@Dusk and the Ledger That Can Whisper and Still Hold in Court

In real finance, privacy isn’t a preference. It’s the boundary that keeps ordinary business from becoming public spectacle. A broker isn’t trying to be mysterious when they protect client positions and deal terms; they’re trying to prevent harm—front-running, coercion, reputational risk, and the quiet erosion of trust that happens when too many strangers can stare at the same sensitive truth. Dusk lives inside that reality. It’s built around the idea that markets can be verifiable without being naked, and that accountability doesn’t have to be paid for with humiliation.

What makes Dusk feel different when you spend time close to it is that it treats “regulated” as a design constraint, not a marketing audience. The chain’s public arc reflects that seriousness: it staged its mainnet rollout with explicit on-chain migration steps and an operational launch sequence rather than a single dramatic switch. That timeline—onramping stakes, preparing genesis state, and then producing the first immutable block—reads like a team that expects to be audited by time itself, not applauded by a timeline.

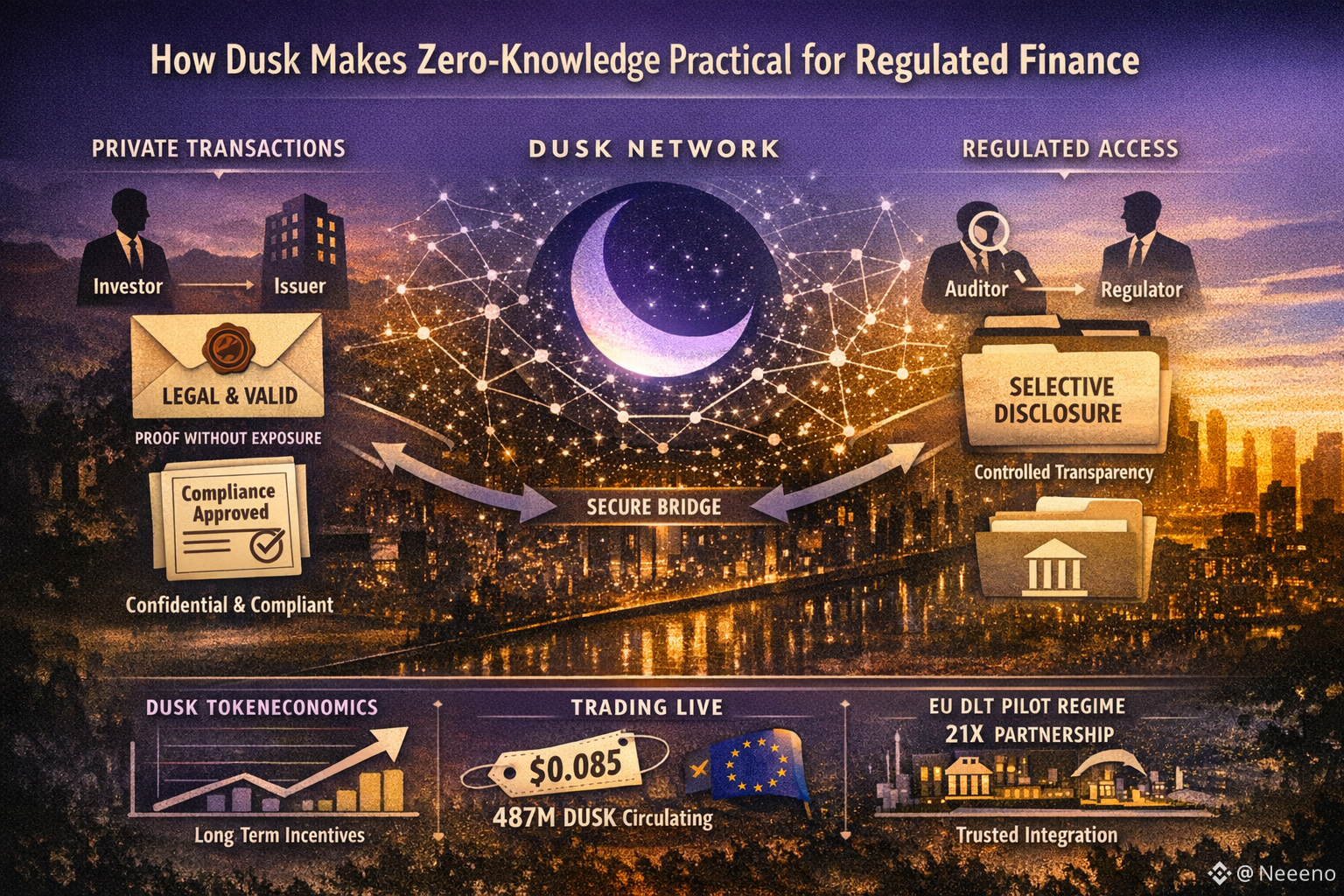

The deeper point is not the calendar, though. The deeper point is what Dusk is trying to make emotionally safe. Most people don’t fear “transparency” as an ideology; they fear what transparency does to them when conditions turn hostile. Dusk’s wager is that you can let a market prove it followed the rules without forcing every participant to broadcast their identity, their inventory, their intent, or their vulnerabilities. This is where zero-knowledge stops being a math flex and becomes a social technology: a way to say “this is legitimate” without turning “legitimate” into “exposed.”

Under the surface, that promise only works if proof generation and verification are real engineering, not aspiration. Dusk has kept a public, Rust-native implementation of its proving system—small proofs, efficient verification, polynomial commitments, custom gates—because the cost of proving is the cost of privacy in practice. If it’s too slow, users abandon it. If it’s too expensive, only whales can afford dignity. If it’s too brittle, compliance teams stop trusting it the first time a corner case appears in production.

But finance isn’t just cryptography. Finance is incentives dressed as routine. That’s why DUSK—the token—matters beyond price talk. Dusk’s own tokenomics frame DUSK as the incentive and the currency of participation: an initial 500,000,000 DUSK supply, with another 500,000,000 emitted over 36 years to reward stakers, culminating in a 1,000,000,000 max supply. The emission schedule is designed to decay over time, a long negotiation between “secure the network early” and “don’t poison the future with runaway issuance.” Even the minimum staking threshold is a quiet statement: participation should be reachable, but not weightless.

Zoom out and you can see Dusk gradually reorganizing itself around the way institutions actually integrate.

In mid-2025, the project outlined a split architecture: the base does the heavy lifting (consensus + data + settlement), another part runs apps using familiar developer workflows, and a dedicated privacy layer is intended as the next step. The key detail is that it keeps one token across the stack and emphasizes a validator-run bridge between layers—because in regulated workflows, the weakest link is usually the handoff.

Token mobility is one of those unglamorous handoffs where trust quietly dies if you get it wrong. That’s why the two-way bridge update mattered more than it sounded: it wasn’t just “more places for DUSK to go,” it was a statement that Dusk intends to let value move without surrendering the idea of a single source of truth. When users can move native DUSK out to other environments and back again, the chain is admitting something important: adoption is messy, liquidity has habits, and you don’t win by pretending everyone will live inside your walls forever.

Privacy for real-world finance also has a specific shape: confidentiality that can be inspected by the right party at the right time. In June 2025, Dusk described a privacy mechanism for its execution environment that combines zero-knowledge proofs with encrypted computation so balances and amounts can remain hidden while correctness can still be proven—and auditability can be preserved when required. This is the hard middle ground institutions actually need: not invisibility, but controlled visibility that doesn’t leak to the whole world by default.

You can’t claim you’re built for regulated markets and then avoid regulated counterparties. Dusk’s collaboration with 21X under the EU DLT Pilot Regime is a real signal because it lives in the zone where oversight is not theoretical. The reporting and Dusk’s own announcement both emphasize Dusk onboarding as a trade participant and describe deeper integration ambitions. That kind of relationship forces your privacy model to grow up: it has to survive governance, supervision, and the possibility of disputes—without collapsing into “just trust us.”

The same pattern shows up in Dusk’s work with NPEX and the decision to adopt Chainlink standards for interoperability and market data. There’s a human reason this matters: disputes in finance often start as disagreements about data—what was the official price, what was published, what was known, when it was known. Pulling regulated exchange data on-chain and standardizing cross-chain settlement rails is less about connectivity as a buzzword and more about reducing the places where ambiguity can hide and later explode into blame.

And then there’s the token as a social object, not just an instrument. When DUSK became available on Binance US in October 2025, the announcement framed it as access to a market that cares deeply about compliance and venue legitimacy. Listings don’t prove technology, but they do change the emotional temperature around a token: liquidity deepens, participation broadens, and volatility starts to feel less like a private room and more like a public square. For a project that wants institutions to take it seriously, that shift in who can touch the token—and how easily—matters.

As of January 16, 2026, DUSK is trading around $0.085 in the live market feed, with a wide intraday range that reminds you how young this story still is. And yet the supply numbers read like something built to be measured: CoinMarketCap reports roughly 487M DUSK circulating against a 1B max supply.That gap—between what’s liquid today and what will be emitted over decades—isn’t just tokenomics. It’s an incentive horizon. It’s Dusk telling stakers, builders, and institutions: “We intend to be here long enough that short-term noise won’t be the only thing you remember.

The hardest part of building privacy for regulated finance is accepting that failure is not an edge case—it’s a season. People make operational mistakes. Counterparties miscommunicate. Regulators ask questions late. Auditors need proofs that don’t depend on anyone’s goodwill. Dusk’s recent public cadence—the architectural shift, the bridging work, the regulated partnerships, the execution-environment privacy direction, the continual preparation for the next launch phase—feels like a project trying to design for the day trust is under pressure, not the day everything is calm.

In the end, Dusk’s most interesting claim is also its quietest one: that the future of on-chain finance won’t be won by attention, but by restraint. By systems that can carry sensitive value without turning people into targets. By infrastructure that can prove correctness without demanding confession. By a token economy that rewards honesty over time, not just excitement in the moment. Quiet responsibility is not cinematic, but it is what real markets run on—and if Dusk earns a place in that world, it will be because reliability mattered more than noise.