When Dusk Network was founded in 2018, it did not start from the idea of building just another blockchain. It started from a very grounded observation about how real financial markets operate.

In traditional finance, privacy is not optional and transparency is not absolute. Large trades are protected from exposure, ownership records are handled with care, and sensitive information is revealed only when legally required.

At the same time, regulators and auditors must be able to verify that rules were followed. Most blockchains struggle with this balance.

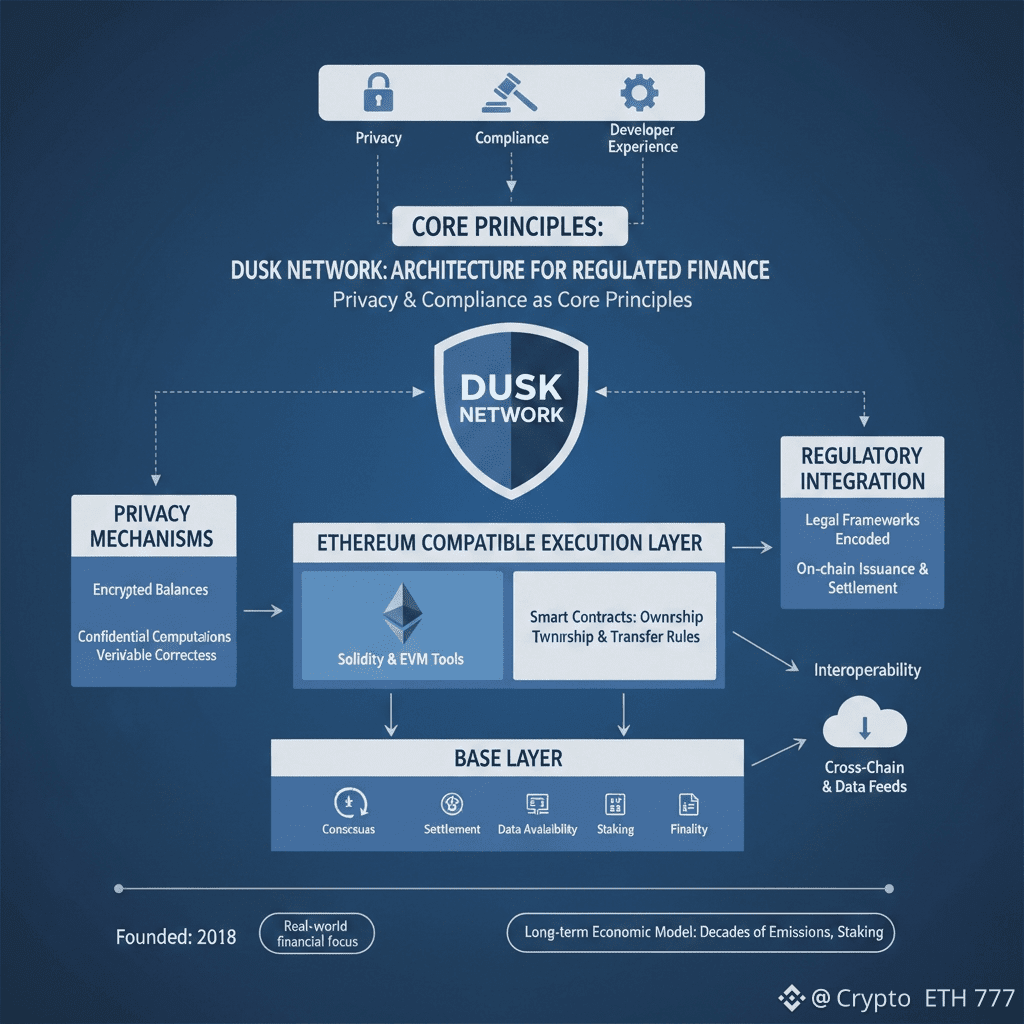

They either expose everything publicly or hide too much to remain compliant. Dusk was designed around the belief that privacy and regulation are not opposites but complementary requirements.

Rather than chasing fast-moving crypto trends, Dusk focused on infrastructure that could realistically support regulated financial activity. Securities, bonds, funds, and other real-world assets already have established legal frameworks.

Dusk does not attempt to rewrite those frameworks. Instead, it aims to encode them directly into blockchain logic so that issuance, transfers, and settlement can happen onchain without breaking existing rules. This approach treats blockchain as financial plumbing rather than a speculative experiment.

A central idea behind Dusk is that privacy protects market integrity. Markets function better when trading intent is not instantly visible and when sensitive data is not broadcast to everyone.

At the same time, outcomes must remain verifiable. Dusk is built so that information can stay confidential while correctness can still be proven. This allows transactions to remain private without sacrificing accountability, a requirement that regulated markets cannot compromise on.

As the network evolved, Dusk adopted a modular architecture to stay practical and adaptable. Instead of forcing all responsibilities into a single layer, different parts of the system handle different roles. The base layer focuses on consensus, settlement, data availability, staking, and finality.

This layer is intentionally designed to be predictable and auditable. In regulated environments, reliability matters more than raw speed, and systems that behave consistently under scrutiny are easier to trust.

Above this foundation sits an Ethereum compatible execution layer. This decision reflects a deep understanding of adoption barriers. Developers and institutions already rely on Ethereum tooling, Solidity, and familiar workflows.

By supporting this environment, Dusk removes unnecessary friction and allows teams to build without abandoning their existing knowledge.

This makes the network far more accessible to serious builders who want privacy and compliance without sacrificing usability.

Within this execution environment, financial assets behave more like real instruments rather than unrestricted tokens. Rules around ownership, transfers, and permissions can be enforced at the smart contract level.

This allows assets to move onchain while still respecting regulatory constraints. It also opens the door to compliant decentralized finance, where automation exists alongside clear boundaries.

Privacy inside this system is handled with care rather than shortcuts. Sensitive values such as balances and positions can remain encrypted while the network still verifies that all computations are correct.

This preserves confidentiality without compromising trust. It closely mirrors how traditional financial systems operate, where sensitive data is protected but results are still subject to review.

This design becomes especially important when considering market behavior. Fully transparent systems often create unintended risks such as front running and strategy leakage.

By restoring informational boundaries, Dusk aims to create healthier onchain markets where participants are not penalized for acting honestly.

This is a subtle but critical distinction that separates experimental finance from infrastructure that can support real economic activity.

Security and correctness are treated as foundational principles. Core components of the network have undergone external audits, and development has followed a careful and deliberate path.

This reflects an understanding that infrastructure meant for regulated finance must prioritize stability over speed. Trust is built through consistency, documentation, and proven behavior over time.

Interoperability is another key part of the vision. Financial assets cannot exist in isolation. They require data, pricing, and the ability to interact with other systems.

By integrating standardized data and cross chain infrastructure, Dusk ensures that assets issued on its network are not locked in but can still move within a broader ecosystem while maintaining compliance.

The economic model of the network supports long term sustainability. Emissions are distributed over decades with gradual reductions, aligning incentives for early participation while allowing real usage and fees to play a larger role over time.

Staking is structured to encourage network security without creating unnecessary barriers.

What ultimately defines Dusk is the consistency of its approach. Privacy is treated as a requirement, not a luxury. Compliance is embraced rather than avoided.

Developer experience is respected instead of ignored. The network is built to fit into real financial systems rather than forcing those systems to adapt to crypto ideals.

Challenges remain. Institutional adoption takes time, ecosystems grow slowly, and trust cannot be rushed.

But the direction is clear. As global markets move toward tokenization and programmable settlement, infrastructure that understands regulation and privacy will be essential. Dusk is not trying to replace traditional finance. It is trying to give it a modern foundation.