolted on as an afterthought; moving upward into the execution layer, particularly across environments like DuskEVM, DUSK stops behaving like a passive fee token and starts functioning as a coordination mechanism, enabling smart contracts, decentralized applications, and programmable logic to operate under a shared economic language, which is subtle but important, because when execution relies on the same asset that settles outcomes, developers are incentivized to build responsibly, users are discouraged from spam or waste, and the system naturally prices complexity and computation without artificial constraints; what makes this especially interesting is that DUSK does not lose its identity as it moves between layers, meaning the same token that finalizes private transfers on DuskDS can be deployed into composable smart contracts on DuskEVM, creating a continuity of value that most multi-layer ecosystems struggle to achieve, and this continuity is what allows liquidity to flow without distortion, speculation to remain grounded in utility, and growth to occur without constantly minting new abstractions; the third layer—privacy—is where DUSK’s role becomes even more distinct, because here the token is not just paying for execution or settling balances, it is actively participating in a design where confidentiality is enforced without undermining economic accountability, and that balance is rare, since many privacy-focused systems either isolate tokens from governance and staking or rely on external assets to secure consensus, whereas DUSK remains fully exposed, fully stakeable, and fully governable even while transactions remain shielded, which means that privacy does not dilute responsibility but instead coexists with it; staking, in this context, is not simply a yield mechanism but a form of long-term commitment, where validators lock DUSK not just to earn rewards but to underwrite the correctness of private computation, settlement finality, and cross-layer consistency, and because slashing and rewards are denominated in the same asset that powers execution and governance, incentives remain aligned across time horizons rather than optimized for short-term extraction; governance further reinforces this alignment, because DUSK holders do not merely vote on cosmetic upgrades or parameter tweaks, they shape how the network evolves across all three layers simultaneously, influencing privacy assumptions, execution standards, and settlement guarantees through proposals that carry real economic consequences, and this is where sustainability quietly emerges as the central theme, since a token that governs, secures, executes, and settles is far less likely to drift into irrelevance than one that exists only to subsidize transactions; from an economic perspective, this multi-layer utility creates what could be described as depth rather than breadth, meaning DUSK does not need to be everything to everyone across unrelated verticals, but instead becomes indispensable within its own ecosystem, a trait that tends to age better over market cycles than speculative narratives; for investors and long-term participants, this matters because value accrual is not dependent on constant user growth alone but on sustained participation in staking, governance, and application usage, all of which feed back into the same token rather than leaking value outward; even inflation, when viewed through this lens, functions less as dilution and more as redistribution toward those actively securing and maintaining the network, which reinforces the idea that DUSK is designed to reward contribution rather than passive holding; what ties all of this together is the fact that DUSK does not fragment its identity across layers, wrappers, or synthetic representations unless strictly necessary, preserving economic clarity in an industry that often thrives on abstraction, and that clarity makes the system easier to reason about, easier to govern, and ultimately more resilient; in a market where many tokens struggle to justify their existence beyond fees or speculation, DUSK stands out not because it promises explosive growth, but because it quietly embeds itself into every critical function of the network, making it difficult to replace without dismantling the system itself, and that, more than any short-term metric, is what gives a token staying power; when viewed this way, DUSK stops being a gas asset and starts behaving like infrastructure capital, the kind that doesn’t shout, doesn’t rely on constant narrative reinvention, but compounds relevance over time by being useful in ways that are difficult to replicate; sustainability, in this sense, is not a marketing claim but an emergent property of design, where settlement, execution, and privacy reinforce each other through a single economic instrument, and whether one approaches DUSK as a developer, validator, or investor, the conclusion slowly becomes the same: a token that carries responsibility across layers is far more likely to endure than one that exists only to be spent.