The crypto market has gone through another week of uneven and volatile price action. Bitcoin recently climbed to an eight-week high above $97,000, but the rally quickly lost momentum and prices slipped back toward the $90,000 area. This behavior suggests that buyers are still struggling to sustain a decisive breakout.

Dogecoin followed a similarly mixed path. The memecoin briefly pushed toward resistance near $0.15 last week, only to fall back below $0.13 as traders locked in profits. Despite the pullback, new signals suggest DOGE may once again gain the upper hand over Bitcoin on a relative basis.

The BTC/DOGE Ratio Signals a Shift

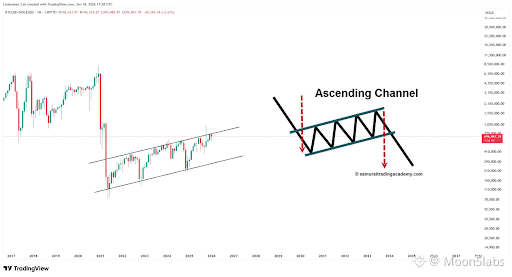

Analysts are increasingly focused on the BTC/DOGE cross pair, which offers insight into the relative performance of the two assets. Technical charts show the ratio trading within an ascending channel for an extended period, repeatedly testing the upper boundary without a convincing breakout.

In technical analysis, repeated failures at resistance often precede a reversal. The fading momentum in recent attempts to push the BTC/DOGE ratio higher suggests that Bitcoin may be losing relative strength against Dogecoin in the short term. A rejection from the top of the channel would imply downside pressure on the ratio, favoring DOGE in comparative performance.

Importantly, this signal does not comment on the absolute price direction of either coin. It purely reflects relative performance. A move below the lower trendline of the channel would be interpreted as confirmation that Dogecoin is gaining strength versus Bitcoin, potentially prompting traders to reallocate capital toward the stronger asset.

Bitcoin Hesitates While Dogecoin May Hold Firmer

Bitcoin’s recent price action has been defined by volatility around the $90,000 region. Easing inflation concerns and certain political developments helped push BTC close to $97,000 last week, but the move lacked follow-through. The leading cryptocurrency has since retreated and is once again searching for direction.

Dogecoin, meanwhile, has broadly tracked the wider market but showed resilience after being rejected near $0.15. The pullback stalled around $0.127, just below the $0.13 level, which has acted as a key support zone over recent months.

Outperformance Doesn’t Require a Price Explosion

If the technical outlook implied by the BTC/DOGE ratio plays out, Dogecoin’s outperformance does not necessarily need to come in the form of a dramatic rally. Relative strength can also appear in more subtle ways—such as DOGE declining less than Bitcoin during market pullbacks, or recovering more quickly after sell-offs.

This type of behavior often attracts traders looking for assets with superior relative strength. Should the trend confirm, Dogecoin could once again emerge as an unexpected winner versus Bitcoin, at least in short- to medium-term performance terms.

#Dogecoin , #DOGE , #bitcoin , #crypto , #BTC

Stay one step ahead – follow our profile and stay informed about everything important in the world of cryptocurrencies!

Notice:

,,The information and views presented in this article are intended solely for educational purposes and should not be taken as investment advice in any situation. The content of these pages should not be regarded as financial, investment, or any other form of advice. We caution that investing in cryptocurrencies can be risky and may lead to financial losses.“