The Moment Plasma XPL Started to Make Sense

Plasma XPL did not appear because the blockchain world needed another chain. It appeared because the way people were actually using crypto no longer matched how most blockchains were designed. As Ethereum matured, the gap between technical ideals and everyday experience became impossible to ignore. Transactions slowed during peak demand. Fees fluctuated wildly. Simple actions required deep technical understanding. I’m seeing that Plasma XPL emerged from this tension, not as a reactionary project, but as a deliberate response to what blockchains were becoming.

They’re not trying to rewrite the philosophy of decentralization. Instead, Plasma XPL begins with a quieter question. If crypto is meant to be used daily, what kind of execution layer does that actually require? That question shaped the project long before the name or token existed. It was less about speed benchmarks and more about how systems feel when real people interact with them.

Learning From Ethereum Without Competing With It

One of the defining traits of Plasma XPL is that it does not frame Ethereum as something to replace. Ethereum remains the most important smart contract settlement layer in the ecosystem. Plasma XPL treats that as a given. I’m noticing that many of its design decisions assume Ethereum will continue to exist as the anchor of trust.

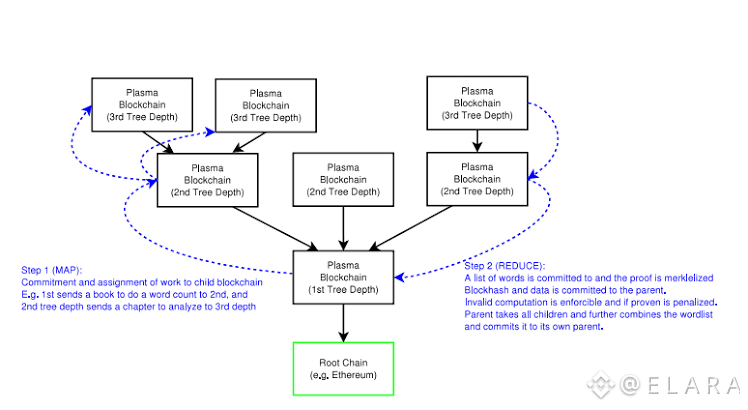

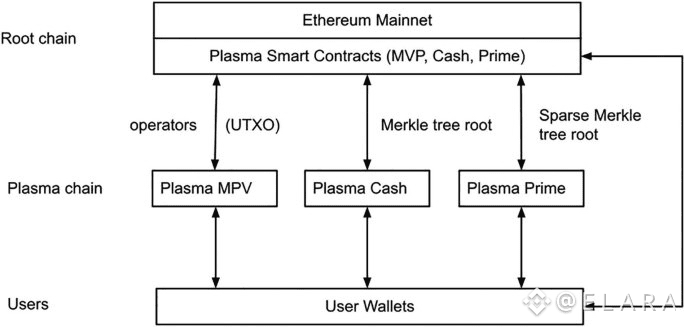

Rather than pushing everything onto Ethereum, Plasma XPL explores how execution can be moved elsewhere while still respecting Ethereum’s security assumptions. This is where Plasma-style thinking reenters the conversation, not as an old idea revived, but as a concept reinterpreted for a different era. They’re building an execution-focused environment that can process transactions efficiently while relying on stronger layers for final settlement and dispute resolution.

If it becomes successful, Plasma XPL does not weaken Ethereum. We’re seeing it attempt to make Ethereum more usable by reducing the load placed directly on it.

The Shift Toward Execution as a Service

In earlier blockchain designs, execution, settlement, and data availability were tightly coupled. Plasma XPL reflects a newer understanding that these components can be separated. Execution does not need to carry the full weight of global consensus. It needs to be fast, predictable, and reliable.

I’m seeing Plasma XPL approach execution almost as a service layer. Applications deploy there not because it is the most decentralized place possible, but because it is the most practical place to operate. That shift matters. It signals a maturing ecosystem where tradeoffs are acknowledged rather than denied.

They’re designing for applications that need consistency more than ideology. Payments, stablecoin transfers, and backend logic for decentralized apps benefit from execution layers that feel calm rather than congested.

Stablecoins at the Center of the Design

One of the clearest signals of Plasma XPL’s priorities is its stablecoin-native approach. In practice, most crypto users interact more with stablecoins than with native gas tokens. Yet many blockchains still force users to hold assets like ETH just to pay fees. Plasma XPL questions this default.

By focusing on gas abstraction, the network allows transaction costs to be handled in ways that are invisible or at least simpler for users. I’m seeing that this design removes a psychological barrier that has quietly limited adoption. If users can transact without constantly thinking about gas mechanics, the system begins to feel more like software and less like infrastructure.

This also aligns Plasma XPL with broader trends across the ecosystem. Account abstraction, smart wallets, and sponsored transactions all point toward a future where complexity is absorbed by the protocol rather than pushed onto users.

Thinking About Bitcoin Without Copying It

Bitcoin plays a unique role in crypto. It is not flexible, but it is trusted. Plasma XPL’s design acknowledges this reality. Rather than attempting to compete with Bitcoin’s role as a store of value, the project explores how Bitcoin liquidity might interact with more expressive execution environments.

I’m noticing that Plasma XPL treats BTC integration as a long-term goal rather than a headline feature. Bridging Bitcoin securely is one of the hardest problems in crypto. Many projects have rushed this and paid the price. Plasma XPL appears to be more cautious, exploring models that reduce trust assumptions even if progress is slower.

If successful, this could allow BTC to participate in programmable ecosystems without compromising its core security principles. We’re seeing how that possibility continues to influence Plasma XPL’s roadmap.

Building the Network Slowly and Deliberately

When development began, Plasma XPL did not rush toward a public launch. Early work focused on core mechanics. Execution reliability. Validator coordination. Transaction finality. These are not glamorous topics, but they determine whether a network survives real usage.

They’re testing how the system behaves under stress rather than ideal conditions. I’m seeing an emphasis on understanding failure modes. What happens when validators disagree. How state recovers after interruptions. How users exit safely if something breaks. These questions rarely attract attention, but they define trust.

This stage shaped Plasma XPL’s culture. Progress was measured in stability rather than speed. That mindset continues to influence how updates are communicated and how expectations are set.

Validators, Incentives, and the Role of XPL

The XPL token exists to coordinate the network rather than to define it. Its primary roles revolve around validator participation, transaction processing, and aligning incentives with long-term health. Plasma XPL’s token design reflects lessons learned from earlier cycles, where misaligned incentives led to fragile ecosystems.

I’m noticing that they’re cautious about inflation and distribution. Rather than relying on constant rewards to attract participation, the network aims to tie value creation to actual usage. If activity grows, demand for XPL grows organically. If it does not, the system remains restrained.

This approach does not guarantee success, but it reduces the risk of hollow growth. We’re seeing an attempt to ground economics in utility rather than narrative.

Developer Experience as a Priority

Plasma XPL is not built only for end users. Developers are a critical audience. By maintaining compatibility with Ethereum tooling, the project lowers the barrier to entry. Teams do not need to relearn everything to deploy on Plasma XPL.

I’m seeing that this choice positions Plasma XPL as an extension of existing ecosystems rather than a silo. Developers can experiment, migrate, and iterate without committing fully from day one. That flexibility matters in an environment where standards evolve quickly.

If it becomes easier to build and maintain applications, adoption follows naturally. Plasma XPL’s design reflects this understanding.

Early Applications and Practical Use Cases

As the network matured, early applications began to appear. These were not headline-grabbing projects, but practical experiments. Stablecoin transfers. Lightweight DeFi primitives. Backend services for decentralized applications.

What mattered was not scale but feedback. How did the system behave under real use. Where did friction still exist. I’m seeing that Plasma XPL treated these early deployments as learning tools rather than proof of dominance.

This phase helped clarify the network’s identity. Plasma XPL is infrastructure. It does not try to define user-facing narratives. It enables others to do so.

Navigating Market Cycles Without Losing Direction

Like every crypto project, Plasma XPL exists within market cycles. There are moments of attention and moments of silence. The challenge is to avoid letting either dictate development.

I’m noticing that Plasma XPL maintains a relatively consistent pace regardless of external conditions. Updates focus on technical progress rather than price movements. This can feel quiet in an industry that rewards noise, but it builds credibility over time.

If the project survives multiple cycles without abandoning its core principles, that resilience becomes a strength.

Where Plasma XPL Stands Today

Today, Plasma XPL exists as a functioning execution environment with a clear philosophy. It emphasizes usability, predictable costs, and stablecoin-native flows. It integrates with Ethereum while exploring longer-term connections to Bitcoin.

Developers can deploy familiar applications while benefiting from different execution dynamics. Users encounter fewer barriers. I’m seeing a network that feels less like an experiment and more like a tool in progress.

This middle stage is often overlooked, but it is where long-term outcomes are decided.

Looking Several Years Ahead

Projecting years into the future is uncertain, but certain paths are visible. If Plasma XPL continues on its current trajectory, it may become part of the invisible infrastructure that powers everyday crypto activity.

Payments may flow through it without users noticing. Applications may rely on it for execution while settling elsewhere. We’re seeing a future where blockchains specialize rather than compete for the same role.

Challenges will remain. Competition is intense. Standards shift. Regulatory landscapes evolve. Plasma XPL’s ability to adapt without losing coherence will matter more than any single feature.

A Quiet Ending That Points Forward

Plasma XPL is not a story of sudden disruption. It is a story of alignment. Aligning execution with how people actually use crypto. Aligning incentives with utility. Aligning ambition with patience.

If it becomes widely used, most people may never think about it. They’ll simply notice that things work. Transactions feel calmer. Costs feel predictable. Complexity fades into the background.

We’re seeing that kind of future slowly take shape across the ecosystem. Plasma XPL is one attempt to build toward it, not loudly, but deliberately, leaving space for time to decide how the story ultimately unfolds.