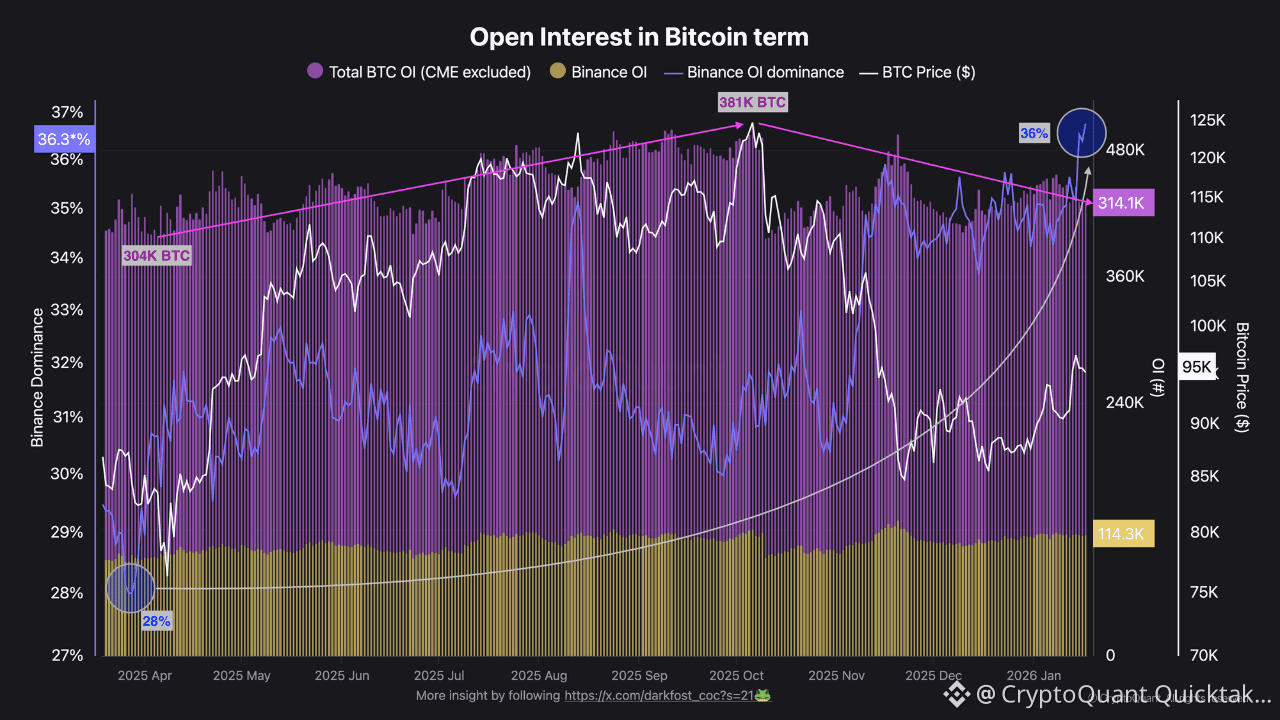

Futures markets continue to account for the vast majority of Bitcoin trading volumes, far ahead of spot and ETFs. In this context, Open Interest is a key indicator to assess investor behavior. Binance clearly stands out as the dominant player, accounting for roughly 36% of total Open Interest, making it a critical venue to monitor market dynamics.

Since the latest ATH, BTC has undergone a correction of around 36%, accompanied by a partial deleveraging across derivatives markets.

Open Interest declined by nearly 17.5%, falling from 381,000 BTC to 314,000 BTC, reflecting a phase of risk reduction and the unwinding of leveraged positions.

Following the April 2025 correction, with Open Interest hovering around 300,000 BTC and Binance’s dominance dropping to roughly 26%, we observed a gradual return of exposure on futures markets. Nearly 80,000 BTC were reintroduced into futures, a dynamic that supported the bullish recovery and ultimately contributed to the formation of a new ATH.

This analysis is based on Open Interest expressed in BTC rather than USD notional value. Doing so allows us to isolate genuine investor positioning, without the distortion caused by BTC price fluctuations that can artificially inflate or deflate Open Interest in dollar terms.

At present, Open Interest is showing signs of a gradual recovery, suggesting a slow return of risk appetite.

If this trend continues and strengthens, it could increasingly support a continuation of the bullish momentum, although for now the rebound remains relatively modest.

Written by Darkfost