Most blockchains talk about adoption as if it’s something you convince the world into.

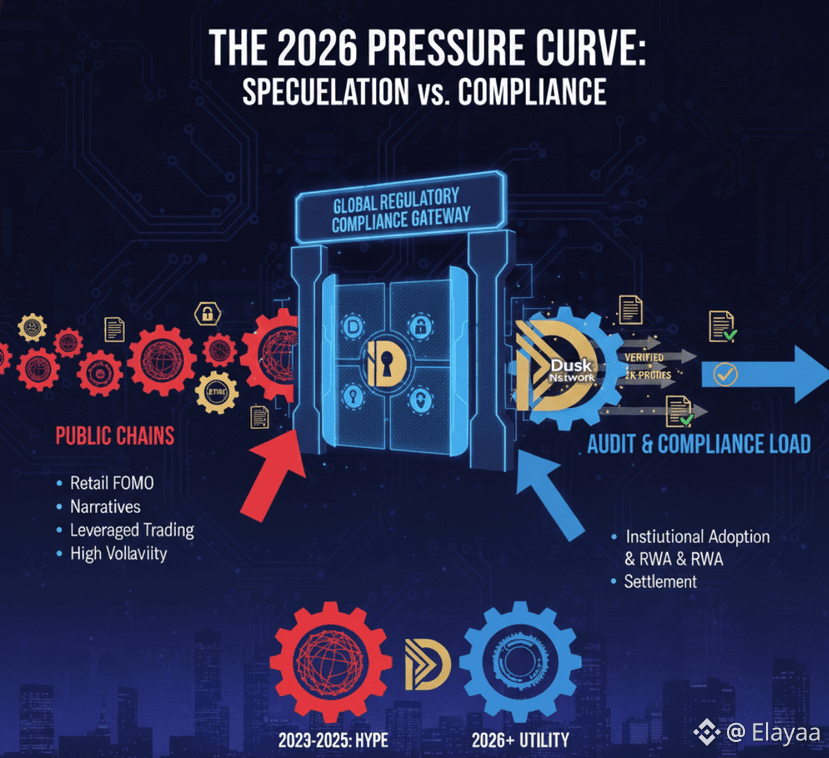

In regulated finance, adoption is permission-based. You don’t scale because users arrive. You scale because systems allow you to stay.

This is the part crypto often misunderstands.

Financial institutions don’t adopt networks. They assess risk surfaces. They ask where data lives, who can see it, how it’s proven, and what happens when regulators intervene. If the answers are vague, adoption never starts.

Dusk was built with this reality baked in.

The Layer 1 architecture doesn’t treat compliance as an edge case. It assumes that regulated interaction is the default state. Tokenized assets, compliant DeFi, and institutional-grade applications are not special verticals. They are the core use case.

That framing changes everything.

Hedger is often described as a privacy solution, but that undersells its role. Hedger is a permission-management system. It defines who is allowed to learn what, and under which conditions. That is how financial privacy actually works. Information is not hidden. It is scoped.

This scoping is what allows audits to exist without surveillance. Regulators don’t need raw data. They need proof that rules were followed. Dusk produces that proof without collapsing confidentiality.

DuskEVM fits into this picture by removing artificial barriers. Institutions don’t want experimental environments. They want known tooling running on infrastructure that understands regulation. DuskEVM gives them exactly that.

Then there is DuskTrade.

The collaboration with NPEX is not important because it is a partnership. It is important because NPEX already operates under licenses. That means the blockchain infrastructure must conform to existing regulatory reality, not hypothetical frameworks.

You don’t bend regulation to fit the chain. You build the chain to fit regulation.

$DUSK powers this environment. Not loudly. Not theatrically. It supports execution, settlement, and continuity. It exists because financial systems don’t run on narratives. They run on infrastructure that doesn’t fail during reviews.

The quiet truth is this: most blockchains never get rejected by regulators. They disqualify themselves long before that by not being explainable.

Dusk is explainable.

And in finance, that’s permission.