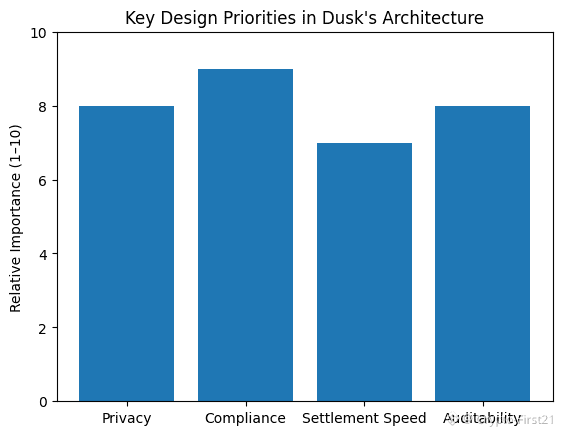

At a high level, Dusk is a Layer 1 blockchain designed specifically for regulated finance. Dusk went the other way around. Its core idea is that institutions don’t want secrecy for its own sake. They want confidentiality where it’s legitimate, and the ability to prove things when it’s legally required. That distinction shapes everything from its architecture to its consensus design.

When people hear “financial privacy,” they often think it means hiding everything. In practice, it means something more subtle. A trader doesn’t want positions broadcast in real time. A fund doesn’t want counterparties front-running settlements. A bank doesn’t want client balances visible on a public ledger. At the same time, regulators need reporting, auditors need trails, and courts need enforceable records. Dusk’s approach relies on cryptography, particularly zero-knowledge techniques, to allow transactions to remain confidential while still being verifiable under specific conditions. In simple terms, the system can prove that rules were followed without revealing all the underlying data.

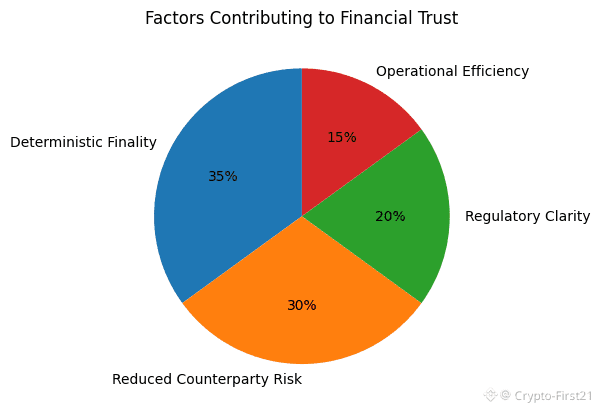

From a market perspective, finality is just as important as privacy. If you’ve ever traded size, you know how uncomfortable it feels when settlement is uncertain. Dusk uses a Proof-of-Stake model called Succinct Attestation, which is designed to provide fast and deterministic finality. Instead of waiting through long confirmation windows, participants get clear settlement outcomes in a timeframe that fits real financial workflows. That’s a big deal for institutions that measure risk in minutes, not blocks.

One thing that’s struck me in the past year is how sophisticated the architecture is. By the middle of 2025, it’s clear that Dusk had distinguished its system into tiers: a core settlement and data system, exec environments, and privacy elements. Such modularity may not seem exciting, which is precisely the point in finance. Starting from a clean slate, risk can now be simply removed, improvements made without knocking the whole thing over, and compliance people can grasp what they’re approving. Such simplicity often trumps numbers.

As the incentives are often left out of the privacy talk. First, a confidential network still requires validators to remain honest and online. This is why Dusk's token is connected with staking, security, and fees. Validators also have skin in the game, meaning their actions correlate with the welfare of the network. This is easy to understand: if you act up or go dark, you'll cost yourself money. This is hardly Dusk-specific, but it is crucial if your customers hold regulated assets.

In all privacy discussions, incentives tend to get overlooked. A network that says it will provide confidentiality also needs validators who stay honest and online, and that has a role for DUSK in staking, security, and transaction fees. Validators have capital at risk, which aligns their behavior with network health. In simple words: if you misbehave or go offline, it costs you money. That is not unique to DUSK, but it's essential when you are asking institutions to trust a system that handles regulated assets.

Of course, none of this removes the hard parts. Privacy systems are complex, and complexity creates room for bugs. Regulators are cautious by nature, and many are still uncomfortable with anything that reduces visibility, even if controlled disclosures exist. There’s also the challenge of explaining these ideas to developers and compliance officers who don’t live in cryptography. Education takes time, and adoption usually moves slower than markets expect.

Part of it is timing. Real-world assets, tokenized securities, and on-chain settlement have moved from theory into early production. Broadcasting every transaction might work for retail speculation, but it doesn’t map cleanly to professional finance. Dusk sits right at that intersection, offering an alternative that feels closer to how markets already operate.

There are real risks to keep in mind. Competing platforms are also targeting regulated finance. Traditional systems are improving, not standing still. Regulatory frameworks differ by region, which can force compromises. And governance questions remain tricky. Who decides when disclosures happen? How are disputes resolved across jurisdictions? These aren’t problems you solve once. They’re ongoing tensions that require careful design and constant adjustment.

Financial privacy that survives scrutiny isn’t about hiding from regulators. It’s about giving market participants the same protections they’ve always had, but in an on-chain environment. It’s whether institutions are willing to settle real value on-chain, knowing that privacy is preserved, rules are enforced, and audits are possible when required. That’s the line Dusk is trying to walk. For anyone watching the evolution of regulated DeFi, it’s a line worth paying attention to.