It’s 2026, and privacy coins are back in the spotlight. Not long ago, Monero, $DASH , and Zcash felt like old news—almost forgotten. Now? They’re everywhere. You see them trending on Twitter, popping up in Telegram chats, and sparking heated debates. So, what flipped the script? Well, the market’s gotten tougher, regulations are closing in, and a new crowd actually cares about keeping their finances private.

A New Chapter for Privacy Coins

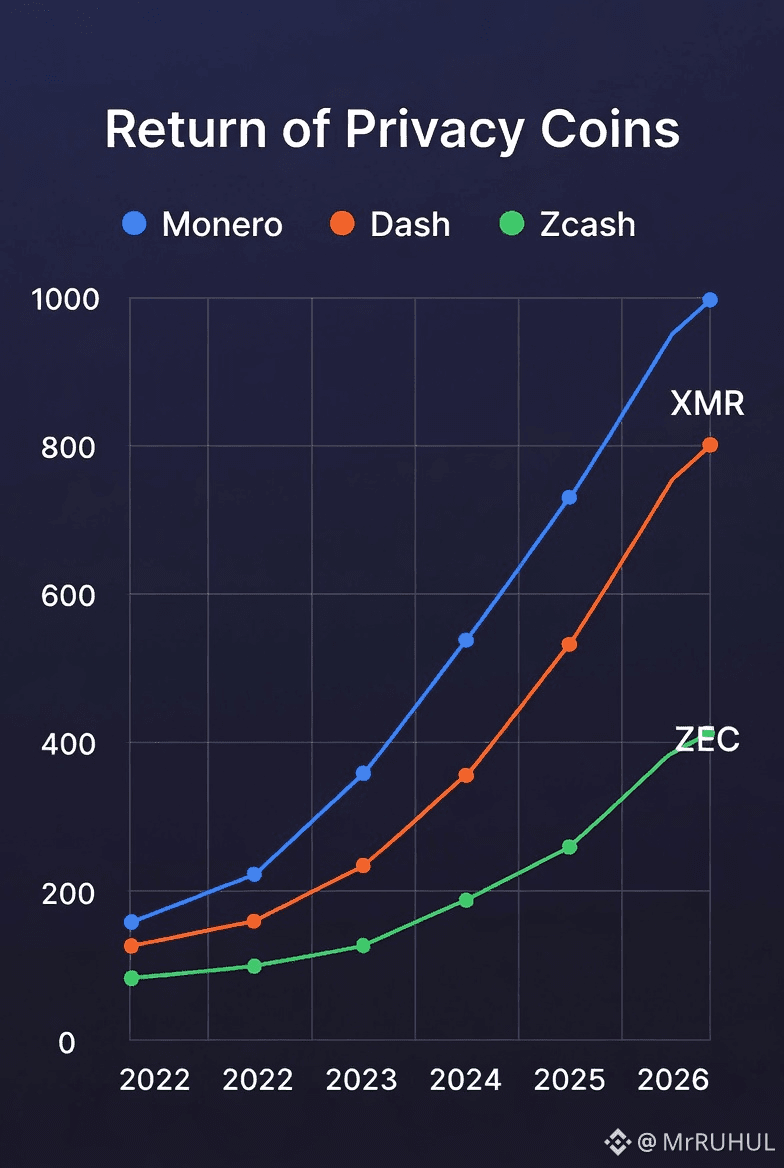

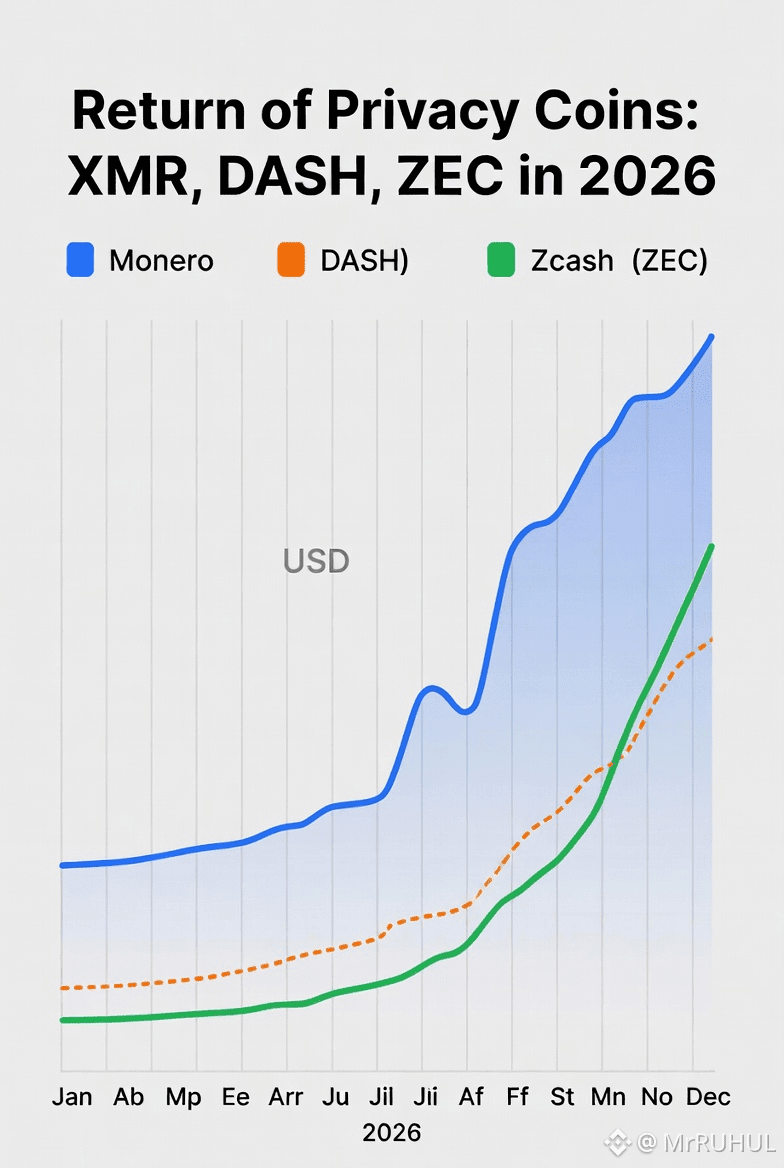

Just a couple years back, privacy coins barely got a mention. Big exchanges dropped them. Everyone braced for the next regulatory crackdown. But as 2025 rolled into 2026, something shifted. Monero blew past $800 and kept climbing. Suddenly, people remembered—privacy isn’t dead in crypto. That rally pulled in new money—not just into the old favorites, but into a wave of smaller, lesser-known privacy projects too.

Why the comeback? It’s a mix of things. Surveillance is everywhere now. Governments want more KYC, more reports, more control. For a lot of people, privacy isn’t just nice anymore—it’s urgent. And there’s the real-world risk: “wrench attacks” (yeah, it’s as bad as it sounds—people literally getting threatened for their crypto). Privacy matters again, in a big way.

The numbers don’t lie. In 2025, privacy coins left the rest of the market in the dust. Gains that made everything else look boring. Zcash, especially, was on fire—outperforming almost everything.

Monero ($XMR ): Still the King

Monero hasn’t lost its crown. It’s still the most recognized, and probably the most advanced, privacy coin out there. Privacy isn’t an extra—it’s built into every Monero transaction. Ring signatures, stealth addresses, confidential transactions—the works. Nobody sees who sent what, to whom, or how much. When XMR smashed through new highs in early 2026, it was clear: people—from everyday users to big investors—still want real privacy.

And it’s not just about trading hype. As banks and exchanges ramp up chain surveillance, users—especially in countries with heavy government monitoring or anyone dealing with sensitive money—are hunting for safe ways to move funds without leaving a trail. Monero’s tech just makes sense if privacy actually matters to you.

But here’s the catch: all that privacy is making regulators nervous. Some governments are threatening bans or pushing exchanges to ditch Monero entirely. The clash between privacy and regulation isn’t going away anytime soon. It’s probably going to shape Monero’s story for the rest of the year.

Zcash (ZEC): Privacy with Options

Zcash plays a different game. It lets you choose: keep your transaction private with zk-SNARKs, or go transparent for things like audits and compliance. That flexibility opened doors, especially for institutional investors who have to follow the rules but still want some privacy.

This “choose your privacy” thing worked for Zcash in 2025. For a while, it even led the pack by market cap. Recent upgrades made shielded transactions easier, so ZEC started carving out its own space—somewhere between privacy purists and companies that need to keep regulators happy.

But it’s not all smooth sailing. If only a few people use the privacy features, the whole network’s anonymity suffers. Smaller privacy pool, less cover. And as regulations tighten, some exchanges have already dropped $ZEC , which makes it harder to trade.

Dash (DASH): Old School Finds New Energy

Dash took a different path. It started with privacy features like PrivateSend, but over time it focused more on speed and easy payments. Still, when privacy coins surged, DASH got swept up too. Investors seemed to like the mix of privacy and actual real-world use.

Some hardcore privacy fans say Dash doesn’t really count anymore, since its tools don’t stack up with Monero or Zcash. But in 2026, Dash is back in the mix. Maybe people just want coins that balance privacy with being actually useful.

Innovation vs. Regulation

If you want to know what’s really driving privacy coins right now, look at regulation. In places like the EU and the UAE, authorities are tightening anti-money laundering rules and.#BinanceSquare