@Dusk If you zoom out from the daily chatter around token prices, the question that decides whether a network survives is unglamorous: who pays for it to keep running in year three, year five, year ten? That’s one reason DUSK keeps resurfacing in more serious conversations. Dusk Network’s mainnet rollout culminated on January 7, 2025, and the team framed that moment less like a finish line and more like the start of operating in public, under real constraints. “Live” is when ideals collide with operations—nodes need clear incentives, users need predictable costs, and upgrades need a path that doesn’t depend on a brief rush of attention. The networks that last are usually the ones that can keep doing the boring work when nobody is cheering.

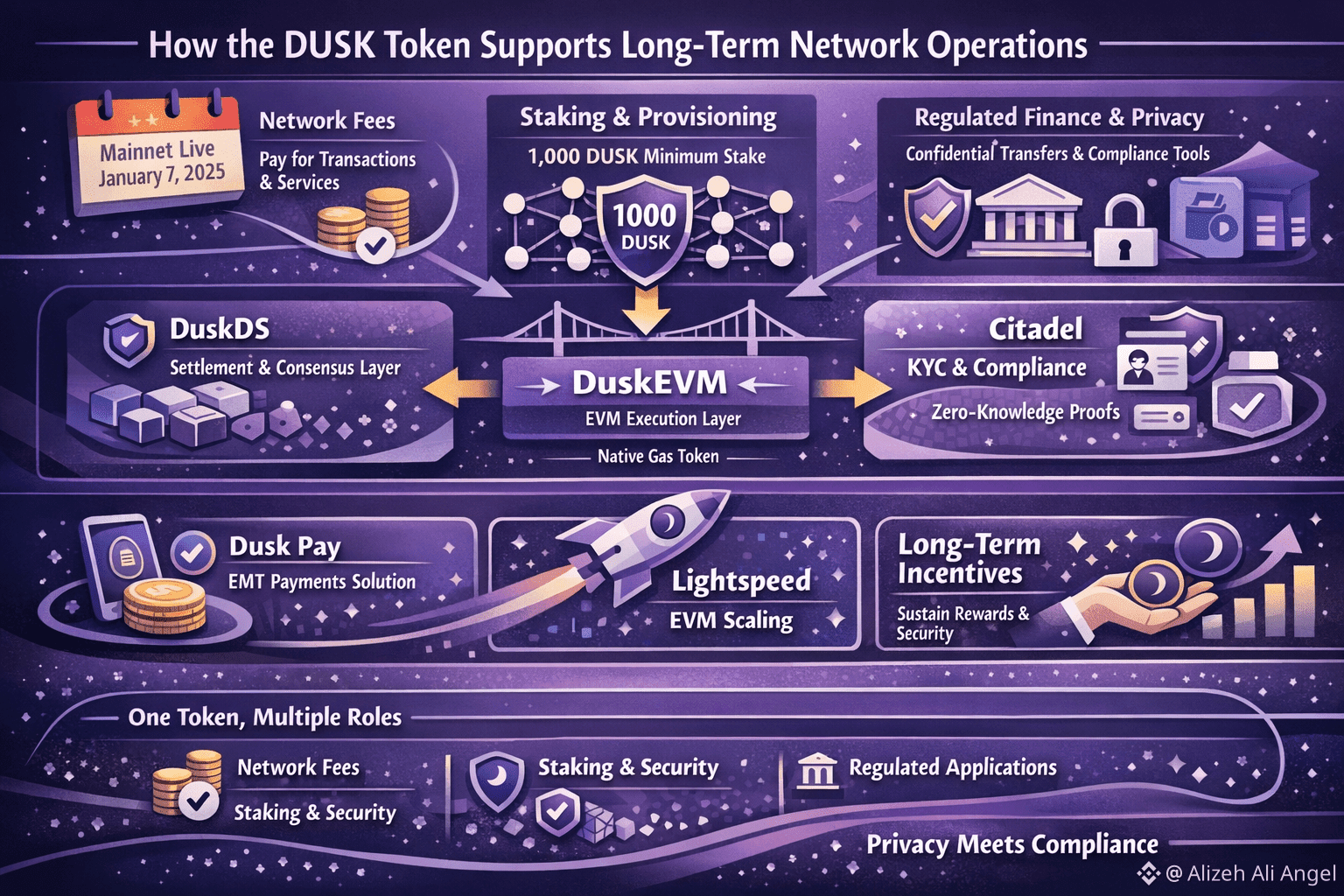

DUSK sits at the center of that maintenance loop because it plays the practical roles a network needs money to play. It is used to pay network fees, and it is also used to deploy applications and pay for services on the chain. Those fee flows are easy to dismiss when activity is quiet, but they matter because they create a clean “cost of use” that can be routed back into the system as rewards for the people who keep it running. In Dusk’s case, the docs also make a point about moving from ERC-20 and BEP-20 representations toward native mainnet DUSK via an official bridge, which is a subtle operational improvement: fewer wrappers, fewer moving parts, fewer places for liquidity and attention to fragment.

Still, fees alone rarely carry a proof-of-stake network through its early years. Usage is uneven, and “real demand” tends to arrive in waves. The sturdier pillar is staking: people lock DUSK so the network can choose block producers and validators who have something at risk. Dusk’s documentation is plain about this: DUSK is used for staking, and rewards are paid to consensus participants. On the operator side, Dusk calls these block-producing participants “provisioners,” and the operator docs specify a minimum stake of 1,000 DUSK to participate. That’s not a philosophical detail. It’s a simple economic commitment that helps keep the validator set from being purely opportunistic. When operators have funds locked and rewards at stake, reliability stops being charity and becomes routine.

What’s made Dusk more “current” lately is not just the mechanics of staking and fees, but the kind of markets it is aiming to serve. Dusk positions itself as a privacy-first chain for regulated finance, with the idea that users can have confidential balances and transfers without making institutions give up on compliance requirements. That balance—privacy without pretending audits and rules don’t exist—has become a sharper topic as tokenization inches closer to traditional financial rails. If you’ve watched how institutions talk about blockchains, they’re rarely excited by radical transparency; they’re worried about leaking business relationships, positions, and customer data. Yet they’re equally worried about systems that can’t be explained to regulators or counterparties when something goes wrong. Dusk is trying to live in that uncomfortable middle, and that is exactly where the industry conversation is drifting.

This is where DUSK’s role starts to look less like a generic “utility token” and more like the accounting unit of an operational stack. Dusk’s architecture splits the foundational settlement and consensus layer—DuskDS—from execution environments like DuskEVM, and the project describes DuskDS as providing finality, security, and native bridging for what’s built on top. Meanwhile, the DuskEVM bridge guide states that once DUSK is bridged to DuskEVM, it becomes the native gas token there, letting developers use familiar EVM tooling while still settling back to the core layer. That matters for long-term operations because it concentrates demand: one token supports the base chain’s security model and also pays for activity in the execution environment people actually build on.

Identity and compliance tooling adds another layer of relevance. Dusk’s Citadel framework was introduced as a zero-knowledge approach to KYC-style claims, aiming to let people prove they meet requirements without handing their personal data to everyone in the process. And the “Mainnet is Live” update points to near-term products like Dusk Pay, described as a payments circuit powered by an electronic money token (EMT) to enable regulatory-compliant transactions, alongside an EVM-compatible scaling effort (“Lightspeed”). You can argue about timelines and adoption—and you should—but it’s real progress in the sense that it translates abstract goals into concrete primitives and products.

None of this guarantees longevity. Tokens can be mispriced, reward schedules can create perverse incentives, and real usage can remain stubbornly small. But DUSK’s “job description” is at least coherent: it pays for network usage, it secures consensus through staking, and it underwrites the everyday work of keeping a modular, privacy-aware protocol running. When that job description holds up through quiet periods, a token stops feeling like a narrative and starts behaving like infrastructure.