Our previous analysis concluded that institutional capital awaits "macro clarity" to return to Bitcoin. The Japanese Yen crisis defines exactly what this macro fog is and why the safety of gold is still preferred.

THE CURRENCY DOMINO EFFECT: AN ARTIFICIALLY STRONG DOLLAR

The managed devaluation of the JPY acts as a structural headwind to the DXY (dollar index). Even with a cautious Fed, the dollar remains resilient because one of its main components (the yen) is in a planned collapse – a strategy to devalue the world's largest sovereign debt and relieve the massive loans of the 'carry trade' in yen. A strong dollar is a classic brake for risk assets like Bitcoin.

THE PRICE OF UNCERTAINTY: SYSTEMIC RISK AND THE FLIGHT TO SAFETY

The scenario places the global market in a "dilemma": any sharp movement of the yen can destabilize markets. This geopolitical and monetary tail risk justifies the continuous tactical allocation to safe-haven assets, explaining the explosive performance of gold (+61.4%) while BTC oscillates.

THE WITHHELD TRIGGER: HOW THE YEN BLOCKS THE ROTATION TO RISK

The thesis that the "second rally" of altcoins depends on a new cycle of dollar (DXY) weakness. If the yen's decline sustains the DXY, this key catalyst is postponed. The capital, therefore, is in no hurry to leave gold.

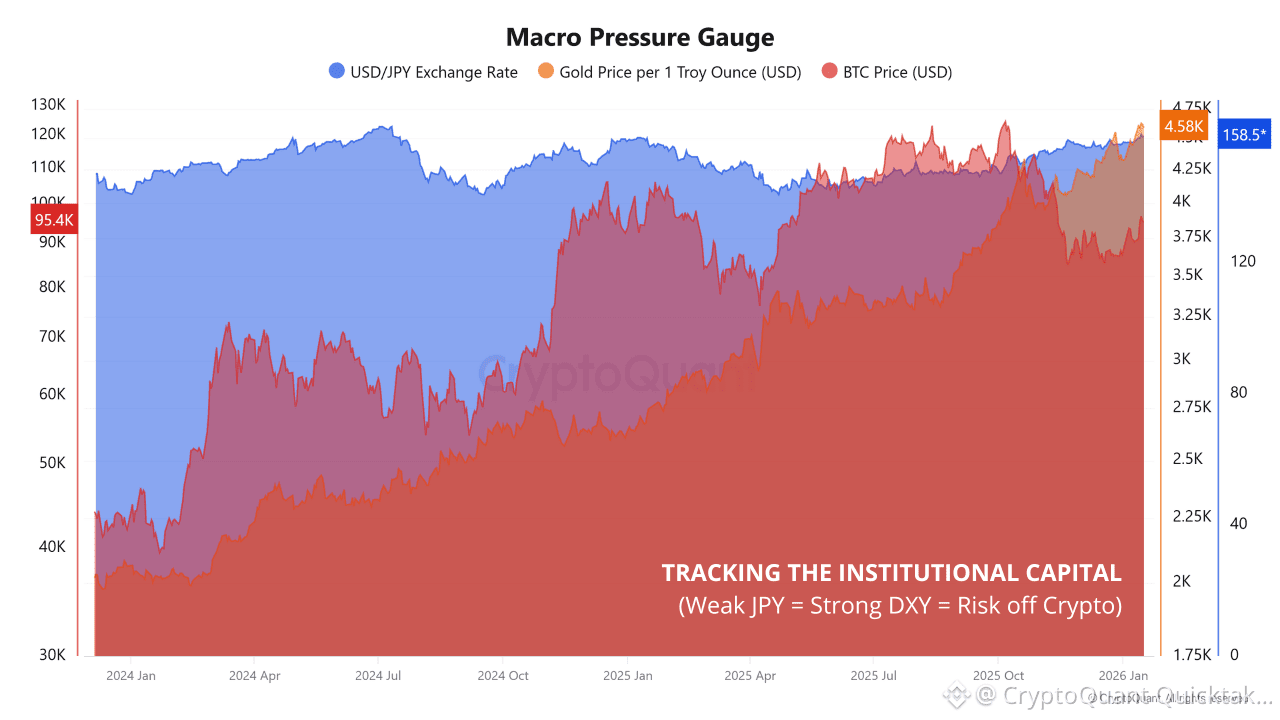

MACRO PRESSURE GAUGE INDICATOR

It monitors three key variables: the price of Bitcoin (in USD), the price of gold per troy ounce (in USD), and the USD/JPY rate, where higher values indicate a weaker yen. At the time of analysis: BTC was trading at $95,099K thousand, gold at $4,5883, and ¥158.54 were needed to buy $1.

COMPLETE NARRATIVE CONCLUSION

The "Deviation to Gold" protects against planned currency disorder. The macro clarity that capital awaits is the resolution of the Yen crisis. This trilogy – from BTC Scenarios to the Deviation to Gold – traces the path of institutional capital in 2026. Strategic patience is imperative.

Written by GugaOnChain