Dusk Foundation has never tried to compete in the loud end of crypto. Its trajectory has been quieter, slower, and far more deliberate—because the problem it is solving is not speculative finance, but regulated finance. And that distinction matters more now than at any earlier point in the market.

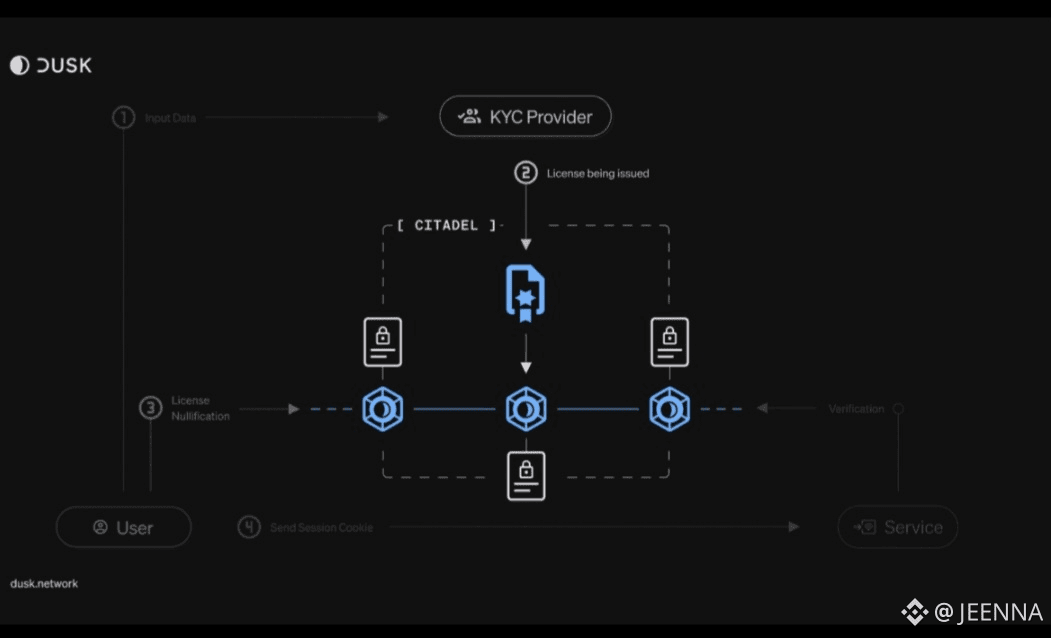

Dusk is a Layer-1 blockchain built specifically for confidential assets, privacy-preserving smart contracts, and compliant financial workflows. Unlike networks that added privacy later as an optional feature, Dusk was architected from the start around selective disclosure. This allows transaction data to remain private while still being verifiable to regulators, auditors, or counterparties when required. In a world moving toward on-chain securities, funds, and real-world assets, that design choice is not cosmetic—it is foundational.

Recent updates and announcements reinforce this direction. Dusk continues to progress toward deeper EVM compatibility, lowering friction for developers migrating existing Ethereum tooling into a confidential execution environment. This is not about chasing developer mindshare for consumer apps; it is about making institutional-grade applications easier to deploy without compromising privacy guarantees. The result is an ecosystem that grows methodically rather than explosively, with a clear focus on correctness, auditability, and long-term viability.

Another important development is Dusk’s expanding role in regulated asset tokenization. Through integrations and standards alignment with infrastructure providers such as Chainlink and regulated venues like NPEX, Dusk is positioning itself as a settlement layer for tokenized securities rather than experimental DeFi instruments. These efforts reflect a broader shift: institutions no longer ask whether assets will move on-chain, but how they can do so without violating disclosure, custody, and compliance requirements. Dusk’s technology is explicitly built to answer that question.

From a technical standpoint, Dusk’s confidential smart contracts enable issuers to define who can see what, and under which conditions. This is critical for use cases like equity, debt instruments, funds, and identity-linked financial products. Public blockchains optimize for radical transparency; traditional finance does not. Dusk bridges that gap without forcing either side to abandon its core constraints.

The network’s recent ecosystem activity also signals a maturing phase. Rather than incentivizing short-term liquidity or attention, Dusk has emphasized protocol stability, validator participation, and infrastructure resilience. This aligns with its target users: financial institutions, regulated entities, and developers building long-lived systems. For these actors, reliability and legal clarity matter more than rapid experimentation.

What makes Dusk particularly relevant now is timing. Regulatory frameworks around digital assets are no longer theoretical. Markets in Europe and beyond are formalizing rules for tokenized securities, on-chain settlement, and digital identity. Blockchains that cannot support confidentiality, audit trails, and controlled disclosure will struggle to participate in this next phase. Dusk was built for exactly this environment, years before it became mainstream.

In practical terms, Dusk is not promising to replace existing financial systems overnight. It is offering something more realistic: infrastructure that allows parts of those systems to move on-chain safely. That is why its progress may appear understated compared to hype-driven networks, but its relevance continues to grow.

Dusk’s recent updates and partnerships suggest a network entering execution mode. Less narrative, more infrastructure. Less noise, more alignment with real financial constraints. As on-chain finance evolves from experimentation to implementation, blockchains designed for privacy and compliance will not be optional. Dusk is positioning itself as one of the few networks prepared for that reality.