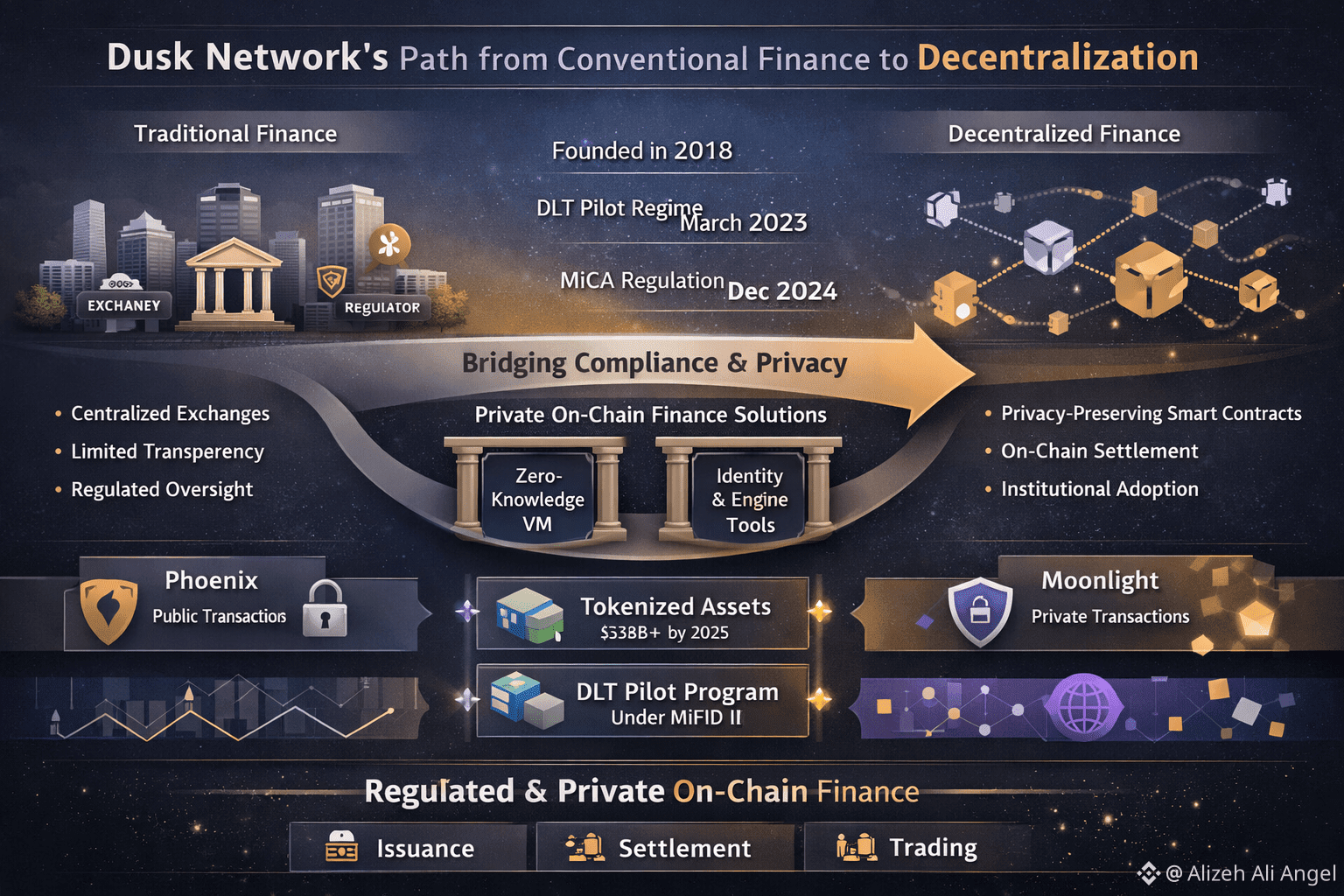

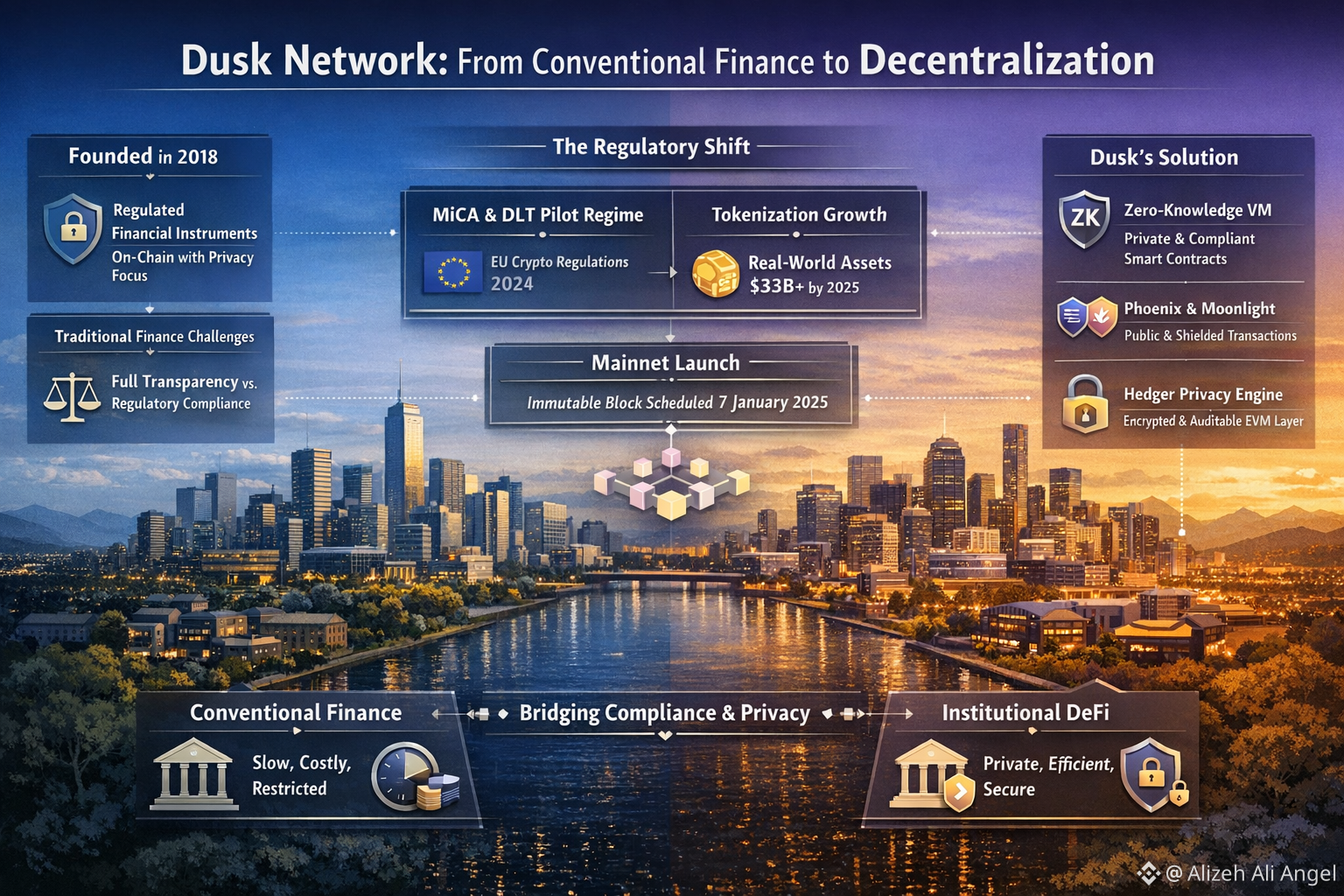

Dusk Network makes more sense when you start with the problem it picked, not the market cycle it happened to live through. It was founded in 2018 with a narrow goal: bring regulated financial instruments on-chain without turning every balance and trade into public theater. That’s a conventional-finance instinct—privacy as a requirement, not a preference—and it helps explain why Dusk has spent years building plumbing instead of chasing quick narratives. In 2023, the team framed its rebrand as an evolution toward a more mature, institution-facing posture, after investing heavily in research and internal tooling like its zero-knowledge virtual machine and identity-oriented components.

The trade-off Dusk is trying to manage isn’t new—it’s just sharper on-chain. In traditional markets, visibility is controlled by design: exchanges, brokers, custodians, and regulators see what they’re meant to see, while everyone else gets a delayed or limited view. Public blockchains turned that inside out, making everything transparent by default and treating privacy like an optional add-on. For open experimentation, that can be refreshing. For equities, debt, funds, and the messy choreography of corporate actions, it can be a non-starter. Dusk’s own materials are unusually blunt about the target: privacy-preserving smart contracts that still satisfy compliance criteria, and final settlement that looks more like “done” than “probably done.”

This is trending now because the industry’s excuses are running out. Europe’s Markets in Crypto-Assets regulation (MiCA) became fully applicable on 30 December 2024, pushing builders from “compliance later” talk into concrete design decisions. The EU’s DLT Pilot Regime has been applying since 23 March 2023, giving market operators a live framework to test DLT-based trading and settlement under MiFID II rules. Meanwhile, tokenization is producing numbers that are hard to wave away: Chainalysis noted tokenized money market funds holding U.S. Treasuries rising above $8 billion by December 2025, and Deutsche Bank Research put tokenized real-world assets around $33 billion in 2025 (with a much larger total if you include stablecoins). Even central banks are leaning into the operational side of tokenized settlement, with BIS-linked cross-border testing projects making headlines in January 2026.

With that context, Dusk’s progress feels less like a hype surge and more like a clear ops plan. In late December 2024, the team shared a staged mainnet rollout, even calling out 7 January 2025 as the target for the first immutable block, with onramping and migration steps laid out ahead of time. I find that sequencing quietly reassuring. It suggests a mindset shaped by settlement risk, user error, and the dull mechanics of moving value safely—areas where “move fast” is usually just a slogan.

The design choices reinforce that posture. Dusk’s documentation describes a proof-of-stake consensus called Succinct Attestation aimed at deterministic finality, and a modular split where DuskDS handles settlement and data while DuskEVM provides Ethereum-compatible execution. It also supports two transaction models—Phoenix and Moonlight—so participants can choose public or shielded flows, with the option to reveal information to authorized parties when required. If you strip away the jargon, the bet is simple: institutions don’t want to broadcast positions and intent, but regulators and auditors still need a path to verify that rules were followed.

The most telling step is Hedger. In June 2025, Dusk introduced Hedger as a privacy engine for the EVM layer that combines homomorphic encryption with zero-knowledge proofs, explicitly pairing confidentiality with auditability. My take is that this is the right kind of ambition: not “make everything invisible,” but “make it private by default, provable when necessary.” The open question is whether the ecosystem can deliver the surrounding pieces—identity checks, reporting hooks, custody integrations, and the unglamorous operational playbooks that real institutions demand.

If Dusk succeeds, it probably won’t be because decentralization replaced conventional finance. It will be because a few workflows—issuance, settlement, and trading where intent isn’t broadcast to the whole world—become cheaper and safer without asking institutions to abandon their obligations. If it stumbles, the reasons will likely be ordinary: integrations are slow, regulation varies by jurisdiction, and trust is earned one cautious pilot at a time.